Volvo 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

see how things look in reality – which immediately

makes the situation more complicated.

Without roads, no trucks

If truck sales are to be possible on a large scale,

a functioning road network and an industrial

infrastructure are essential. Other pieces of the

jigsaw include a system for financing, a haulage

tradition and trained staff to service the trucks.

These prerequisites exist primarily in the north-

ern and southern parts of Africa and this is

reflected in the Volvo Group’s delivery figures for

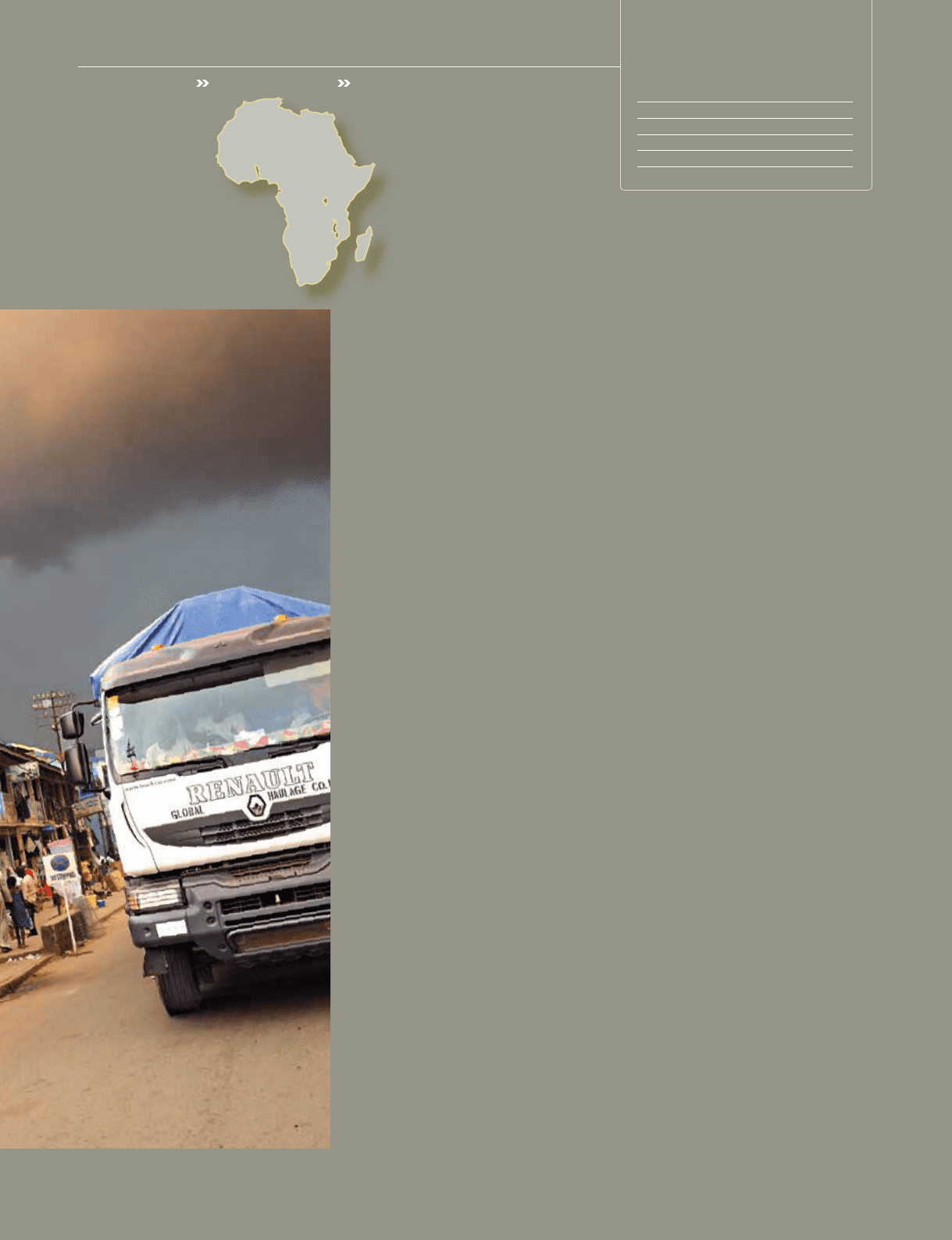

2012. By tradition, Renault Trucks enjoys a

strong position in North Africa, in Algeria in par-

ticular, but it is also represented in many other

African markets. Volvo trucks are also sold in the

north, in Morocco, for example, but the brand is

largest in South Africa. South Africa is also the

most important market for UD Trucks, while

Mack enjoys a special position in Nigeria.

In a conference room in Lundby in Gothenburg,

Lars-Erik Forsbergh is talking about strategy. At

the time of the interview he headed up Group

Trucks Sales & Marketing EMEA’s operations in

Northern Africa and the Middle East, with respon-

sibility for the Volvo, Mack and UD Trucks brands.

Lars-Erik Forsbergh is optimistic about the future.

So optimistic, in fact that the vision for his region is

described as substantial growth in business. He

stresses that the distribution network is going to

be totally decisive.

− We can never be larger than our local importer.

We have to be perfectly synchronized and have the

same vision. Having a good product is not enough.

Our service network must expand so that we can

keep our promises. One method involves deliver-

ing modular workshops in kits. All the importer

needs to do is cast a concrete foundation. After a

couple of weeks, everything is in place. We also

have another product in the shape of a turn-key

permanent workshop which is delivered by a Turkish

company, says Lars-Erik Forsbergh.

Africa is a continent that generates creativity.

One example is Mack’s importer in Nigeria’s largest

city, Lagos, who is putting together truck deals by

gathering hauliers, developers and financiers

around the same conference table – a local form of

total transport solution.

Products for Africa, today and tomorrow

Nigeria can also serve as an illustration of the two

faces of Africa. Outside Lagos, work is in progress

on creating Eko Atlantic – an artificial peninsula

on which a city district as large as Manhattan will

rise from the sea. Three years from now, it is esti-

mated that 25 million people will be living and

working in the region. There are already more than

50 cities in Africa with populations of over one

million and the urbanization process is continuing.

Jan Vandooren, Director Middle East, Africa

and CIS at Volvo Buses, picks up a glossy brochure

to illustrate developments.

− We delivered two Bus Rapid Transport sys-

tems prior to the Football World Cup in South

Africa. This system is without question the trans-

port solution for the mega-cities that are develop-

ing in Africa. The cost of a BRT system corre-

sponds to just 5% of the investment in a traditional

rail-bound system and it can be operational within

a year after a decision is made.

At the same time, the majority of people in

Africa currently live in the countryside, where the

infrastructure is frequently inferior or non-existent.

For Jan Vandooren, this poses a challenge.

In many parts of Africa, buses with engines at the

front are still the order of the day. They have more

ground clearance and can therefore be driven on

roads of poorer quality. In some circumstances, they

may also be easier and less expensive to service and

purchase. Jan Vandooren can see similarities with

the Indian market. There is also a market in Africa

for buses with a European specification, but they

would be best suited to long-distance transport

along the transport corridors that are currently

being constructed in parts of the continent.

The Chinese dominance

The sale of trucks and buses is linked to the devel-

opment of an improved road network and function-

ing towns and cities and Johan Haglund, Vice

Truck deliveries in Africa

2012 2011

Mack 159 387

Renault Trucks 4,258 3,480

UD Trucks 3,658 3,899

Volvo 4 ,117 3,240

FOCUS AFRICA

A GLOBAL GROUP 2012 GROUP PERFORMANCE DEVELOPMENT BY CONTINENT – AFRICA

By tradition, Renault Trucks

enjoys a powerful position

in North Africa, but it is also

represented in many other

African markets.

54