Xcel Energy 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

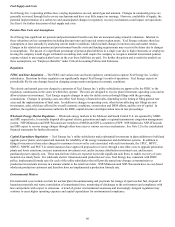

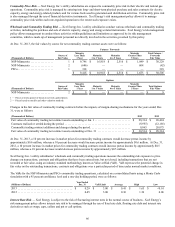

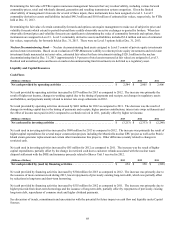

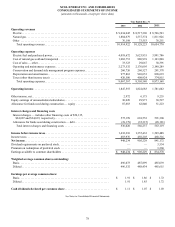

Contractual Obligations and Other Commitments — In addition to its capital expenditure programs, Xcel Energy has contractual

obligations and other commitments that will need to be funded in the future. The following is a summarized table of contractual

obligations and other commercial commitments at Dec. 31, 2013. See the statements of capitalization and additional discussion in

Notes 4 and 13 to the consolidated financial statements.

Payments Due by Period

(Thousands of Dollars) Total Less than 1 Year 1 to 3 Years 4 to 5 Years After 5 Years

Long-term debt, principal and interest

payments (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 18,532,746 $ 758,294 $ 1,846,741 $ 2,438,796 $ 13,488,915

Capital lease obligations . . . . . . . . . . . . . . . . . . . 371,697 17,966 34,896 29,686 289,149

Operating leases (b)(c) . . . . . . . . . . . . . . . . . . . . . . 3,028,807 240,669 452,213 420,423 1,915,502

Unconditional purchase obligations (d) . . . . . . . . 12,087,474 2,217,694 3,103,409 1,776,893 4,989,478

Other long-term obligations, including current

portion (e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 218,718 55,416 85,089 62,743 15,470

Payments to vendors in process . . . . . . . . . . . . . 28,955 28,955 — — —

Short-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . 759,000 759,000 — — —

Total contractual cash obligations (f)(g)(h) . . . . . $ 35,027,397 $ 4,077,994 $ 5,522,348 $ 4,728,541 $ 20,698,514

(a) Includes interest payments over the terms of the debt. Interest is calculated using the applicable interest rate at Dec. 31, 2013, and outstanding principal for each

investment with the terms ending at each instrument’s maturity.

(b) Under some leases, Xcel Energy would have to sell or purchase the property that it leases if it chose to terminate before the scheduled lease expiration date. Most

of Xcel Energy’s railcar, vehicle and equipment and aircraft leases have these terms. At Dec. 31, 2013, the amount that Xcel Energy would have to pay if it chose

to terminate these leases was approximately $73.4 million. In addition, at the end of the equipment lease terms, each lease must be extended, equipment

purchased for the greater of the fair value or unamortized value of equipment sold to a third party with Xcel Energy making up any deficiency between the sales

price and the unamortized value.

(c) Included in operating lease payments are $214.2 million, $404.4 million, $387.1 million and $1.8 billion, for the less than 1 year, 1-3 years, 4-5 years and after 5

years categories, respectively, pertaining to PPAs that were accounted for as operating leases.

(d) Xcel Energy Inc. and its subsidiaries have contracts providing for the purchase and delivery of a significant portion of its current coal, nuclear fuel and natural gas

requirements. Additionally, the utility subsidiaries of Xcel Energy Inc. have entered into agreements with utilities and other energy suppliers for purchased power

to meet system load and energy requirements, replace generation from company-owned units under maintenance and during outages, and meet operating reserve

obligations. Certain contractual purchase obligations are adjusted on indices. The effects of price changes are mitigated through cost of energy adjustment

mechanisms.

(e) Other long-term obligations relate primarily to amounts associated with technology agreements as well as uncertain tax positions.

(f) Xcel Energy also has outstanding authority under O&M contracts to purchase up to approximately $3.1 billion of goods and services through the year 2050, in

addition to the amounts disclosed in this table.

(g) In January 2014, contributions of $130.0 million were made across three of Xcel Energy’s pension plans. Obligations of this type are dependent on several

factors, including management discretion, and therefore, they are not included in the table.

(h) Xcel Energy expects to contribute approximately $13.3 million to the postretirement health care plans during 2014. Obligations of this type are dependent on

several factors, including management discretion, and therefore, they are not included in the table.

Common Stock Dividends — Future dividend levels will be dependent on Xcel Energy’s results of operations, financial position, cash

flows, reinvestment opportunities and other factors, and will be evaluated by the Xcel Energy Inc. Board of Directors. Xcel Energy’s

general objective is to continue to grow annual EPS four percent to six percent and to grow the annual dividend four percent to six

percent. On Feb. 19, 2014, Xcel Energy announced dividends of $0.30 per share. Xcel Energy’s dividend policy balances:

• Projected cash generation;

• Projected capital investment;

• A reasonable rate of return on shareholder investment; and

• The impact on Xcel Energy’s capital structure and credit ratings.

In addition, there are certain statutory limitations that could affect dividend levels. Federal law places certain limits on the ability of

public utilities within a holding company system to declare dividends.

Specifically, under the Federal Power Act, a public utility may not pay dividends from any funds properly included in a capital

account. The utility subsidiaries’ dividends may be limited directly or indirectly by state regulatory commissions or bond indenture

covenants. See Note 4 to the consolidated financial statements for further discussion of restrictions on dividend payments.