Volvo 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

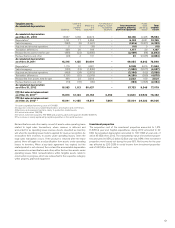

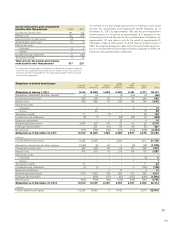

Obligations in defined-benefit plans Sweden

Pensions US

Pensions France

Pensions

Great

Britain

Pensions

US

Other

benefits Other

plans Total

Obligations at January 1, 2011 9,144 12,998 1,605 4,226 3,441 4,707 36,121

Acquisitions, divestments and other changes (1) (2) 1(2) (59) (3) (66)

Current year service costs 246 295 52 31 74 255 953

Interest costs 435 582 70 226 144 145 1,602

Past service costs

– Unvested – 4 – – 9 1 14

– Vested –40 –––18 58

Termination benefits 77 –(1) – – 26 102

Curtailments and settlements (8) (1) –(69) (44) (7) (129)

Employee contributions – – – 12 – 4 16

Actuarial (gains) and losses 2,434 925 136 52 115 39 3,701

Exchange rate translation –301 (12) 54 66 58 467

Benefits paid (315) (782) (86) (161) (169) (968) (2,481)

Obligations as of December 31, 2011 12,012 14,360 1,765 4,369 3,577 4,275 40,358

of which

Funded defined-benefit plans 11, 624 13,925 –4,369 –1, 817 31,735

Acquisitions, divestments and other changes (1,362) (9) 84 0(3) (45) (1,335)

Current year service costs 442 299 59 22 131 259 1,212

Interest costs 419 576 78 215 138 131 1,557

Past service costs – – – – – – –

– Unvested – – 1 – – (1) 0

– Vested – – – – 1 – 1

Termination benefits 21 – – – – 11 32

Curtailments and settlements (7) (1) – – 2 (122) (128)

Employee contributions – – 1 10 – 3 14

Actuarial (gains) and losses 1,315 1,546 169 390 312 382 4,114

Exchange rate translation –(879) (67) (81) (237) (298) (1,562)

Benefits paid (330) (763) (88) (185) (184) (241) (1,791)

Obligations as of December 31, 2012 12,510 15,129 2,002 4,740 3,737 4,354 42,472

of which

Funded defined-benefit plans 10,934 14,645 6 4,740 – 2,675 33,000

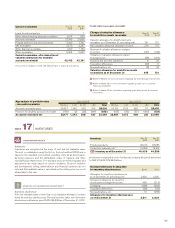

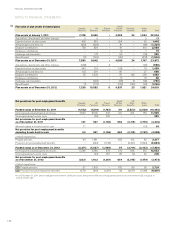

Costs for the period, post–employment

benefits other than pensions 2012 2 011

Current year service costs 141 85

Interest costs 142 148

Expected return on plan assets (2) –

Actuarial gains and losses119 9

Past service costs

– Unvested 4 5

– Vested 1 –

Curtailments and settlements 6(35)

Termination benefits 625

Total costs for the period, post–employ-

ment benefits other than pensions 317 237

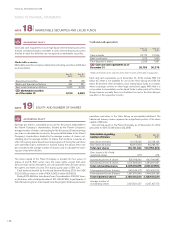

1 For each plan, actuarial gains and losses are reported as income or expense

when the accumulated amount exceed the so called corridor. The income or

expenses are then recognized over the expected average remaining service

period of the employees.

An increase of one percentage point per year in healthcare costs would

increase the accumulated post–employment benefit obligation as of

December 31, 2012 by approximately 166, and the post–employment

benefit expense for the period by approximately 8. A decrease of one

percentage point would decrease the accumulated value of obligations by

approximately 141 and reduce costs for the period by approximately 6.

Calculations made as of December 31, 2012 show an annual increase of

8% in the weighted average per capita costs of covered health care bene-

fits. It is assumed that the percentage will decline gradually to 4.5% until

2029 and subsequently remain at that level.

129