Xcel Energy 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

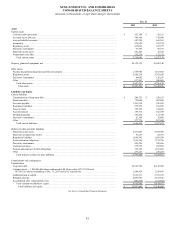

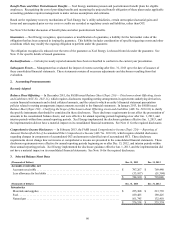

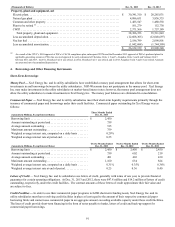

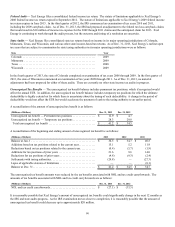

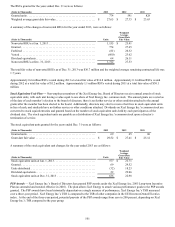

(Thousands of Dollars) Dec. 31, 2013 Dec. 31, 2012

Property, plant and equipment, net

Electric plant. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,341,310 $ 28,285,031

Natural gas plant. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,086,651 3,836,335

Common and other property. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,485,547 1,480,558

Plant to be retired (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101,279 152,730

CWIP . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,371,566 1,757,189

Total property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38,386,353 35,511,843

Less accumulated depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12,608,305) (12,048,697)

Nuclear fuel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,186,799 2,090,801

Less accumulated amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,842,688) (1,744,599)

$ 26,122,159 $ 23,809,348

(a) As a result of the CPUC’s 2010 approval of PSCo’s CACJA compliance plan, subsequent CPCNs and the December 2013 approval of PSCo’s preferred plans for

applicable generating resources, PSCo has received approval for early retirement of Cherokee Units 1, 2 and 3, Arapahoe Units 3 and 4 and Valmont Unit 5

between 2011 and 2017. In 2011, Cherokee Unit 2 was retired, in 2012, Cherokee Unit 1 was retired, and in 2013, Arapahoe Units 3 and 4 were retired. Amounts

are presented net of accumulated depreciation.

4. Borrowings and Other Financing Instruments

Short-Term Borrowings

Money Pool — Xcel Energy Inc. and its utility subsidiaries have established a money pool arrangement that allows for short-term

investments in and borrowings between the utility subsidiaries. NSP-Wisconsin does not participate in the money pool. Xcel Energy

Inc. may make investments in the utility subsidiaries at market-based interest rates; however, the money pool arrangement does not

allow the utility subsidiaries to make investments in Xcel Energy Inc. The money pool balances are eliminated in consolidation.

Commercial Paper — Xcel Energy Inc. and its utility subsidiaries meet their short-term liquidity requirements primarily through the

issuance of commercial paper and borrowings under their credit facilities. Commercial paper outstanding for Xcel Energy was as

follows:

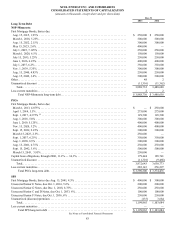

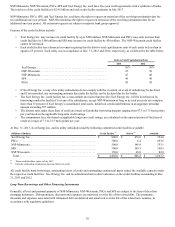

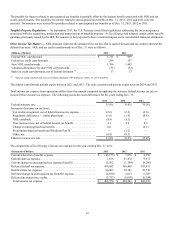

(Amounts in Millions, Except Interest Rates) Three Months Ended

Dec. 31, 2013

Borrowing limit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,450

Amount outstanding at period end . . . . . . . . . . . . . . . . . . . . . . . . . . 759

Average amount outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 515

Maximum amount outstanding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 759

Weighted average interest rate, computed on a daily basis . . . . . . . 0.29%

Weighted average interest rate at period end . . . . . . . . . . . . . . . . . . 0.25

(Amounts in Millions, Except Interest Rates) Twelve Months Ended

Dec. 31, 2013 Twelve Months Ended

Dec. 31, 2012 Twelve Months Ended

Dec. 31, 2011

Borrowing limit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,450 $ 2,450 $ 2,450

Amount outstanding at period end . . . . . . . . . . . . . . . . . . . . . . . . . . 759 602 219

Average amount outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 481 403 430

Maximum amount outstanding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,160 634 824

Weighted average interest rate, computed on a daily basis . . . . . . . 0.31% 0.35% 0.36%

Weighted average interest rate at end of period . . . . . . . . . . . . . . . . 0.25 0.36 0.40

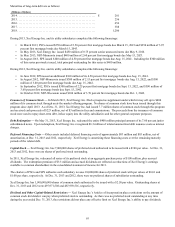

Letters of Credit — Xcel Energy Inc. and its subsidiaries use letters of credit, generally with terms of one year, to provide financial

guarantees for certain operating obligations. At Dec. 31, 2013 and 2012, there were $47.8 million and $14.2 million of letters of credit

outstanding, respectively, under the credit facilities. The contract amounts of these letters of credit approximate their fair value and

are subject to fees.

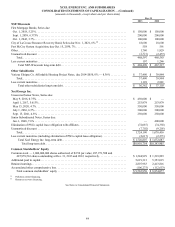

Credit Facilities — In order to use their commercial paper programs to fulfill short-term funding needs, Xcel Energy Inc. and its

utility subsidiaries must have revolving credit facilities in place at least equal to the amount of their respective commercial paper

borrowing limits and cannot issue commercial paper in an aggregate amount exceeding available capacity under these credit facilities.

The lines of credit provide short-term financing in the form of notes payable to banks, letters of credit and back-up support for

commercial paper borrowings.