Volvo 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190

|

|

LIQUIDITY RISKS

Liquidity risk is defined as the risk that the Volvo Group would be unable

to finance or refinance its assets or fulfill its payment obligations.

POLICY

The Volvo Group assures itself of sound financial preparedness by always

keeping a certain percentage of its sales in liquid assets. A balance

between short and long-term borrowing, as well as borrowing prepared-

ness in the form of overdraft facilities, are intended to meet the long-term

financing needs.

LIQUIDITY RISKS

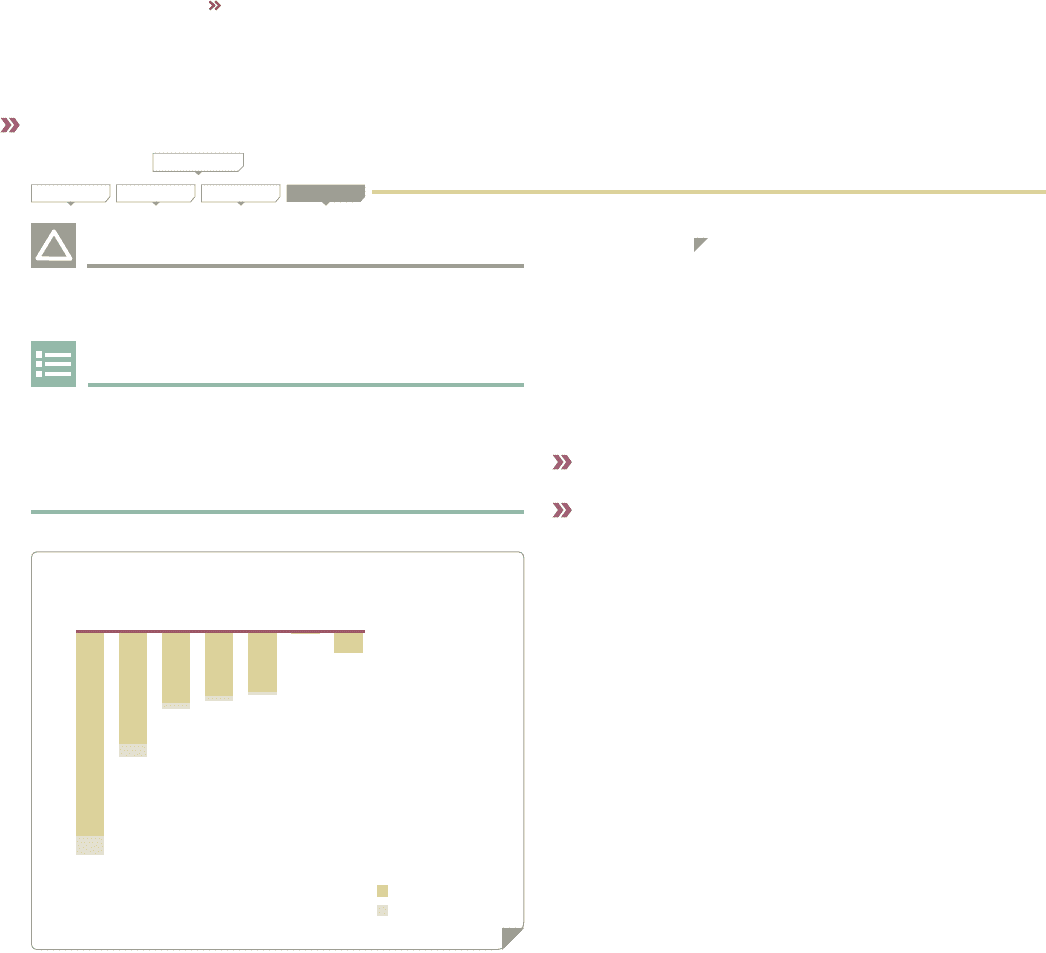

The adjacent graph J discloses expected future cash-flows including

derivatives related to financial liabilities. Capital flow refers to expected

payments of loans and derivatives, see note 22. Expected interest flow

refers to the future interest payments on loans and derivatives based on

interest rates expected by the market. The interest flow is recognized

within cash flow from operating activities.

In addition to derivatives included in capital flow in the table there are

also derivatives related to financial liabilities recognized as assets, which

are expected to give a future capital flow of SEK 0.8 billion and a future

interest flow of SEK 3.2 billion.

Read more about the maturity structure of bond loans and other loans, as

well as granted but unutilized credit facilities in Note 22.

Read more about contractual term analyses of the Volvo Group’s future pay-

ments from non-annullable financial and operational lease contracts in Note 14.

Future cash-flow including derivatives related to non-current

and current financial liabilities

Capital flow, SEK bn

Interest flow, SEK bn

2019

(5.0)

(0.3)

2016

(16.0)

(1.1)

2017

(14.9)

(0.7)

2018

(0.5)

(0.2)

2015

(17.5)

(1.7)

2014

(27.6)

(3.2)

2013

(50.3)

(4.6)

(

50)

0

(

40)

(

30)

(

20)

(

10)

J

Goals and policies in financial risk management (cont.)

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2012

108