Xcel Energy 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

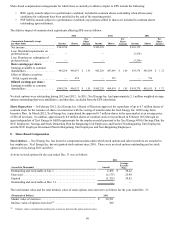

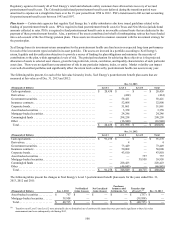

105

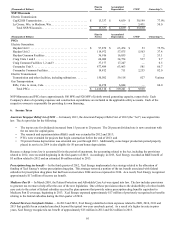

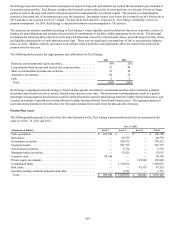

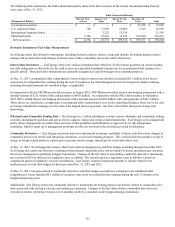

Dec. 31, 2012

(Thousands of Dollars) Level 1 Level 2 Level 3 Total

Cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 164,096 $ — $ — $ 164,096

Derivatives. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 12,955 — 12,955

Government securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 298,141 — 298,141

Corporate bonds. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 622,597 — 622,597

Asset-backed securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 14,639 14,639

Mortgage-backed securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 39,904 39,904

Common stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73,247 — — 73,247

Private equity investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 158,498 158,498

Commingled funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,524,563 — 1,524,563

Real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 64,597 64,597

Securities lending collateral obligation and other . . . . . . . . . . . . . . . . . . . . — (29,454) — (29,454)

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 237,343 $ 2,428,802 $ 277,638 $ 2,943,783

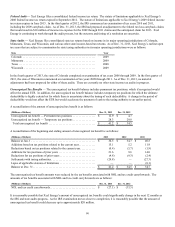

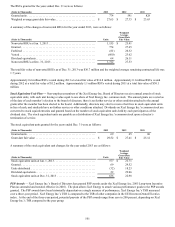

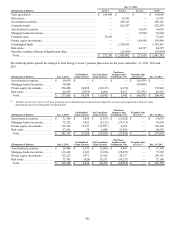

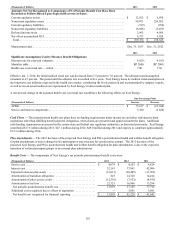

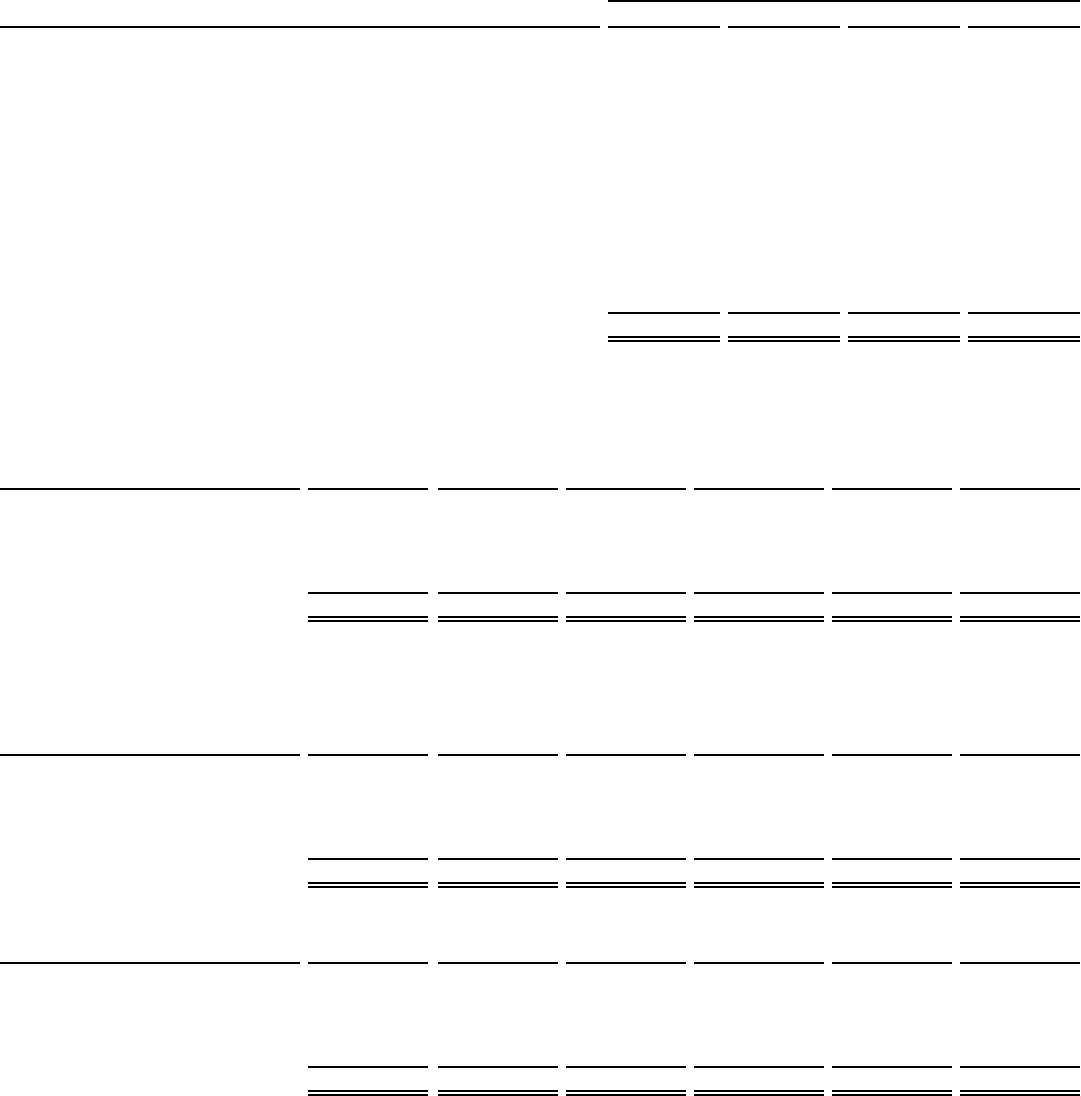

The following tables present the changes in Xcel Energy’s Level 3 pension plan assets for the years ended Dec. 31, 2013, 2012 and

2011:

(Thousands of Dollars) Jan. 1, 2013 Net Realized

Gains (Losses) Net Unrealized

Gains (Losses)

Purchases,

Issuances and

Settlements, Net Transfers Out

of Level 3 (a) Dec. 31, 2013

Asset-backed securities . . . . . . . . . . $ 14,639 $ — $ — $ — $ (14,639) $ —

Mortgage-backed securities. . . . . . . 39,904 — — — (39,904) —

Private equity investments. . . . . . . . 158,498 22,058 (24,335)(3,372) — 152,849

Real estate . . . . . . . . . . . . . . . . . . . . 64,597 (2,659) 8,690 9,317 (32,392) 47,553

Total. . . . . . . . . . . . . . . . . . . . . . . . $ 277,638 $ 19,399 $ (15,645) $ 5,945 $ (86,935) $ 200,402

(a) Transfers out of Level 3 into Level 2 were principally due to diminished use of unobservable inputs that were previously significant to these fair value

measurements and were subsequently sold during 2013.

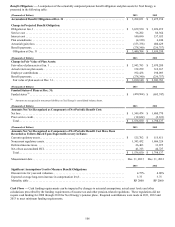

(Thousands of Dollars) Jan. 1, 2012 Net Realized

Gains (Losses) Net Unrealized

Gains (Losses)

Purchases,

Issuances and

Settlements, Net Transfers Out

of Level 3 Dec. 31, 2012

Asset-backed securities . . . . . . . . . . $ 31,368 $ 3,886 $ (5,363) $ (15,252) $ — $ 14,639

Mortgage-backed securities. . . . . . . 73,522 1,822 (2,127)(33,313) — 39,904

Private equity investments. . . . . . . . 159,363 17,537 (22,587) 4,185 — 158,498

Real estate . . . . . . . . . . . . . . . . . . . . 37,106 19 6,048 21,424 — 64,597

Total. . . . . . . . . . . . . . . . . . . . . . . . $ 301,359 $ 23,264 $ (24,029) $ (22,956) $ — $ 277,638

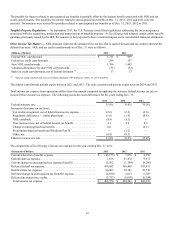

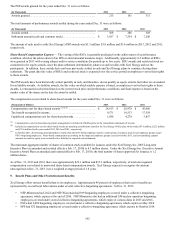

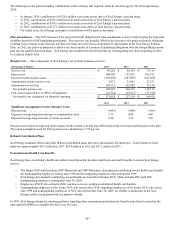

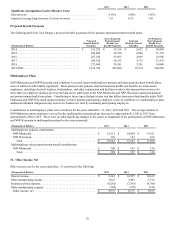

(Thousands of Dollars) Jan. 1, 2011 Net Realized

Gains (Losses) Net Unrealized

Gains (Losses)

Purchases,

Issuances and

Settlements, Net Transfers Out

of Level 3 Dec. 31, 2011

Asset-backed securities . . . . . . . . . . $ 26,986 $ 2,391 $ (2,504) $ 4,495 $ — $ 31,368

Mortgage-backed securities. . . . . . . 113,418 1,103 (5,926)(35,073) — 73,522

Private equity investments. . . . . . . . 122,223 3,971 12,412 20,757 — 159,363

Real estate . . . . . . . . . . . . . . . . . . . . 73,701 (629) 20,271 (56,237) — 37,106

Total. . . . . . . . . . . . . . . . . . . . . . . . $ 336,328 $ 6,836 $ 24,253 $ (66,058) $ — $ 301,359