Volvo 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated financial statements

Principles for consolidation

The consolidated financial statements have been prepared in accordance

with the principles set forth in IAS 27, Consolidated and Separate Financial

Statements. Accordingly, intra-group transactions and gains on transac-

tions with associated companies are eliminated. The consolidated finan-

cial statements comprise the Parent Company, subsidiaries, joint ventures

and associated companies.

– Subsidiaries are defined as companies in which the Volvo Group holds

more than 50% of the voting rights or in which Volvo Group otherwise

has a controlling interest.

– Joint ventures are companies over which Volvo Group has joint control

together with one or more external parties. Up and until December 31,

2012 joint ventures are recognized using the proportionate method of

consolidation.

– Associated companies are companies in which Volvo Group has a sig-

nificant influence, which is normally when Volvo Group’s holding of

shares correspond to at least 20% but less than 50% of the voting

rights. Holdings in associated companies are recognized in accordance

with the equity method.

Translation to Swedish kronor when consolidating companies using

foreign currencies

AB Volvo’s functional currency is the Swedish krona (SEK). The functional

currency of each Volvo Group company is determined based on the pri-

mary economic environment in which it operates. The primary economic

environment is normally the one in which the company primarily generates

and expends cash. In most cases, the functional currency is the currency

of the country where the company is located. AB Volvo’s and the Volvo

Group’s presentation currency is SEK. In preparing the consolidated

financial statements, all items in the income statements of foreign sub-

sidiaries and joint ventures (except for subsidiaries in hyperinflationary

economies) are translated to SEK at monthly exchange rates. All balance-

sheet items are translated at exchange rates at the respective year-ends

(closing rate). The differences in consolidated shareholders’ equity, arising

from variations between closing rates for the current and preceding year

are charged or credited to other comprehensive income as a separate

component.

The accumulated translation difference related to a certain subsidiary,

joint venture or associated company is reversed to the profit or loss state-

ment as a part of the gain/loss arising from the divestment or liquidation

of such a company.

Receivables and liabilities in foreign currency

Receivables and liabilities in foreign currency are measured at closing

rates. Translation differences on operating assets and liabilities are rec-

ognized in operating income, while translation differences arising in finan-

cial assets and liabilities are charged to other financial income and

expenses. Financial assets and liabilities are defined as items included in

the net financial position of the Volvo Group (see Definitions at the end of

this report). Derivative financial instruments used for hedging of exchange

and interest risks are recognized at fair value. Gains on exchange rates

are recognized as receivables and losses on exchange rates are recog-

nized as liabilities. Depending on the lifetime of the financial instrument,

the item is recognized as current or non-current in the balance sheet.

Exchange rate differences on loans and other financial instruments in

foreign currency, which are used to hedge net assets in foreign subsidiaries

and associated companies, are offset against translation differences in

the shareholders’ equity of the respective companies. Exchange-rate

gains and losses on assets and liabilities in foreign currencies, both on

payments during the year and on measurements at year-end, impact profit

or loss in the year in which they are incurred. The more important exchange

rates applied are shown in the table.

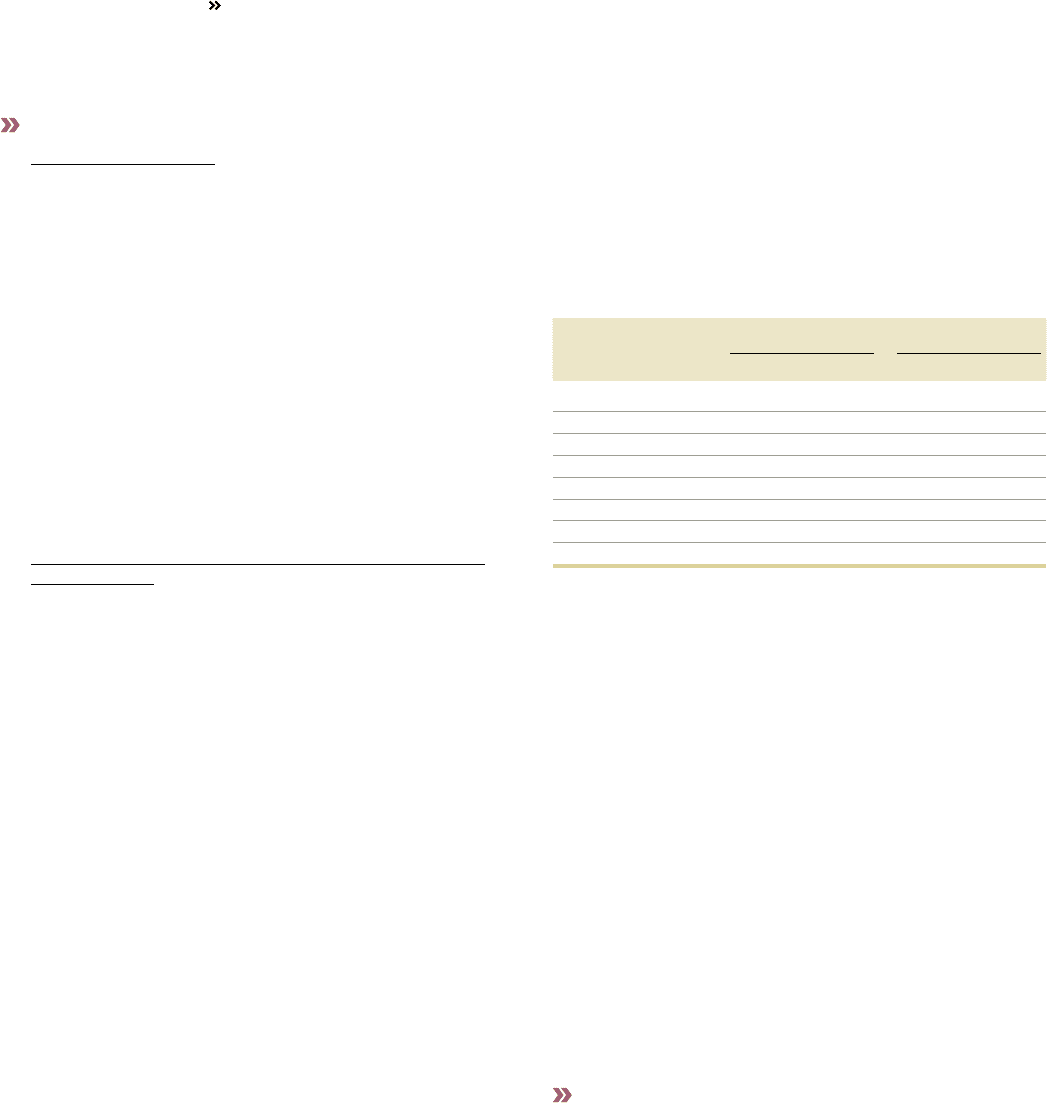

Exchange rates Average rate Closing rate

as of Dec 31

Country Currency 2012 2 011 2012 2 011

Brazil BRL 3.4837 3.8850 3.1885 3.7109

Euro Zone EUR 8.7145 9.0430 8.6259 8.9540

Japan JPY 0.0851 0.0817 0.0757 0.0892

Canada CAD 6.7827 6.5694 6.5536 6.7808

China CNY 1.0738 1.0057 1.0456 1.0998

Great Britain GBP 10.7402 10.4179 10.4977 10.6831

South Korea KRW 0.0060 0.0059 0.0061 0.0060

United States USD 6.7767 6.4982 6.5169 6.9247

New accounting principles for 2012

None of the new accounting principles or interpretations effective from

January 1, 2012 has had any significant impact on the Volvo Group’s

financial statements.

New disclosure requirements in accordance with the amendement of

IFRS 7 Disclosures - Transfers of Financial Assets are presented in note 30.

The Swedish Financial Reporting Board has published an amendment

in RFR 2 regarding group contribution which is effective for the annual

period beginning January 1, 2013. This amendment has been early

adopted by the parent company in 2012. AB Volvo applies the alternative

rule and group contributions are recognized as allocations in the income

statement. Previously, group contributions were recognized as income

from investments in group companies. The comparative numbers in the

2011 income statement for the parent company have been adjusted.

Other amendments in RFR 2 effective from January 1, 2012 have not

had any significant impact on the parent company’s financial statements.

New accounting principles for 2013 and later

When preparing the consolidated financial statements as of December

31, 2012, a number of standards and interpretations has been published,

but has not yet become effective. See note 31 for information related to

Amendment to IAS 19 Employee benefits and IFRS 11 Joint Arrange-

ments and restated income statement and balance sheet for 2012 in

accordance with the two above mentioned standards.

Read more in Note 31 regarding changes in the financial reporting as from

January 1, 2013.

The following is an assessment of the effect that the implementation of

other new standards and statements could have on the Volvo Group’s

financial statements.

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2012

100