Xcel Energy 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.142

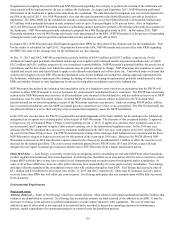

Pacific Northwest FERC Refund Proceeding — In July 2001, the FERC ordered a preliminary hearing to determine whether there

were unjust and unreasonable charges for spot market bilateral sales in the Pacific Northwest for December 2000 through June 2001.

PSCo supplied energy to the Pacific Northwest markets during this period and has been a participant in the hearings. In September

2001, the presiding ALJ concluded that prices in the Pacific Northwest during the referenced period were the result of a number of

factors, including the shortage of supply, excess demand, drought and increased natural gas prices. Under these circumstances, the

ALJ concluded that the prices in the Pacific Northwest markets were not unreasonable or unjust and no refunds should be ordered.

Subsequent to the ruling, the FERC has allowed the parties to request additional evidence. Parties have claimed that the total amount

of transactions with PSCo subject to refund is $34 million. In June 2003, the FERC issued an order terminating the proceeding

without ordering further proceedings. Certain purchasers filed appeals of the FERC’s orders in this proceeding with the Ninth Circuit.

In an order issued in August 2007, the Ninth Circuit remanded the proceeding back to the FERC and indicated that the FERC should

consider other rulings addressing overcharges in the California organized markets. The Ninth Circuit denied a petition for rehearing in

April 2009, and the mandate was issued.

The FERC issued an order on remand establishing principles for the review proceeding in October 2011. In September 2012, the City

of Seattle filed its direct case against PSCo and other Pacific Northwest sellers claiming refunds for the period January 2000 through

June 2001. The City of Seattle indicated that for the period June 2000 through June 2001 PSCo had sales to the City of Seattle of

approximately $50 million. The City of Seattle did not identify specific instances of unlawful market activity by PSCo, but rather

based its claim for refunds on market dysfunction in the Western markets. PSCo submitted its answering case in December 2012.

In April 2013, the FERC issued an order on rehearing. The FERC confirmed that the City of Seattle would be able to attempt to obtain

refunds back from January 2000, but reaffirmed the transaction-specific standard that the City of Seattle and other complainants would

have to comply with to obtain refunds. In addition, the FERC rejected the imposition of any market-wide remedies. Although the

FERC order on rehearing established the period for which the City of Seattle could seek refunds as January 2000 through June 2001, it

is unclear what claim the City of Seattle has against PSCo prior to June 2000. In the proceeding, the City of Seattle does not allege

specific misconduct or tariff violations by PSCo but instead asserts generally that the rates charged by PSCo and other sellers were

excessive.

A hearing in this case was held before a FERC ALJ and concluded in October 2013. The matter is presently being briefed, and the

ALJ is expected to issue an initial decision on or before March 18, 2014.

Preliminary calculations of the City of Seattle’s claim for refunds from PSCo are approximately $28 million excluding interest. PSCo

has concluded that a loss is reasonably possible with respect to this matter; however, given the surrounding uncertainties, PSCo is

currently unable to estimate the amount or range of reasonably possible loss in the event of an adverse outcome of this matter. In

making this assessment, PSCo considered two factors. First, not withstanding PSCo’s view that the City of Seattle has failed to apply

the standard that the FERC has established in this proceeding, and the recognition that this case raises a novel issue and the FERC’s

standard has been challenged on appeal to the Ninth Circuit, the outcome of such an appeal cannot be predicted with any certainty.

Second, PSCo would expect to make equitable arguments against refunds even if the City of Seattle were to establish that it was

overcharged for transactions. If a loss were sustained, PSCo would attempt to recover those losses from other PRPs. No accrual has

been recorded for this matter.

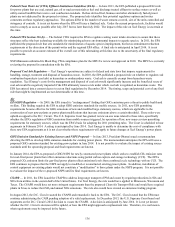

Fru-Con Construction Corporation (Fru-Con) vs. Utility Engineering Corporation (UE) et al. — In December 2001, a former

wholly owned subsidiary of SPS and power plant design services company, UE, was engaged by the Sacramento Municipal Utility

District (SMUD) to furnish design services for a natural gas-fired, combined-cycle power plant to be constructed by Fru-Con. In

March 2005, Fru-Con commenced a lawsuit against UE and SMUD for damages allegedly suffered during the construction of the

plant. In April 2005, Zachry Group (Zachry) purchased UE from Xcel Energy. As this lawsuit commenced prior to the sale of UE to

Zachry, Xcel Energy agreed to indemnify Zachry for damages related to this case up to $17.5 million. In October 2013, the lawsuit

was dismissed. Xcel Energy’s obligation to indemnify Zachry for damages related to the sale expired upon final resolution of this

case, which brings this litigation to a close.

Nuclear Power Operations and Waste Disposal

Nuclear Waste Disposal Litigation — In 1998, NSP-Minnesota filed a complaint in the U.S. Court of Federal Claims against the

United States requesting breach of contract damages for the DOE’s failure to begin accepting spent nuclear fuel by Jan. 31, 1998, as

required by the contract between the United States and NSP-Minnesota. NSP-Minnesota sought contract damages in this lawsuit

through Dec. 31, 2004. In September 2007, the court awarded NSP-Minnesota $116.5 million in damages. In August 2007, NSP-

Minnesota filed a second complaint; this lawsuit claimed damages for the period Jan. 1, 2005 through Dec. 31, 2008.