Volvo 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BOARD OF DIRECTORS’ REPORT 2012 GROUP PERFORMANCE

VOLVO FINANCIAL

SERVICES

Profitable growth

The demand for VFS products in 2012 was

good and the global VFS credit portfolio reached

historically high levels. In the Americas, Brazil

rebounded well after a short downturn during

Q3 and the US and Canadian credit portfolios

continued to grow and perform well throughout

the year. In EMEA (Europe, Middle East and

Africa), the market remained soft but the VFS

portfolio grew nonetheless and the perfor-

mance of the credit portfolio improved steadily

throughout the year. In APAC (Asia Pacific), the

slowdown in China experienced towards the latter

half of the year negatively impacted VFS growth

rates in that country. However, portfolio perfor-

mance remained good in China during the year

even in light of the weakening economic condi-

tions. In 2012, VFS continued to serve the markets

of South Africa, India and Indonesia with third

party finance alliances.

Customer finance operations

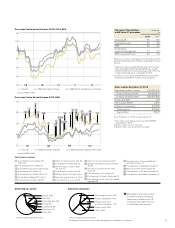

Total new financing volume in 2012 amounted to

SEK 46.6 billion (44.8). Adjusted for changes in

exchange rates, new business volume increased

by 5.3% compared to 2011 as a result of increased

penetration levels. In total, 50,994 new Volvo

Group vehicles and machines (49,757) were

financed during the year. In the markets where

financing is offered, the average penetration

rate was 27% (25).

As of December 31, 2012, the net credit port-

folio amounted to SEK 99,690 M (94,275). The

funding of the credit portfolio is matched in terms

of maturity, interest rates and currencies in

accordance with Volvo Group policy. For further

information see note 15 to the Consolidated

financial statements.

The operating income for the year amounted to

SEK 1,492 M compared to SEK 969 M in the pre-

vious year. Return on shareholders’ equity was

12.5% (7.3). The equity ratio at the end of the year

was 8.1% (9.1). The improvement in profitability is

driven mainly by higher earning assets and good

margins. During the year, credit provision

expenses amounted to SEK 640 M (682) while

write-offs of SEK 577 M (804) were recorded.

The write-off ratio for 2012 was 0.58% (0.93). At

the end of December 31, 2012, credit reserves

were 1.23% (1.33) of the credit portfolio.

Conducts operations in customer and

dealer financing.

Number of employees

1,400

Position on world market

Volvo Financial Services operates

exclusively to provide finance and

leasings solutions to customers and

distributors of Volvo Group products,

thus enhancing the sales process and

the competitiveness of the Group

product offering.

y developing long-term relationships

with customers and dealers, VFS

seeks to establish a number one

market position for the financing of

Volvo Group products wherever VFS operates.

When customers choose a vehicle or equipment

supplier, the availability of financial solutions is an

important factor. Customers desire total transport

solutions that enable them to work more effi-

ciently while maximizing profitability and reliability.

VFS creates value for Volvo Group customers

by providing solutions including customer financ-

ing and leasing, dealer financing and other fee-

based products such as insurance. Financial

services are delivered to customers through VFS

in conjunction with dealers of Volvo Group prod-

ucts, allowing customers to enjoy the benefits of

a convenient, one stop-shop experience.

Good profitability levels

Although global economies and financial mar-

kets continued to be characterized by uncertainty

and slow movement during 2012, VFS continued

to achieve good profitability levels and growth

while at the same time improving credit portfolio

performance. Customer repayment patterns

improved, which resulted in continued reductions

in customer delinquencies, defaults and repos-

sessions. During the year, VFS also continued to

reduce inventories of repossessed units through

good, coordinated remarketing activities with the

other business areas.

In markets where VFS financing is offered,

market penetration and financing volumes were

strong in 2012. Through a disciplined approach to

balancing new business development with risk

and cost control, VFS managed its portfolio in a

good way while growing its operations and sup-

porting Volvo Group sales with historically high

levels of finance market penetration of 27%.

Market development

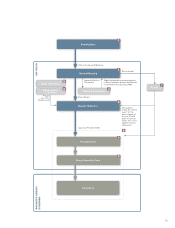

During 2012, VFS provided financial services in

40 markets around the globe. In support of

these offerings, VFS continued to strengthen its

services through operational consolidation, pro-

cess standardization and systems harmoniza-

tion. These activities have enabled VFS to capi-

talize on profitable growth opportunities with

scalable business platforms that boost efficien-

cies while improving service levels.

Volvo Financial Services

(VFS) supports the Volvo

Group product range with

expert financial services

by delivering integrated,

competitive financial solu-

tions that meet customer

and dealer needs.

B

3% (3)

Share of Group

net sales

66