Xcel Energy 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

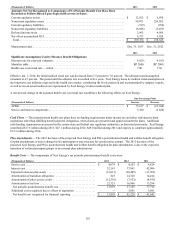

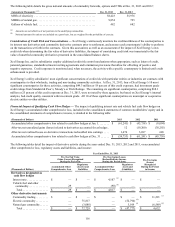

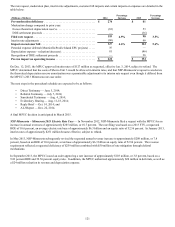

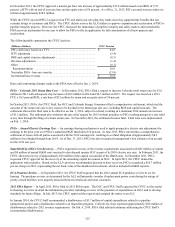

The following table presents the changes in Level 3 commodity derivatives for the years ended Dec. 31, 2013, 2012 and 2011:

Year Ended Dec. 31

(Thousands of Dollars) 2013 2012 2011

Balance at Jan. 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16,649 $ 12,417 $ 2,392

Purchases. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61,474 37,595 33,609

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (45,199)(44,950)(36,555)

Net transactions recorded during the period:

Gains recognized in earnings (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,947 463 69

Gains recognized as regulatory assets and liabilities . . . . . . . . . . . . . . 4,789 11,124 12,902

Balance at Dec. 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 41,660 $ 16,649 $ 12,417

(a) These amounts relate to commodity derivatives held at the end of the period.

Xcel Energy recognizes transfers between levels as of the beginning of each period. There were no transfers of amounts between

levels for derivative instruments for the years ended Dec. 31, 2013, 2012 and 2011.

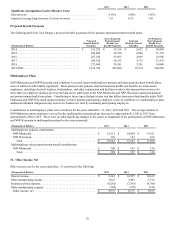

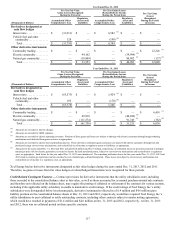

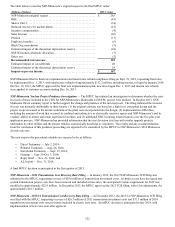

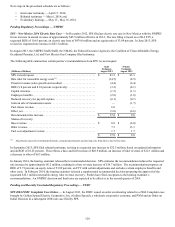

Fair Value of Long-Term Debt

As of Dec. 31, 2013 and 2012, other financial instruments for which the carrying amount did not equal fair value were as follows:

2013 2012

(Thousands of Dollars) Carrying

Amount Fair Value Carrying

Amount Fair Value

Long-term debt, including current portion . . . . . . . . . . . $ 11,191,517 $ 11,878,643 $ 10,402,060 $ 12,207,866

The fair value of Xcel Energy’s long-term debt is estimated based on recent trades and observable spreads from benchmark interest

rates for similar securities. The fair value estimates are based on information available to management as of Dec. 31, 2013 and 2012,

and given the observability of the inputs to these estimates, the fair values presented for long-term debt have been assigned a Level 2.

12. Rate Matters

NSP-Minnesota

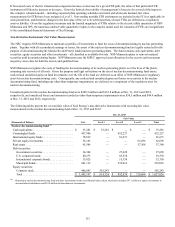

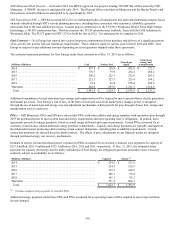

Pending and Recently Concluded Regulatory Proceedings — MPUC

NSP-Minnesota – Minnesota 2014 Multi-Year Electric Rate Case — On Nov. 4, 2013, NSP-Minnesota filed a two-year, electric rate

case with the MPUC. The rate case is based on a requested ROE of 10.25 percent, a 52.5 percent equity ratio, a 2014 average electric

rate base of $6.67 billion and an additional average rate base of $412 million in 2015.

The NSP-Minnesota electric rate case reflects an overall increase in revenues of approximately $193 million or 6.9 percent in 2014

and an additional $98 million or 3.5 percent in 2015. The request includes a proposed rate moderation plan for 2014 and 2015. After

reflecting interim rate adjustments, the impact of NSP-Minnesota’s request on customer bills would result in a 4.6 percent increase in

2014 and an additional 5.6 percent in 2015.

NSP-Minnesota’s moderation plan includes the acceleration of the eight-year amortization of the excess theoretical depreciation

reserve which the MPUC approved in NSP-Minnesota’s last electric rate case and the use of expected funds from the DOE for

settlement of certain claims. These DOE refunds would be in excess of amounts needed to fund its decommissioning expense. The

interim rate adjustments are primarily associated with ROE, Monticello LCM/EPU project costs and NSP-Minnesota’s request to

amortize amounts associated with the canceled Prairie Island EPU project. NSP-Minnesota plans to file a petition for deferred

accounting regarding these Monticello costs in the first quarter of 2014.