Xcel Energy 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

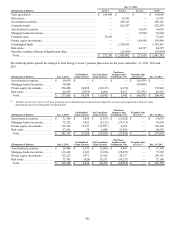

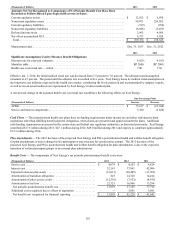

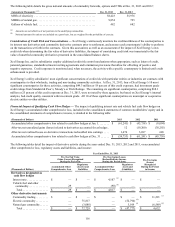

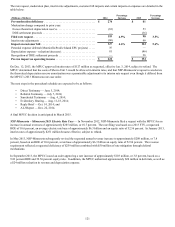

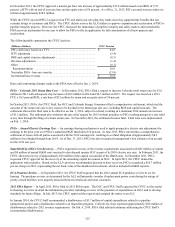

The following table summarizes the final contractual maturity dates of the debt securities in the nuclear decommissioning fund, by

asset class, at Dec. 31, 2013:

Final Contractual Maturity

(Thousands of Dollars) Due in 1 Year

or Less Due in 1 to 5

Years Due in 5 to 10

Years Due after 10

Years Total

Government securities. . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ — $ 27,628 $ 27,628

U.S. corporate bonds . . . . . . . . . . . . . . . . . . . . . . . . . . 780 17,850 63,089 1,819 83,538

International corporate bonds . . . . . . . . . . . . . . . . . . . — 2,222 13,136 — 15,358

Municipal bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,554 25,663 33,109 169,690 232,016

Debt securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,334 $ 45,735 $ 109,334 $ 199,137 $ 358,540

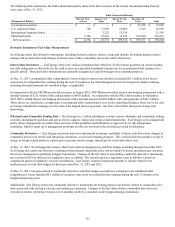

Derivative Instruments Fair Value Measurements

Xcel Energy enters into derivative instruments, including forward contracts, futures, swaps and options, for trading purposes and to

manage risk in connection with changes in interest rates, utility commodity prices and vehicle fuel prices.

Interest Rate Derivatives — Xcel Energy enters into various instruments that effectively fix the interest payments on certain floating

rate debt obligations or effectively fix the yield or price on a specified benchmark interest rate for an anticipated debt issuance for a

specific period. These derivative instruments are generally designated as cash flow hedges for accounting purposes.

At Dec. 31, 2013, accumulated other comprehensive losses related to interest rate derivatives included $2.3 million of net losses

expected to be reclassified into earnings during the next 12 months as the related hedged interest rate transactions impact earnings,

including forecasted amounts for unsettled hedges, as applicable.

In conjunction with the NSP-Minnesota debt issuance in August 2012, NSP-Minnesota settled interest rate hedging instruments with a

notional amount of $225 million with cash payments of $45.0 million. In conjunction with the PSCo debt issuance in September

2012, PSCo settled interest rate hedging instruments with a notional amount of $250 million with cash payments of $44.7 million.

These losses are classified as a component of accumulated other comprehensive loss on the consolidated balance sheet, net of tax, and

are being reclassified to earnings over the term of the hedged interest payments. See Note 4 for further discussion of long-term

borrowings.

Wholesale and Commodity Trading Risk — Xcel Energy Inc.’s utility subsidiaries conduct various wholesale and commodity trading

activities, including the purchase and sale of electric capacity, energy and energy-related instruments. Xcel Energy’s risk management

policy allows management to conduct these activities within guidelines and limitations as approved by its risk management

committee, which is made up of management personnel not directly involved in the activities governed by this policy.

Commodity Derivatives — Xcel Energy enters into derivative instruments to manage variability of future cash flows from changes in

commodity prices in its electric and natural gas operations, as well as for trading purposes. This could include the purchase or sale of

energy or energy-related products, natural gas to generate electric energy, natural gas for resale and vehicle fuel.

At Dec. 31, 2013, Xcel Energy had various vehicle fuel contracts designated as cash flow hedges extending through December 2016.

Xcel Energy also enters into derivative instruments that mitigate commodity price risk on behalf of electric and natural gas customers

but are not designated as qualifying hedging transactions. Changes in the fair value of non-trading commodity derivative instruments

are recorded in OCI or deferred as a regulatory asset or liability. The classification as a regulatory asset or liability is based on

commission approved regulatory recovery mechanisms. Xcel Energy recorded immaterial amounts to income related to the

ineffectiveness of cash flow hedges for the years ended Dec. 31, 2013 and 2012.

At Dec. 31, 2013, net gains related to commodity derivative cash flow hedges recorded as a component of accumulated other

comprehensive losses included $0.1 million of net gains expected to be reclassified into earnings during the next 12 months as the

hedged transactions occur.

Additionally, Xcel Energy enters into commodity derivative instruments for trading purposes not directly related to commodity price

risks associated with serving its electric and natural gas customers. Changes in the fair value of these commodity derivatives are

recorded in electric operating revenues, net of amounts credited to customers under margin-sharing mechanisms.