Volvo 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group’s cash, cash equivalents and

marketable securities combined, amounted to

SEK 28.9 billion at December 31, 2012 which

includes SEK 0.2 billion not available for use by

the Volvo Group and SEK 9.4 billion where other

limitations exist, mainly liquid funds in countries

where exchange controls or other legal restric-

tions apply. In addition to this, granted but not uti-

lized credit facilities amounted to SEK 33.1 billion.

Total assets in the Volvo Group amounted to

SEK 338.7 billion as of December 31, 2012, a

decrease of SEK 14.5 billion compared to year-

end 2011. The decrease is mainly a result of

changes in currency rates and the divestment

of Volvo Aero which is offset by increased cus-

tomer financing receivables due to portfolio

growth in the Customer Finance Operations

Net debt in the Volvo Group’s Industrial Operations amounted to SEK 23.0 billion at December 31, 2012,

equal to 29.3% of shareholders’ equity. Excluding provisions for post-employment benefits the Industrial

Operation’s net debt amounted to SEK 19.0 billion, which was equal to 24.3% of shareholders’ equity.

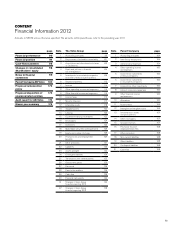

FINANCIAL POSITION

Continued strong financial position

BALANCE SHEETS VOLVO GROUP – ASSETS

Industrial Operations Customer Finance Eliminations Volvo Group

SEK M

Dec 31

2012

Dec 31

2011

Dec 31

2012

Dec 31

2011

Dec 31

2012

Dec 31

2011

Dec 31

2012

Dec 31

2011

Assets

Non-current assets

Intangible assets Note 12 40,267 39,385 106 122 – – 40,373 39,507

Tangible assets Note 13

Property, plant and equipment 54,145 53,563 105 94 – – 54,250 53,657

Investment property 754 883 – – – – 754 883

Assets under operating leases 21,263 16,749 12,543 11, 52 5 (4,784) (4,352) 29,022 23,922

Financial assets

Investments in associated companies Note 5 2,045 684 – – – – 2,045 684

Other shares and participations Note 5 839 1,187 6 3 – – 845 1,190

Non-current customer-financing receivables Note 15 600 579 47,329 44,651 (6,773) (4,612) 41,156 40,618

Deferred tax assets Note 10 10,406 12,480 760 358 – – 11,16 6 12,838

Prepaid pensions Note 20 2,708 2,263 16 14 – – 2,724 2,277

Non-current interest-bearing receivables Note 16 653 757 – – (316) (63) 337 694

Other non-current receivables Note 16 3,565 4,500 127 50 (373) (235) 3,319 4,315

Total non-current assets 137,24 5 133,030 60,992 56,817 (12,246) (9,262) 185,991 180,585

Current assets

Inventories Note 17 40,057 43,828 352 771 – – 40,409 44,599

Current receivables

Customer-financing receivables Note 15 797 1,123 39,946 38,050 (910) (1,092) 39,833 38,081

Tax assets 1,173 1,152 35 48 – – 1,208 1,200

Interest-bearing receivables Note 16 3,038 1,461 – 226 (464) (1,020) 2, 574 667

Internal funding14,612 2,253 – – (4,612) (2,253) – –

Accounts receivable Note 16 27,228 27,492 121 207 – – 27,349 27,699

Other receivables Note 16 11, 9 52 13,438 2,651 1, 411 (2 ,114) (1,024) 12,489 13,825

Non interest-bearing assets held for sale Note 3 – 9,344 – – – – – 9,344

Interest-bearing assets held for sale Note 3 – 4 – – – – – 4

Marketable securities Note 18 3,129 6,838 1 24 – – 3,130 6,862

Cash and cash equivalents Note 18 24,017 2 9 ,113 2 ,116 1,593 (374) (327) 25,759 30,379

Total current assets 116,003 136,046 45,222 42,330 (8 ,474) (5,717) 152,751 172,659

Total assets 253,248 269,076 106,214 99,147 (20,720) (14,979) 338,742 353,244

1 Internal funding is internal lending from Industrial Operations to Customer Finance.

and an increase in assets under operating lease

mainly related to the construction equipment

rental operation.

The Volvo Group’s intangible assets amounted

to SEK 40.4 billion as of December 31, 2012.

Investments in research and development

amounted to SEK 5.4 billion in 2012, resulting

in a net value of capitalized development costs

of SEK 13.4 billion at the end of the year. The

Volvo Group’s total goodwill amounted to SEK

23.3 billion as of December 31, 2012, an

decrease by SEK 0.6 billion compared to year-

end 2011 as a result of translation differences.

The tangible assets increased by SEK 5.6 bil-

lion during 2012, mainly related to the expansion

in the construction equipment rental operation.

The value of the inventories decreased by

SEK 4.2 billion during 2012. The decrease is

mainly related to finished products within trucks

and construction equipment.

The net value of assets and liabilities related to

pensions and similar obligations amounted to

SEK 4.0 billion as of December 31, 2012, a

decrease of SEK 0.4 billion compared to year-end

2011. Post-employment benefits valued at SEK

13.9 billion were reported outside the Volvo

Group’s balance sheet. For further information

see Note 20.

At year-end, the equity ratio in the Industrial

Operations was 30.9% and in the Volvo Group

25.7%. Equity in the Volvo Group amounted to

SEK 86.9 billion at December 31, 2012.

94

FINANCIAL INFORMATION 2012