Xcel Energy 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

Providing options and solutions to customers

Adapting to a changing environment is critical to our success. Our customers expect to be offered choices and we are committed to

providing options and solutions that are fair and satisfy their needs. Environmental leadership is a core priority and is designed to

meet customer and policy maker expectations for clean energy at a competitive price while creating shareholder value. We will

continue to offer and expand our production of renewable energy, including wind and solar alternatives, and further develop DSM,

conservation and renewable programs.

Investing for the future

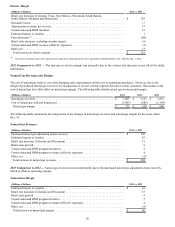

Sound investments today are necessary for tomorrow’s success. From 2014 through 2018, we anticipate investing approximately

$14.1 billion in our utility businesses, which will grow rate base at a compounded average annual rate of approximately 5.4 percent.

Our capital investment plan is primarily intended to take advantage of opportunities to grow the business, refresh our infrastructure,

reduce emissions and improve reliability. Xcel Energy has a proven record for making sound investments, including proactive and

forward-looking decisions to balance its generation portfolio and expand alternative energy production. Our customers, stakeholders

and the environment are currently benefiting from these decisions and will continue to do so in the future. Organic growth will remain

a priority, but ventures such as transmission related projects outside our established footprint are also being considered.

Enhancing engagement with employees, customers, shareholders, communities and policy makers

Engagement starts with our employees and creating a productive place to work. Providing the right tools and opportunities to our

employees is important not only for their future development, but the future of Xcel Energy. Communicating with customers,

shareholders, communities and policymakers is also crucial to enhancing our business relationships and overall engagement.

Maintaining a constructive regulatory environment is a key part of our overall strategy. We plan to further improve the regulatory

compact by proposing additional rate mitigation methodologies, rider mechanisms and continuing to negotiate multi-year rate

agreements.

Provide an attractive total return

Successful execution of our strategic plan should allow Xcel Energy to deliver an attractive total return to our shareholders. Through

a combination of earnings growth and dividend yield, we plan to:

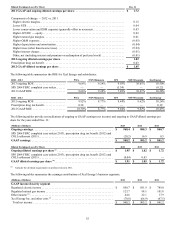

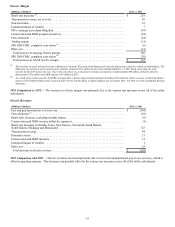

• Deliver long-term annual EPS growth of four percent to six percent, based on a normalized 2013 EPS of $1.90 per share;

• Deliver annual dividend increases of four percent to six percent; and

• Maintain senior unsecured debt credit ratings in the BBB+ to A range.

We have successfully achieved our prior financial objectives and believe we are positioned to continue to achieve our value

proposition. Our ongoing earnings have grown approximately 6.8 percent and our dividend has grown approximately 3.4 percent

annually since 2005. In addition, our current senior unsecured debt credit ratings for Xcel Energy and it utility subsidiaries are in the

BBB+ to A range.

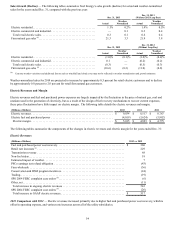

Financial Review

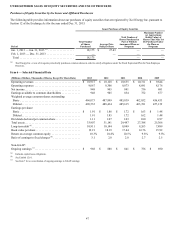

The following discussion and analysis by management focuses on those factors that had a material effect on Xcel Energy’s financial

condition, results of operations and cash flows during the periods presented, or are expected to have a material impact in the future. It

should be read in conjunction with the accompanying consolidated financial statements and the related notes to consolidated financial

statements.

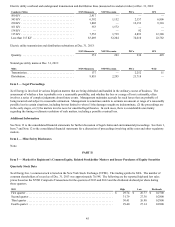

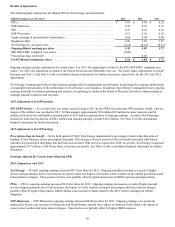

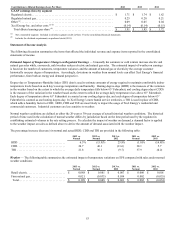

The only common equity securities that are publicly traded are common shares of Xcel Energy Inc. The earnings and EPS as well as

the ROE of each subsidiary discussed below do not represent a direct legal interest in the assets and liabilities allocated to such

subsidiary but rather represent a direct interest in our assets and liabilities as a whole. Ongoing diluted EPS and ongoing ROE for

Xcel Energy and by subsidiary are financial measures not recognized under GAAP. Ongoing diluted EPS is calculated by dividing the

net income or loss attributable to the controlling interest of each subsidiary, adjusted for certain nonrecurring items, by the weighted

average fully diluted Xcel Energy Inc. common shares outstanding for the period. Ongoing ROE is calculated by dividing the net

income or loss attributable to the controlling interest of Xcel Energy or each subsidiary, adjusted for certain nonrecurring items, by

each entity’s average common stockholders’ or stockholder’s equity. We use these non-GAAP financial measures to evaluate and

provide details of earnings results. We believe that these measurements are useful to investors to evaluate the actual and projected

financial performance and contribution of our subsidiaries. These non-GAAP financial measures should not be considered as

alternatives to measures calculated and reported in accordance with GAAP.