Xcel Energy 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.126

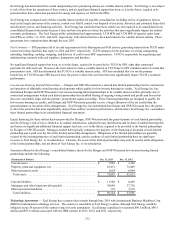

Next steps in the procedural schedule are as follows:

• Evidentiary hearing — March 3 - March 7, 2014;

• Initial brief — March 28, 2014; and

• Reply brief — April 11, 2014.

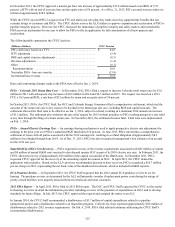

Electric, Purchased Gas and Resource Adjustment Clauses

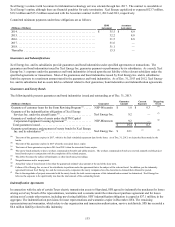

DSM and the DSMCA — The CPUC approved higher savings goals and a slightly higher financial incentive mechanism for PSCo’s

electric DSM energy efficiency programs starting in 2012. Savings goals are 356 GWh in 2013 and 384 GWh in 2014 with incentives

awarded in the year following plan achievements. PSCo is able to earn an incentive on 11 percent of net economic benefits and a

maximum annual incentive of $30 million.

The CPUC approved the PSCo electric and gas DSM budget of $115.5 million and $13.3 million, respectively, effective Jan. 1, 2013.

Energy efficiency and DSM costs are recovered through a combination of the DSMCA riders and base rates. Electric DSMCA rates

are designed to collect $26.8 million in 2013 with the remainder of the electric DSM expenditures collected through base rates. PSCo

filed its 2014 DSM plan in July 2013 and reached a settlement with all but one party. Hearings were held in December 2013 seeking

approval of a 2014 DSM electric budget of $87.8 million and a gas budget of $12.3 million. A decision by the ALJ is anticipated by

the end of the first quarter of 2014. DSMCA riders are adjusted biannually to capture program costs, performance incentives, and any

over- or under-recoveries are trued-up in the following year.

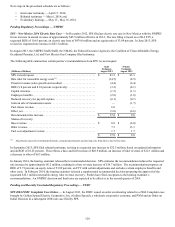

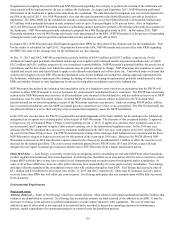

REC Sharing — In May 2011, the CPUC determined that margin sharing on stand-alone REC transactions would be shared 20

percent to PSCo and 80 percent to customers and ultimately becoming 10 percent to PSCo and 90 percent to customers by 2014. The

CPUC also approved a change to the treatment of hybrid REC trading margins (RECs that are bundled with energy) that allows the

customers’ share of the margins to be netted against the RESA regulatory asset balance.

In 2012, the CPUC approved an annual margin sharing on the first $20 million of margins on hybrid REC trades of 80 percent to the

customers and 20 percent to PSCo. Margins in excess of the $20 million are to be shared 90 percent to the customers and 10 percent

to PSCo. The CPUC authorized PSCo to return to customers unspent carbon offset funds by crediting the RESA regulatory asset

balance. PSCo credited the RESA regulatory asset balance $22 million and $46 million in 2013 and 2012, respectively. The

cumulative credit to the RESA regulatory asset balance was $104.5 million and $82.8 million at Dec. 31, 2013 and Dec. 31, 2012,

respectively. The credits include the customers’ share of REC trading margins and the customers’ share of carbon offset funds.

This sharing mechanism will be effective through 2014. The CPUC is then expecting to review the framework and evidence regarding

actual deliveries before determining to continue the sharing mechanism.

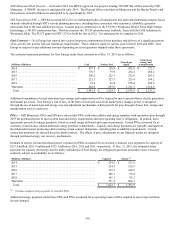

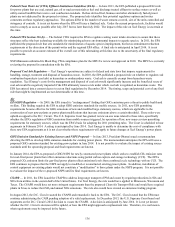

ECA / RESA Adjustment — In July 2013, PSCo advised the CPUC that it had inadvertently allocated purchased power expense

between the deferred accounts for the ECA and the RESA from 2010 to 2012. PSCo proposed to transfer from the RESA deferred

account to the ECA deferred account approximately $26.2 million and to amortize the recovery of this amount over 12 months. In

addition, interest of $4.4 million was accrued on the amount related to the RESA. In January 2014, the ALJ determined that the $26.2

million was prudently incurred and recommended full recovery through the ECA over a 12 month period with interest accrued at the

ECA interest rate. The difference between the RESA interest rate and the ECA interest rate is a decrease of approximately 7.4 percent,

or $4.3 million.

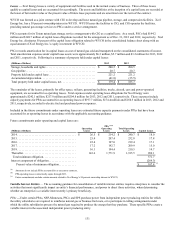

Pending and Recently Concluded Regulatory Proceedings — FERC

PSCo – Production Formula Rate ROE Complaint — In August 2013, PSCo’s wholesale production customers filed a complaint

with the FERC, and requested it reduce the stated ROEs ranging from 10.1 percent through 10.4 percent to 9.04 percent in the PSCo

power sales formula rates effective Sept. 1, 2013, which could reduce revenues approximately $2 million per year prospectively. The

matter is currently pending the FERC’s action.

PSCo Transmission Formula Rate Cases — In April 2012, PSCo filed with the FERC to revise the wholesale transmission formula

rates from a HTY formula rate to a forecast transmission formula rate and to establish formula ancillary services rates. PSCo

proposed that the formula rates be updated annually to reflect changes in costs, subject to a true-up. The request would increase

PSCo’s wholesale transmission and ancillary services revenue by approximately $2.0 million annually. Various transmission

customers taking service under the tariff protested the filing. In June 2012, the FERC issued an order accepting the proposed

transmission and ancillary services formula rates, suspending the increase to November 2012, subject to refund, and setting the case

for settlement judge or hearing procedures.