Xcel Energy 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Leases — Xcel Energy leases a variety of equipment and facilities used in the normal course of business. Three of these leases

qualify as capital leases and are accounted for accordingly. The assets and liabilities at the inception of a capital lease are recorded at

the lower of fair market value or the present value of future lease payments and are amortized over the term of the contract.

WYCO was formed as a joint venture with CIG to develop and lease natural gas pipeline, storage, and compression facilities. Xcel

Energy Inc. has a 50 percent ownership interest in WYCO. WYCO leases the facilities to CIG, and CIG operates the facilities,

providing natural gas storage services to PSCo under a service arrangement.

PSCo accounts for its Totem natural gas storage service arrangement with CIG as a capital lease. As a result, PSCo had $144.2

million and $148.7 million of capital lease obligations recorded for the arrangement as of Dec. 31, 2013 and 2012, respectively. Xcel

Energy Inc. eliminates 50 percent of the capital lease obligation related to WYCO in the consolidated balance sheet along with an

equal amount of Xcel Energy Inc.’s equity investment in WYCO.

PSCo records amortization for its capital leases as cost of natural gas sold and transported on the consolidated statements of income.

Total amortization expenses under capital lease assets were approximately $6.3 million, $5.7 million and $3.2 million for 2013, 2012

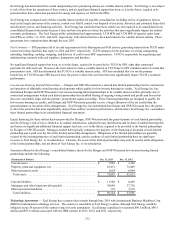

and 2011, respectively. Following is a summary of property held under capital leases:

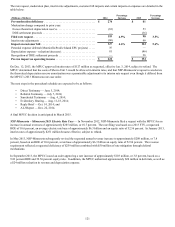

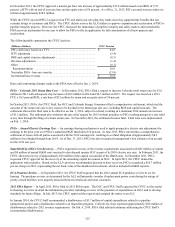

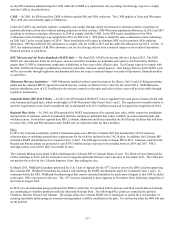

(Millions of Dollars) 2013 2012

Storage, leaseholds and rights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 200.5 $ 200.5

Gas pipeline. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.7 20.7

Property held under capital lease. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 221.2 221.2

Accumulated depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (41.8)(35.5)

Total property held under capital leases, net. . . . . . . . . . . . . . . . . . . . . . . . $ 179.4 $ 185.7

The remainder of the leases, primarily for office space, railcars, generating facilities, trucks, aircraft, cars and power-operated

equipment, are accounted for as operating leases. Total expenses under operating lease obligations for Xcel Energy were

approximately $242.1 million, $217.8 million and $204.8 million for 2013, 2012 and 2011, respectively. These expenses include

capacity payments for PPAs accounted for as operating leases of $197.7 million, $174.4 million and $160.5 million in 2013, 2012 and

2011, respectively, recorded to electric fuel and purchased power expenses.

Included in the future commitments under operating leases are estimated future capacity payments under PPAs that have been

accounted for as operating leases in accordance with the applicable accounting guidance.

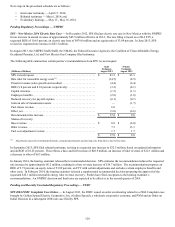

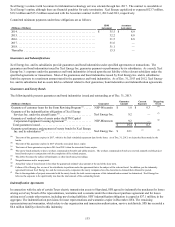

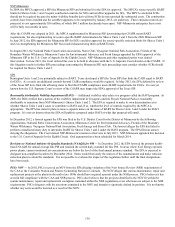

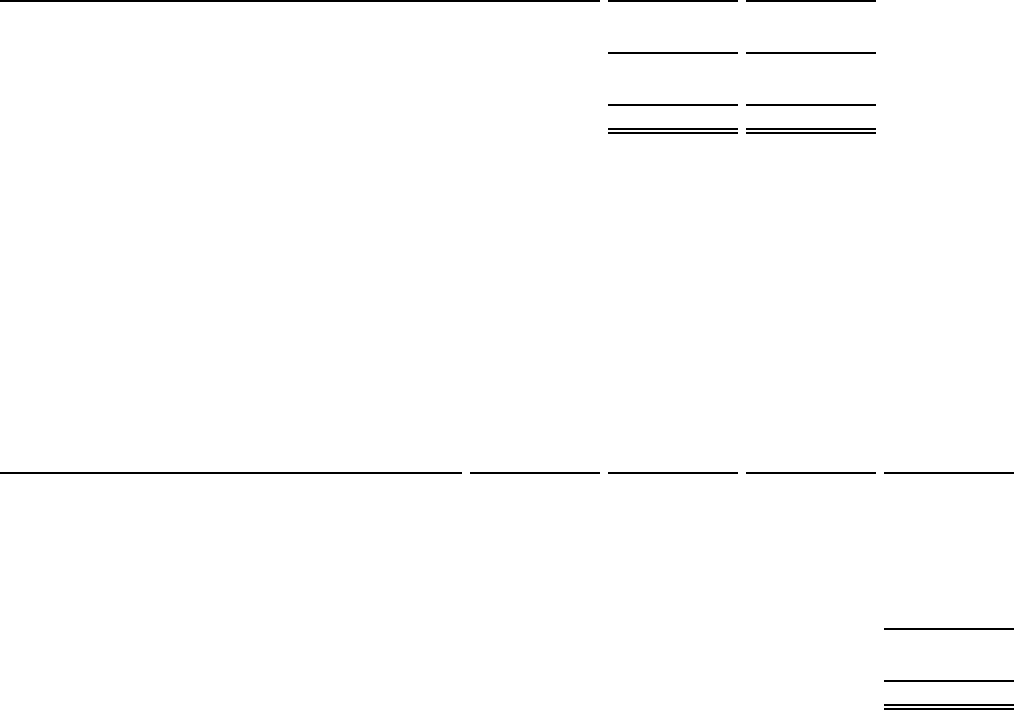

Future commitments under operating and capital leases are:

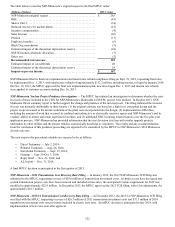

(Millions of Dollars) Operating

Leases

PPA (a) (b)

Operating

Leases Total Operating

Leases Capital Leases

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 26.5 $ 214.2 $ 240.7 $ 18.0

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.4 207.4 232.8 17.8

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.4 197.0 219.4 17.1

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.2 192.7 209.9 15.0

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.1 194.4 210.5 14.7

Thereafter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 143.6 1,771.9 1,915.5 289.1

Total minimum obligation. . . . . . . . . . . . . . . . . . . . . . . 371.7

Interest component of obligation . . . . . . . . . . . . . . . . . . . (264.3)

Present value of minimum obligation. . . . . . . . . . . . $ 107.4 (c)

(a) Amounts do not include PPAs accounted for as executory contracts.

(b) PPA operating leases contractually expire through 2033.

(c) Future commitments exclude certain amounts related to Xcel Energy’s 50 percent ownership interest in WYCO.

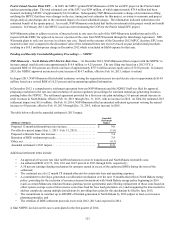

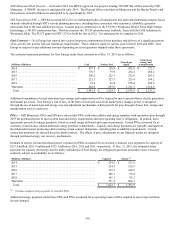

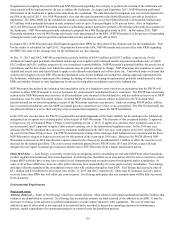

Variable Interest Entities — The accounting guidance for consolidation of variable interest entities requires enterprises to consider the

activities that most significantly impact an entity’s financial performance, and power to direct those activities, when determining

whether an enterprise is a variable interest entity’s primary beneficiary.

PPAs —Under certain PPAs, NSP-Minnesota, PSCo and SPS purchase power from independent power producing entities for which

the utility subsidiaries are required to reimburse natural gas or biomass fuel costs, or to participate in tolling arrangements under

which the utility subsidiaries procure the natural gas required to produce the energy that they purchase. These specific PPAs create a

variable interest in the associated independent power producing entity.