Volvo 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

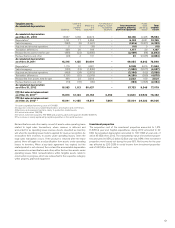

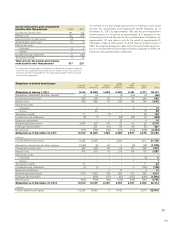

Assumptions applied for actuarial

calculations, % Dec 31,

2012 Dec 31,

2011

Sweden

Discount rate13.25 3.50

Expected return on plan assets26.00 6.00

Expected salary increase 3.00 3.00

Inflation 1.50 1.50

United States

Discount rate1 3 1.75–3.75 3.00–4.75

Expected return on plan assets27.65 7.65

Expected salary increase 3.50 3.00

Inflation 2.00 2.00

France

Discount rate13.75 4.50

Expected salary increase 3.00 3.00

Inflation 1.50 1.50

Great Britain

Discount rate14.25–4.60 4.75–5.00

Expected return on plan assets23.30–4.20 3.60–4.50

Expected salary increases 3.20–3.30 3.30–3.40

Inflation 2.70 3.20

1 The discount rate for each country is determined by reference to market yields

on high–quality corporate bonds. In countries where there is no functioning market

in such bonds, the market yields on government bonds are used. The discount rate

for the Swedish pension obligation is determined by reference to mortgage bonds.

2 Applicable in the subsequent accounting period. These assumptions reflect the

expected long–term return rate on plan assets, based upon historical yield rates

for different categories of investments and weighted in accordance with the

foundation’s investment policy. The expected return has been calculated net of

administrative expenses and applicable taxes.

3 For all plans except one the discount rate used is within the range 3.00–3.75%

(4.25–4.75).

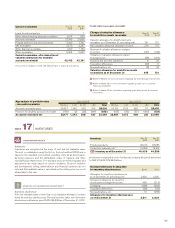

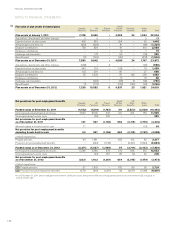

Pension costs 2012 2011

Current year service costs 1,071 867

Interest costs 1,415 1,448

Expected return on plan assets (1,437) (1,405)

Actuarial gains and losses1654 326

Past service costs

– Unvested 9 9

– Vested 360

Curtailments and settlements 35 50

Termination benefits 20 84

Pension costs for the period,

defined–benefit plans 1,770 1,439

Pension costs for defined-contribution plans 2,356 2,032

Total pension costs for the period 4,126 3,471

1 For each plan, actuarial gains and losses are recognized as income or expense

when the accumulated amount exceeds the so called corridor. The income or

expenses are then recognized over the expected average remaining service

period of the employees.

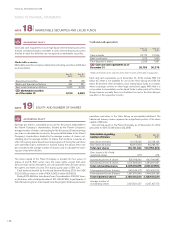

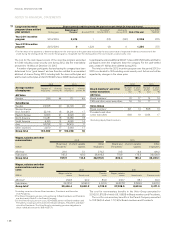

The assumptions include discount rates, health care cost trends rates, infla-

tion, salary growth, long-term return on plan assets, retirement rates, mor-

tality rates and other factors. Health care cost trend assumptions are based

on historical cost data, the near-term outlook, and an assessment of likely

long-term trends. Inflation assumptions are based on an evaluation of exter-

nal market indicators. The salary growth assumptions reflect the historical

trend, the near-term outlook and assumed inflation. Retirement and mortal-

ity rates are based primarily on officially available mortality statistics. The

actuarial assumptions are annually reviewed by Volvo and modified when

deemed appropriate to do so. Actual results that differ from management’s

assumptions are accumulated and amortized over future periods.

The following tables disclose information about defined-benefit plans in the

Volvo Group. Volvo recognizes the difference between the obligations and

the plan assets adjusted for unrecognized actuarial gains and losses in the

balance sheet. The information refers to assumptions applied for actuarial

calculations, periodical costs and the value of obligations and plan assets at

year-end. The tables also include a reconciliation of obligations and plan

assets during the year and the difference between fair values and carrying

amounts at the balance-sheet date.

Summary of provision for

post–employment benefits 2012 2 011

Obligations (42,472) (40,358)

Fair value of plan assets 24,618 23,873

Funded status (17, 85 4) (16,485)

Unrecognized actuarial (gains) and losses 13,633 11, 9 39

Unrecognized past service costs 248 222

Net provisions for post–employment

benefits (3,973) (4,324)

Whereof related to Assets held for sale – 64

Net provision for post–employment

benefits excluding Assets held for sale (3,973) (4,388)

Assumptions when calculating pensions and other post-employment benefits (cont.)

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2012

128