Volvo 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tangible assets

The Volvo Group applies the cost method for measurement of tangible

assets. Borrowing costs are included in the acquisition value of assets

that necessarily take more than 12 months to get ready for their intended

use or sale, so called qualifying assets.

Investment properties are properties owned for the purpose of obtaining

rental income and/or appreciation in value. Investment properties are recog-

nized at cost. Information regarding the estimated fair value of investment

properties is based on discounted cash flow projections The required return

is based on current property market conditions for comparable properties in

comparable locations.

Depreciation and impairment

Property, plant and equipment are depreciated over their useful lives.

Useful lives are based on estimates of the period over which the assets

will generate revenue.

Depreciation is recognized on a straight-line basis based on the cost of

the assets, adjusted in appropriate cases by impairments, and estimated

useful lives. Depreciation is recognized in the respective function to which it

belongs. Impairment tests for depreciable non-current assets are performed

if there are indications of impairment at the balance-sheet date.

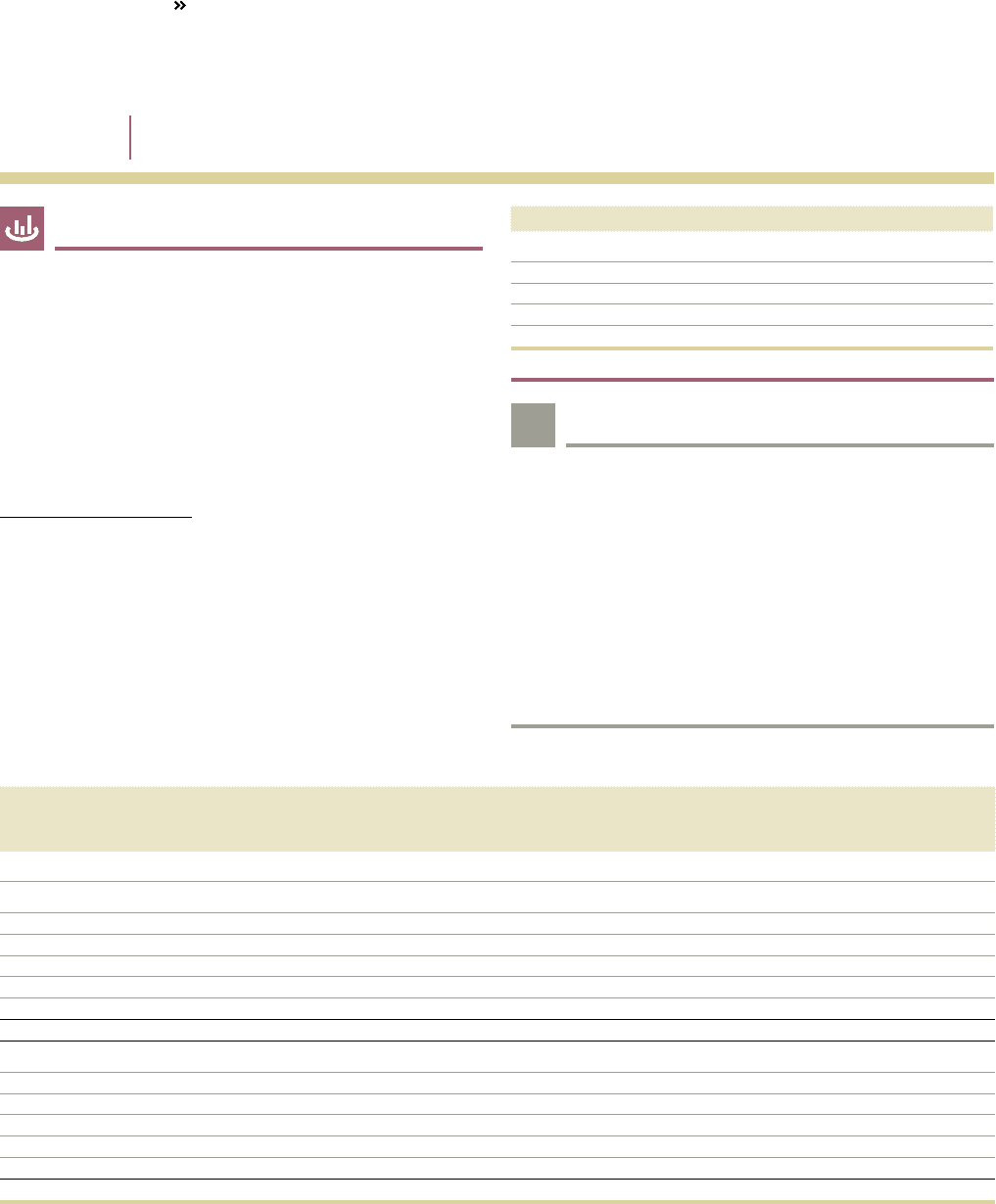

Depreciation periods

Type-specific tools 2 to 8 years

Assets under operating leases 3 to 5 years

Machinery 5 to 20 years

Buildings and investment properties 25 to 50 years

Land improvements 20 years

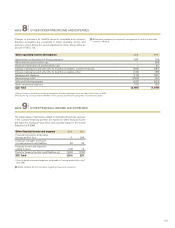

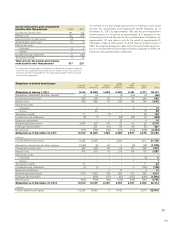

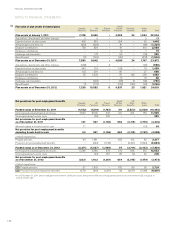

Tangible assets,

Acquisition cost

Buildings

Land and

land

improve-

ments

Machinery

and equip-

ment3

Construction in

progress, including

advance payments

Total investment

property, property,

plant and equipment

Assets

under

operating

leases

Total

tangible

assets

Acquisition costs as of Dec 31, 2010 31,558 12,567 70,514 5,709 120,348 29,095 149,443

Capital expenditures1548 266 3,947 3,455 8,216 7,414 15,630

Sales/scrapping (299) (88) (1,969) 0(2,356) (4,786) (7,142)

Acquired and divested operations 36 10 64 0110 1,503 1,613

Translation differences 373 411 889 (33) 1,640 122 1,762

Reclassified to assets held for sale (706) (49) (4,586) (57) (5,398) (131) (5,529)

Reclassifications and other 619 141 1,897 (2,622) 35 (652) (617)

Acquisition costs as of Dec 31, 2011 32,129 13,258 70,756 6,452 122,595 32,565 155,160

Capital expenditures1848 348 3,296 5,031 9,523 9,986 19,509

Sales/scrapping (234) (32) (2,121) (13) (2,400) (5,229) (7, 629)

Acquired and divested operations (661) (9) (4,244) (92) (5,006) 69 (4,937)

Translation differences (1,775) (1,276) (3,875) (179) (7,105) (1,438) (8,543)

Reclassifiedfrom assets held for sale 706 49 4,584 57 5,396 219 5,615

Reclassifications and other 1, 211 260 1,855 (3,592) (266) 2,196 1,930

Acquisition costs as of Dec 31, 2012 32,224 12,598 70,251 7,6 64 122,737 38,368 161,105

ACCOUNTING POLICIES

SOURCES OF ESTIMATION UNCERTAINTY

!

Impairment of tangible assets

If, at the balance-sheet date, there is any indication that a tangible asset

has been impaired, the recoverable amount of the asset should be esti-

mated. The recoverable amount is the higher of the asset’s net selling

price and its value in use, estimated with reference to management’s pro-

jections of future cash flows. If the recoverable amount of the asset is less

than the carrying amount, an impairment loss is recognized and the carry-

ing amount of the asset is reduced to the recoverable amount. Determina-

tion of the recoverable amount is based upon management’s projections

of future cash flows, which are generally made by use of internal business

plans or forecasts. While management believes that estimates of future

cash flows are reasonable, different assumptions regarding such cash

flows could materially affect valuations.

NOTE 13

TANGIBLE ASSETS

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2012

120