Xcel Energy 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

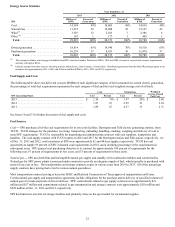

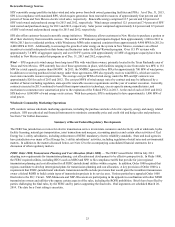

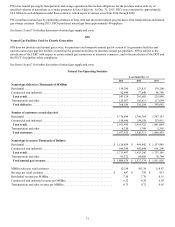

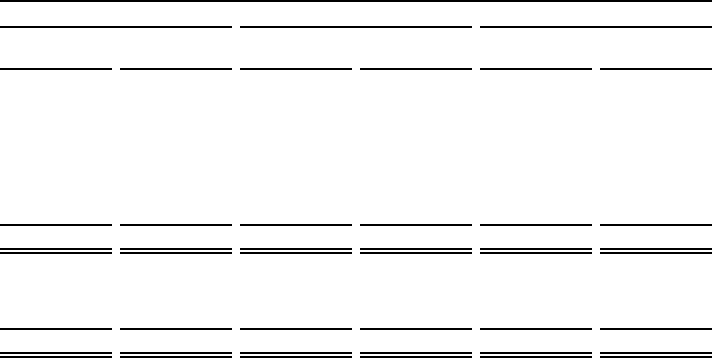

Energy Source Statistics

Year Ended Dec. 31

2013 2012 2011

Xcel Energy Millions of

KWh Percent of

Generation Millions of

KWh Percent of

Generation Millions of

KWh Percent of

Generation

Coal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49,675 46% 51,395 47% 57,014 50%

Natural Gas . . . . . . . . . . . . . . . . . . . . . . . . . . 24,350 23 26,218 24 25,080 22

Wind (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,738 14 13,298 12 11,216 10

Nuclear . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,177 11 13,249 12 13,781 12

Hydroelectric. . . . . . . . . . . . . . . . . . . . . . . . . 3,900 4 3,800 3 4,203 4

Other (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,704 2 2,022 2 1,659 2

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 107,544 100% 109,982 100% 112,953 100%

Owned generation . . . . . . . . . . . . . . . . . . . . . 70,936 66% 75,071 68% 74,722 66%

Purchased generation . . . . . . . . . . . . . . . . . . 36,608 34 34,911 32 38,231 34

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 107,544 100% 109,982 100% 112,953 100%

(a) This category includes wind energy de-bundled from RECs and also includes Windsource RECs. Xcel Energy uses RECs to meet or exceed state resource

requirements and may sell surplus RECs.

(b) Includes energy from other sources, including solar, biomass, oil and refuse. Distributed generation from the Solar*Rewards program is not included, and was

approximately 0.198, 0.152, and 0.146 net million KWh for 2013, 2012 and 2011, respectively.

NATURAL GAS UTILITY OPERATIONS

Overview

The most significant developments in the natural gas operations of the utility subsidiaries are continued volatility in natural gas market

prices, uncertainty regarding political and regulatory developments that impact hydraulic fracturing, safety requirements for natural

gas pipelines and the continued trend of declining use per customer, as a result of improved building construction technologies, higher

appliance efficiencies and conservation. From 2000 to 2013, average annual sales to the typical residential customer declined 17

percent and the typical small commercial and industrial customer declined 11 percent on a weather-normalized basis. Although

wholesale price increases do not directly affect earnings because of natural gas cost-recovery mechanisms, high prices can encourage

further efficiency efforts by customers.

The Pipeline and Hazardous Materials Safety Administration

Pipeline Safety Act — The Pipeline Safety, Regulatory Certainty, and Job Creation Act, signed into law in January 2012 (Pipeline

Safety Act) requires additional verification of pipeline infrastructure records by pipeline owners and operators to confirm the

maximum allowable operating pressure of lines located in high consequence areas or more-densely populated areas. The DOT

Pipeline and Hazardous Materials Safety Administration (PHMSA) will require operators to re-confirm the maximum allowable

operating pressure if records are inadequate. This process could cause temporary or permanent limitations on throughput for affected

pipelines. In addition, the Pipeline Safety Act requires PHMSA to issue reports and develop new regulations including: requiring use

of automatic or remote-controlled shut-off valves; requiring testing of certain previously untested transmission lines; and expanding

integrity management requirements. The Pipeline Safety Act also raises the maximum penalty for violating pipeline safety rules to $2

million per day for related violations. While Xcel Energy cannot predict the ultimate impact Pipeline Safety Act will have on its costs,

operations or financial results, it is taking actions that are intended to comply with the Pipeline Safety Act and any related PHMSA

regulations as they become effective. PSCo can generally recover costs to comply with the transmission and distribution integrity

management programs through the PSIA rider.

NSP-Minnesota

Public Utility Regulation

Summary of Regulatory Agencies and Areas of Jurisdiction — Retail rates, services and other aspects of NSP-Minnesota’s retail

natural gas operations are regulated by the MPUC and the NDPSC within their respective states. The MPUC has regulatory authority

over security issuances, certain property transfers, mergers with other utilities and transactions between NSP-Minnesota and its

affiliates. In addition, the MPUC reviews and approves NSP-Minnesota’s natural gas supply plans for meeting customers’ future

energy needs. NSP-Minnesota is subject to the jurisdiction of the FERC with respect to certain natural gas transactions in interstate

commerce. NSP-Minnesota is subject to the DOT, the Minnesota Office of Pipeline Safety, the NDPSC and the SDPUC for pipeline

safety compliance, including pipeline facilities used in electric utility operations for fuel deliveries.