Xcel Energy 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

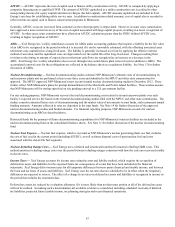

NSP-Minnesota, NSP-Wisconsin, PSCo, SPS and Xcel Energy Inc. each have five-year credit agreements with a syndicate of banks.

The total size of the credit facilities is $2.45 billion and each credit facility terminates in July 2017.

NSP-Minnesota, PSCo, SPS, and Xcel Energy Inc. each have the right to request an extension of the revolving termination date for

two additional one-year periods. NSP-Wisconsin has the right to request an extension of the revolving termination date for an

additional one-year period. All extension requests are subject to majority bank group approval.

Features of the credit facilities include:

• Xcel Energy Inc. may increase its credit facility by up to $200 million, NSP-Minnesota and PSCo may each increase their

credit facilities by $100 million and SPS may increase its credit facility by $50 million. The NSP-Wisconsin credit facility

cannot be increased.

• Each credit facility has a financial covenant requiring that the debt-to-total capitalization ratio of each entity be less than or

equal to 65 percent. Each entity was in compliance at Dec. 31, 2013 and 2012, respectively, as evidenced by the table below:

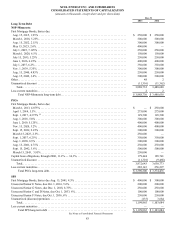

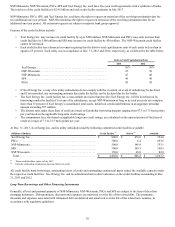

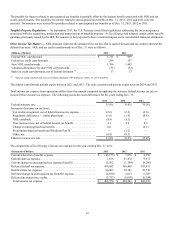

Debt-to-Total Capitalization Ratio

2013 2012

Xcel Energy. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56% 56%

NSP-Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 50

NSP-Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 48

SPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 49

PSCo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 45

• If Xcel Energy Inc. or any of its utility subsidiaries do not comply with the covenant, an event of default may be declared,

and if not remedied, any outstanding amounts due under the facility can be declared due by the lender.

• The Xcel Energy Inc. credit facility has a cross-default provision that provides Xcel Energy Inc. will be in default on its

borrowings under the facility if it or any of its subsidiaries, except NSP-Wisconsin as long as its total assets do not comprise

more than 15 percent of Xcel Energy’s consolidated total assets, default on certain indebtedness in an aggregate principal

amount exceeding $75 million.

• The interest rates under these lines of credit are based on Eurodollar borrowing margins ranging from 87.5 to 175 basis points

per year based on the applicable long-term credit ratings.

• The commitment fees, also based on applicable long-term credit ratings, are calculated on the unused portion of the lines of

credit at a range of 7.5 to 27.5 basis points per year.

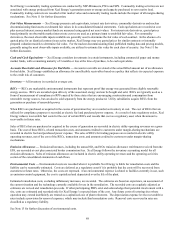

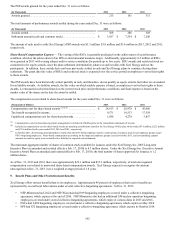

At Dec. 31, 2013, Xcel Energy Inc. and its utility subsidiaries had the following committed credit facilities available:

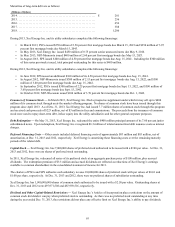

(Millions of Dollars) Credit Facility (a) Drawn (b) Available

Xcel Energy Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 800.0 $ 476.0 $ 324.0

PSCo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 700.0 6.4 693.6

NSP-Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500.0 146.9 353.1

SPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300.0 109.5 190.5

NSP-Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150.0 68.0 82.0

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,450.0 $ 806.8 $ 1,643.2

(a) These credit facilities expire in July 2017.

(b) Includes outstanding commercial paper and letters of credit.

All credit facility bank borrowings, outstanding letters of credit and outstanding commercial paper reduce the available capacity under

the respective credit facilities. Xcel Energy Inc. and its subsidiaries had no direct advances on the credit facilities outstanding at Dec.

31, 2013 and 2012.

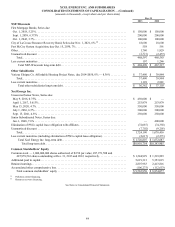

Long-Term Borrowings and Other Financing Instruments

Generally, all real and personal property of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS are subject to the liens of their first

mortgage indentures. Debt premiums, discounts and expenses are amortized over the life of the related debt. The premiums,

discounts and expenses associated with refinanced debt are deferred and amortized over the life of the related new issuance, in

accordance with regulatory guidelines.