Volvo 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 31

CHANGES IN VOLVO GROUP FINANCIAL REPORTING 2013

As from January 1, 2013 Volvo applies the following accounting stand-

ards, IFRS 10 Consolidated Financial Statements, IFRS 11 Joint Arrange-

ments, IFRS 12 Disclosures of Interest in Other Entities amendments in

IAS 27 Separate Financial Statements, amendments in IAS 28 Invest-

ments in Associates and Joint Ventures and the amendment in IAS 19

Employee Benefits. These standards are applied retrospectively and

hence the income statement and balance sheet for 2012 are adjusted to

reflect the changes in these new and amended accounting standards.

IFRS 10 Consolidated Financial Statements, IFRS 12 Disclosures of Inter-

est in Other Entities and the amendments in IAS 27 Separate Financial

Statements, see note 1, will not have a material effect on the Volvo Group

and are not included in the restated numbers for 2012.

Restatement Joint ventures

IFRS 11 replaces IAS 31 Interests in Joint Ventures. Under IFRS 11, joint

arrangements are classified as joint operations or joint ventures. A joint

operation is a joint arrangement whereby the parties to the arrangement

have rights to the assets, and obligations for the liabilities. A joint venture

is a joint arrangement whereby the parties to the arrangement have rights

to the net assets of the arrangement. Volvo Group’s joint arrangements are

classified as joint ventures. Volvo Group has previously accounted for joint

ventures using the proportional method and consolidated the assignable

part item by item in the income statement and balance sheet.

Under IFRS 11, the option of proportional consolidation of joint ventures

included in IAS 31 has been removed, and joint ventures shall be accounted

for using the equity method in accordance with IAS 28. Investments in

Associates and Joint Ventures (revised 2011). Assets and liabilities relating

to the joint ventures are derecognized and a carrying amount correspond-

ing to the net assets derecognized and including goodwill is recognized in

the balance sheet, impairment test has been performed in accordance with

the transition rules in IFRS 11. In accordance with the equity method, Volvo

Group’s share of the joint venture’s profit or loss will be recognized as a one

line item in the income statement, i.e. ”Income from investments in joint

ventures and associates”. The corresponding amount will be recognized in

the balance sheet as “Investment in joint ventures and associates”.

Read more about Volvo Group’s Joint Ventures in Note 5.

Restatement Employee benefits

As from January 1, 2013 the amendment to IAS 19 Employee benefits is

effective. The revised standard is applied retrospectively, and hence the

opening balance for 2012 is adjusted in accordance with the revised IAS

19, and the reported numbers for 2012 is restated accordingly for com-

parison purposes.

The amended standard removes the option to use the corridor method

which is used by the Volvo Group up to and including the financial year 2012.

According to the revised IAS 19, discount rate is used when calculating the

net interest income or expense on the net defined benefit liability (asset),

hence the expected return is no longer used. All changes in the net defined

liability or asset is recognized when they occur. Service cost and net interest

is recognized in profit and loss, while remeasurements such as actuarial gains

and losses is recognized in other comprehensive income. Special payroll tax

is recognized as pension liability, special payroll tax is applicable for Sweden

and Belgium. Amortization of actuarial gains and losses will cease with the

removal of the corridor method.

Read more about provision for post-employment benefit in Note 20.

Restatement hedging of firm flows

As from January 1, 2013 there will be a change of the presentation in the

income statement of financial instruments related to hedging of commercial

flows, from Operating income to Other financial income and expenses. Finan-

cial instruments related to hedging of commercial flows will be presented in

Other financial income and expenses to be able to enhance the possibility to

net all internal flows before entering into external hedging contracts.

Read more about hedging of firm flows Note 30.

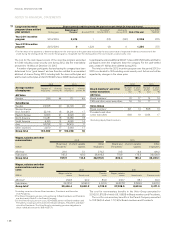

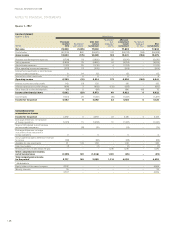

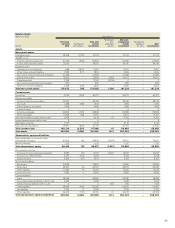

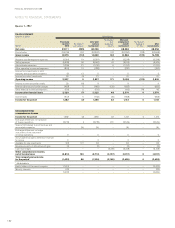

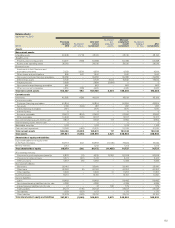

Below you will find the effect from the restatements on net sales, operating

income and operating margin divíded by segment and quarter. Further is a

presentation on the opening balance sheet, income statement and balance

sheet per quarter, full year income statement and net financial position at

December 31, 2012.

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2012

144