Xcel Energy 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

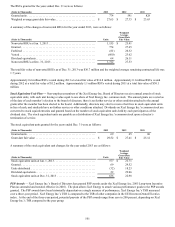

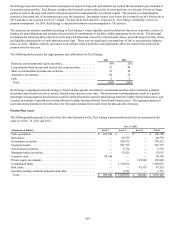

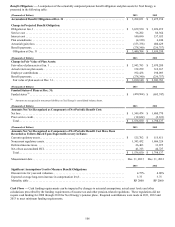

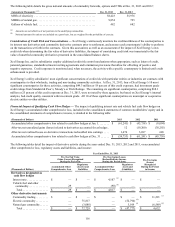

The following are the pension funding contributions, both voluntary and required, made by Xcel Energy for 2011 through January

2014:

• In January 2014, contributions of $130.0 million were made across three of Xcel Energy’s pension plans;

• In 2013, contributions of $192.4 million were made across four of Xcel Energy’s pension plans;

• In 2012, contributions of $198.1 million were made across four of Xcel Energy’s pension plans;

• In 2011, contributions of $137.3 million were made across three of Xcel Energy’s pension plans;

• For future years, Xcel Energy anticipates contributions will be made as necessary.

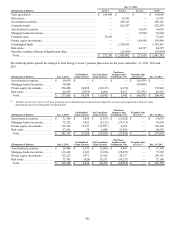

Plan Amendments —The 2013 decrease of the projected benefit obligation for plan amendments is due to fully insuring the long-term

disability benefit for NSP bargaining participants. This decrease was partially offset by an increase to the projected benefit obligation

resulting from a change in the discount rate basis for lump sum conversion of annuities for participants in the Xcel Energy Pension

Plan. In 2012, the plan was amended to allow a one time transfer of a portion of qualifying obligations from the nonqualified pension

plan into the qualified pension plans. Xcel Energy also modified the benefit formula for nonbargaining new hires beginning in 2012

to a reduced benefit level.

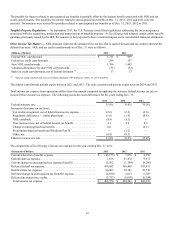

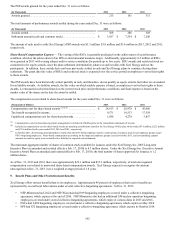

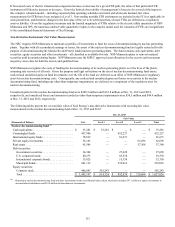

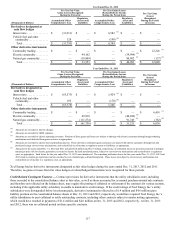

Benefit Costs — The components of Xcel Energy’s net periodic pension cost were:

(Thousands of Dollars) 2013 2012 2011

Service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 96,282 $ 86,364 $ 77,319

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140,690 157,035 161,412

Expected return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (198,452)(207,095)(221,600)

Amortization of prior service cost. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,871 21,065 22,533

Amortization of net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 144,151 108,982 78,510

Net periodic pension cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 188,542 166,351 118,174

Costs not recognized due to effects of regulation . . . . . . . . . . . . . . . . . . . . (36,724)(39,217)(37,198)

Net benefit cost recognized for financial reporting. . . . . . . . . . . . . . . . . . $ 151,818 $ 127,134 $ 80,976

2013 2012 2011

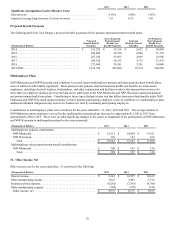

Significant Assumptions Used to Measure Costs:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.00% 5.00% 5.50%

Expected average long-term increase in compensation level . . . . . . . . . . . 3.75 4.00 4.00

Expected average long-term rate of return on assets. . . . . . . . . . . . . . . . . . 6.88 7.10 7.50

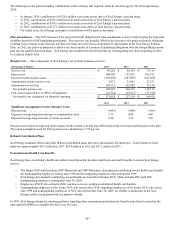

Pension costs include an expected return impact for the current year that may differ from actual investment performance in the plan.

The return assumption used for 2014 pension cost calculations is 7.05 percent.

Defined Contribution Plans

Xcel Energy maintains 401(k) and other defined contribution plans that cover substantially all employees. Total expense to these

plans was approximately $30.3 million in 2013, $28.0 million in 2012 and $27.1 million in 2011.

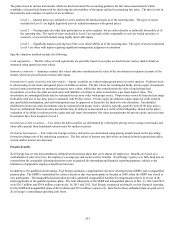

Postretirement Health Care Benefits

Xcel Energy has a contributory health and welfare benefit plan that provides health care and death benefits to certain Xcel Energy

retirees.

• The former NSP, which includes NSP-Minnesota and NSP-Wisconsin, discontinued contributing toward health care benefits

for nonbargaining employees retiring after 1998 and for bargaining employees who retired after 1999.

• Xcel Energy discontinued contributing toward health care benefits for former NCE, which includes PSCo and SPS,

nonbargaining employees retiring after June 30, 2003.

• Employees of NCE who retired in 2002 continue to receive employer-subsidized health care benefits.

• Nonbargaining employees of the former NCE who retired after 1998, bargaining employees of the former NCE who retired

after 1999 and nonbargaining employees of NCE who retired after June 30, 2003, are eligible to participate in the Xcel

Energy health care program with no employer subsidy.

In 1993, Xcel Energy adopted accounting guidance regarding other non-pension postretirement benefits and elected to amortize the

unrecognized APBO on a straight-line basis over 20 years.