Volvo 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

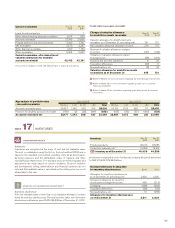

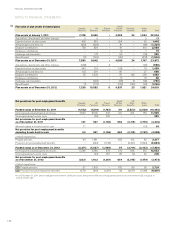

Bond loans Actual interest rate Dec 31, 2012, % Effectiveinterest rate Dec 31, 2012, % Dec 31,

2012 Dec 31,

2011

EUR 2007–2012/2014–2024 0.74–9.89 0.74–9.89 20,725 16,591

SEK 2007–2012/2014–2017 1.90–5.71 1.91–5.71 15,131 15,904

USD 2009/2015 5.98 5.98 4,861 5,165

GBP 2009/2014 6.04 6.18 523 532

CNY2012/2015 3.80–5.93 3.80–6.06 1,852 –

B/S Bond loans as of December 311 43,092 38,192

1 Of which loans raised to finance the credit portfolio of the customer financing operations totalled29,044 (24,501).

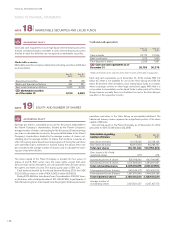

Other loans Actual interest rate

Dec 31, 2012, % Effectiveinterest rate

Dec 31, 2012, % Dec 31,

2012 Dec 31,

2011

USD 2008–2012/2015–2018 0.56–7.50 0.56–7.76 7,902 8,883

EUR 2005–2012/2014–2027 1.49–6.50 1.50–6.50 2,127 2,409

GBP 2011/2014 1.98 1.99 902 925

SEK 2007–2011/2015–2017 1.52–3.22 1.53–3.22 4,270 5,457

CAD 2012/2015 3.06 3.10 675 1,439

MXN 2009–2012/2014–2016 5.74–8.99 5.89–9.37 1,673 1,470

JPY 2007–2012/2014–2017 0.60–1.40 0.60–1.41 7,837 13,132

CHF 2011/2013 1.07 1.07 –736

BRL 2007/2020 4.15 4.28 5,807 5,081

AUD 2012/2015 4.81 6.05 690 1,054

Other loans 4,617 5,509

Revaluation of outstanding derivatives to SEK 1,933 1,670

B/S Other loans as of December 311 38,433 47,765

Bond loans and other loans as of December 31 81,525 85,957

Deferred leasing income 2,247 2,000

Residual value liabilities 4,439 3,608

Accrued expenses service contracts 2,548 1,996

Other non–current financial liabilities 609 701

Other non–current liabilities 871 2,142

B/S Other liabilities as of December 31 10,714 10,447

Non-current liabilities as of December 31 92,239 96,404

1 Of which loans raised to finance the credit portfolio of the customer financing operations 16,874 (24,517). Volvo Treasury employs cross–currency interest swaps to be

able to offer lending and borrowing in various currencies without increasing Volvo Group’s risk. The table on page 95 presents Industrial operations financial net position,

including pensions, listed by currency. Of non–current liabilities, 82,153 (87,923) pertains to financial instruments. Refer also to Note 30 Financial instruments.

Of the above loans, 3.723 (516) was secured.

Refer to Note 23 for an explanation of changes to assets pledged.

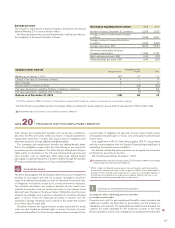

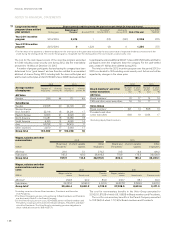

Non-currentloans mature as follows:

2014 27,617

2015 17,518

2016 16,071

2017 14,856

2018 450

2019 or later 5,013

Total 81,525

Refer to Note 15 for maturities of non-current customer financing receivables.

The major part of other non-current liabilities will mature within five years.

At year-end 2012, credit facilities granted but not utilized and which

can be used without restrictions amounted to approximately SEK 33,1

billion (33.6). These facilities consisted of stand-by facilities for loans with

varying maturities through 2013 to 2017. A fee is normally charged for the

unused portion of credit facilities and is recognized in profit or loss under

other financial income and expenses.

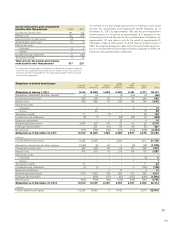

Non-current liabilities

The tables below disclose the Volvo Group’s non-current liabilities in which

the largest loans are listed by currency. The main part are issued by Volvo

Treasury AB. Information regarding loan terms refer to December 31, 2012.

The Volvo Group hedges foreign-exchange and interest-rate risks using

derivative instruments.

Refer to Note 4 Goals and policies in financial risk management and Note 30

Financial Instruments for more information.

NOTE 22

LIABILITIES

133