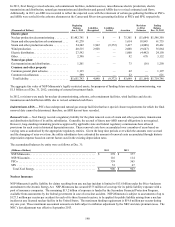

Xcel Energy 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.134

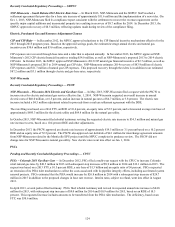

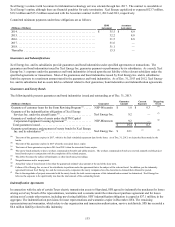

Xcel Energy Inc. and its subsidiaries provide indemnifications through contracts entered into in the normal course of business. These

are primarily indemnifications against adverse litigation outcomes in connection with underwriting agreements, as well as breaches of

representations and warranties, including corporate existence, transaction authorization and income tax matters with respect to assets

sold. Xcel Energy Inc.’s and its subsidiaries’ obligations under these agreements may be limited in terms of duration and amount. The

maximum potential amount of future payments under these indemnifications cannot be reasonably estimated as the obligated amounts

of these indemnifications often are not explicitly stated.

Environmental Contingencies

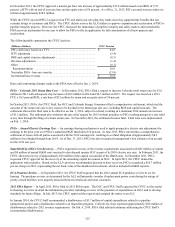

Xcel Energy has been or is currently involved with the cleanup of contamination from certain hazardous substances at several sites. In

many situations, the subsidiary involved believes it will recover some portion of these costs through insurance claims. Additionally,

where applicable, the subsidiary involved is pursuing, or intends to pursue, recovery from other PRPs and through the regulated rate

process. New and changing federal and state environmental mandates can also create added financial liabilities for Xcel Energy,

which are normally recovered through the regulated rate process. To the extent any costs are not recovered through the options listed

above, Xcel Energy would be required to recognize an expense.

Site Remediation — Various federal and state environmental laws impose liability, without regard to the legality of the original

conduct, where hazardous substances or other regulated materials have been released to the environment. Xcel Energy Inc.’s

subsidiaries may sometimes pay all or a portion of the cost to remediate sites where past activities of their predecessors or other parties

have caused environmental contamination. Environmental contingencies could arise from various situations, including sites of former

MGPs operated by Xcel Energy Inc.’s subsidiaries or their predecessors, or other entities; and third-party sites, such as landfills, for

which one or more of Xcel Energy Inc.’s subsidiaries are alleged to be a PRP that sent hazardous materials and wastes to that site.

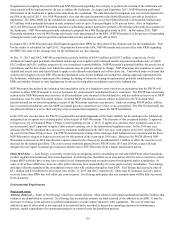

MGP Sites

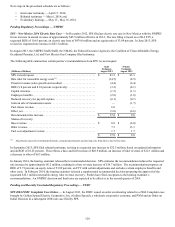

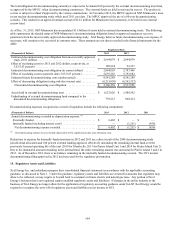

Ashland MGP Site — NSP-Wisconsin has been named a PRP for contamination at a site in Ashland, Wis. The Ashland/Northern

States Power Lakefront Superfund Site (the Ashland site) includes property owned by NSP-Wisconsin, which was a site previously

operated by a predecessor company as a MGP facility (the Upper Bluff), and two other properties: an adjacent city lakeshore park area

(Kreher Park), on which an unaffiliated third party previously operated a sawmill and conducted creosote treating operations; and an

area of Lake Superior’s Chequamegon Bay adjoining the park (the Sediments).

The EPA issued its Record of Decision (ROD) in 2010, which describes the preferred remedy the EPA has selected for the cleanup of

the Ashland site. For the Sediments at the Ashland Site, the ROD preferred remedy is a hybrid remedy involving both dry excavation

and wet conventional dredging methodologies (the Hybrid Remedy). The ROD also identifies the possibility of a wet conventional

dredging only remedy for the Sediments (the Wet Dredge), contingent upon the completion of a successful Wet Dredge pilot study.

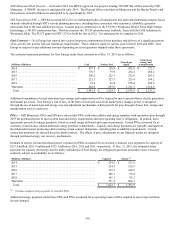

In 2011, the EPA issued special notice letters identifying several entities, including NSP-Wisconsin, as PRPs, for future remediation at

the site. The special notice letters requested that those PRPs participate in negotiations with the EPA regarding how the PRPs intended

to conduct or pay for the remediation at the Ashland site. As a result of settlement negotiations with NSP-Wisconsin, the EPA agreed

to segment the Ashland site into separate areas. The first area (Phase I Project Area) includes soil and groundwater in Kreher Park and

the Upper Bluff. The second area includes the Sediments.

In October 2012, a settlement among the EPA, the WDNR, the Bad River and Red Cliff Bands of the Lake Superior Tribe of

Chippewa Indians and NSP-Wisconsin was approved by the U.S. District Court for the Western District of Wisconsin. This settlement

resolves claims against NSP-Wisconsin for its alleged responsibility for the remediation of the Phase I Project Area. Under the terms

of the settlement, NSP-Wisconsin agreed to perform the remediation of the Phase I Project Area, but does not admit any liability with

respect to the Ashland site. The settlement reflects a cost estimate for the clean up of the Phase I Project Area of $40 million. The

settlement also resolves claims by the federal, state and tribal trustees against NSP-Wisconsin for alleged natural resource damages at

the Ashland site, including both the Phase I Project Area and the Sediments. As part of the settlement, NSP-Wisconsin has conveyed

approximately 1,390 acres of land to the State of Wisconsin and tribal trustees. Fieldwork to address the Phase I Project Area at the

Ashland site began at the end of 2012 and continues.