Volvo 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The table F shows outstanding forward and option contracts for the

hedging of commercial currency risks. The table Operating net flow per

currency on page 92 shows commercial net flows per currency (transac-

tional flows net).

Translation exposure during the consolidation of operating income

in foreign subsidiaries

In conjunction with the translation of operating income in foreign subsidiaries,

the Volvo Group’s earnings are impacted if currency rates change. The Volvo

Group does not hedge this risk. For more information on currency hedging of

equity see below.

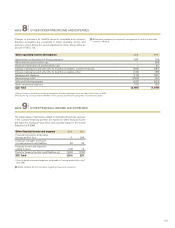

Sensitivity analysis – currencies*

The tables below show the impact on sales and operating income for the

Volvo Group if key currencies fluctuate. The sensitivity analysis include the

transaction impact from commercial flows and the translation impact dur-

ing the consolidation of foreign subsidiaries.

Financial currency exposure

Loans and investments in the Volvo Group’s subsidiaries are performed

mainly through Volvo Treasury in local currencies, which minimizes indi-

vidual companies’ financial currency exposure. Volvo Treasury uses vari-

ous derivatives to facilitate lending and borrowing in different currencies

without increasing the company’s risk. The financial net position of the

Volvo Group is affected by exchange-rate fluctuations since financial

assets and liabilities are distributed among the Volvo Group companies

that conduct their operations using different currencies.

The Impact on Net financial position table D disloses the impact on

earnings before tax of Industrial operations financial net position, includ-

ing pensions and similar net obligations, if the SEK were to strengthen by

10%.

Currency exposure of equity

The consolidated carrying amounts of assets and liabilities in foreign sub-

sidiaries is affected by current exchange rates in conjunction with the trans-

lation of assets and liabilities to Swedish kronor. To minimize currency expo-

sure of equity, the size of equity in foreign subsidiaries is continuously

optimized with respect to commercial and legal conditions. Currency

hedging of equity may occur in cases where a foreign subsidiary is consid-

ered overcapitalized. Net assets in foreign subsidiaries and associated

companies amounted at year-end 2012 to SEK 69.8 billion (67.8). The

remaining loans used as hedging instruments have expired in 2011. For

more information on hedging of net investments in foreign operations rec-

ognized in equity refer to note 30 Financial Instruments. The need to under-

take currency hedging relating to investments in associated companies and

other companies is assessed on a case-by-case basis.

5,000

Changes in currency exchange rates compared to 2011 (Total SEK pos 1.9 bn)

Strengthen in value of SEK by 10% (Total SEK neg 31.2 bn)

3,000

1,000

(1,000)

(3,000)

(5,000)

(7,000)

(9,000)

CNYBRL EUR GBP JPY RUB SGD USD ZAR OtherINR

G

Sensitivity analysis

Currency effect on net sales from inflows in foreign

currency and translation effect when consolidating net

sales in foreign subsidiaries.

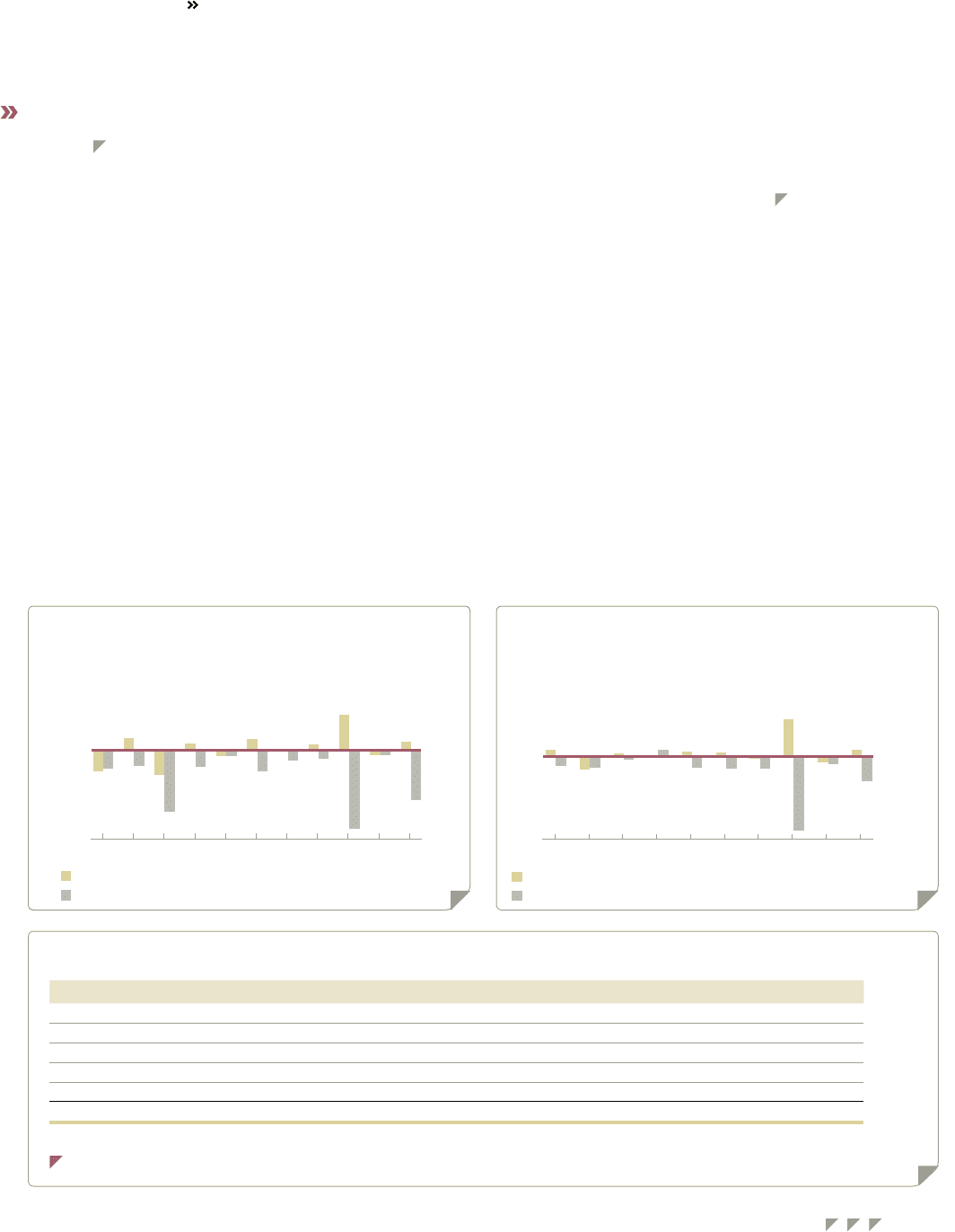

2

Changes in currency exchange rates compared to 2011 (Total SEK pos 1,5 bn)

Strengthen in value of SEK by 10% (Total SEK neg 6.2)

1

0

(1)

(2)

(3)

BRLAUD CNY EUR KRW RUB USD ZAR OtherGBP

H

Sensitivity analysis

Currency effect on operating income from net flows in

foreign currency and translation effect when consolidating

operating income in foreign subsidiaries.

Currency impact on operating income, SEK billion 2012 2011 Change

Net flows in foreign currency 1.6

Realizedgains and losses onhedging contracts 0.0 0.2 (0.2)

Unrealizedgains and lossesonhedging contracts 0.3 (0.3) 0.6

Unrealizedgains and lossesonreceivables andliabilities in foreign currency (0.2) 0.3 (0.6)

Translation effect on operating income in foreign subsidiaries (0.1)

Total currency impact on operating income 1.3

Currency impact onNet flows in foreign currency and Translationeffect on operating income in foreign subsidiaries are detailed in table

Hin key currencies.

The Volvo Group’s currency review When the Volvo Group communicates the currency impact on operating income for Industrial

operations, the following factors are included:

I

* The Note’s sensitivity analysis on currency rate risks is based on simplified

assumptions. It is not unreasonable for the value in SEK to strengthen by 10% in

relation to other currencies. In reality, currencies usually do not change in the

same direction at any given time, so the actual effect of exchange-rate changes

may differ from the sensitivity analysis. Please refer to table D G H

Goals and policies in financial risk management (cont.)

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2012

106