Volvo 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Joint ventures

Joint ventures are companies over which the Volvo Group has controlling

influence together with one or more external parties. Joint ventures are up to

and including December 31, 2012, recognized by applying the proportionate

consolidation method, in accordance with IAS 31 Interests in Joint ventures.

Read more about changes in the Volvo Group’s accouting for Joint Ventures

as from January 1, 2013 in Note 31.

Associated companies

Associated companies are companies in which the Volvo Group has a

significant influence, normally when the Group’s holdings equal at least

20% but less than 50% of the voting rights. Holdings in associated com-

panies are recognized in accordance with the equity method. The Volvo

Group’s share of recognized income in such companies is included in the

consolidated statement of profit or loss under Income from investments in

associated companies, less, where appropriate, depreciation of surplus

values and the effect of applying different accounting policies. Income

from associated companies is included in operating income since the

Volvo Group’s investments are of operating nature. For practical reasons,

some of the associated companies are included in the consolidated finan-

cial statements with a certain time lag, normally one quarter. Dividends

from associated companies are not included in consolidated income. In

the consolidated balance sheet, investments in associated companies are

affected by the Volvo Group’s share of the company’s net income, less

depreciation of surplus values and dividends received.

Other shares and participations

Holding of shares that do not provide the Volvo Group with significant influ-

ence, which generally means that Volvo Group’s holding of shares corre-

sponds to less than 20% of the votes, are recognized as other shares and

participations. For listed shares, the carrying amount is equivalent to the

market value. Unlisted shares and participations, for which a fair value can-

not reasonably be determined, are measured at cost less any impairment.

Joint ventures

The Volvo Group’s investments in joint ventures are listed below.

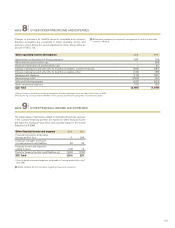

Shares in joint ventures Dec 31, 2012 Dec 31, 2011

Holding percentage Holding percentage

Shanghai Sunwin Bus Corp.,

China 50 50

Dong Feng Nissan Diesel

Motor Co., Ltd., China 50 50

VE Commercial Vehicles,

Ltd., India 501 501

1 Direct equity holdingamounts to45,6%and indirect equity holdingamounts

to4,6%.

ACCOUNTING POLICIES

NOTE 5

INVESTMENTS IN ASSOCIATED COMPANIES AND OTHER SHARES AND PARTICIPATIONS

Volvo Group’s share of joint ventures’

income statements VE Commercial

Vehicles, Ltd. Other joint

ventures Total

2012 VE Commercial

Vehicles, Ltd. Other joint

ventures Total

2011

Net sales 3,302 902 4,204 3,453 743 4,196

Operating income 148 (4) 144 246 77 323

Income after financial items 202 (22) 180 310 69 379

Income taxes (47) 2(45) (72) (1) (73)

Volvo Group’s share of joint

ventures' income for the period 155 (20) 135 238 68 306

Volvo Group’s share of joint ventures’

balance sheets VE Commercial

Vehicles, Ltd. Other joint

ventures Total as of

Dec 31, 2012 VE Commercial

Vehicles, Ltd. Other joint

ventures Total as of

Dec 31, 2011

Non-current assets 1,925 256 2,181 1,746 169 1,915

Current assets 1,329 766 2,095 1,521 727 2,248

The Volvo Group's share of joint

ventures' assets 3,254 1,022 4,276 3,267 896 4,163

Shareholders’ equity 2,140 240 2,380 2,231 274 2,505

Provisions 232 3235 271 3274

Long-term liabilities 3 2 5 3 3 6

Current liabilities 879 777 1,656 762 616 1,378

The Volvo Group's share of joint

ventures' equity and liabilities 3,254 1,022 4,276 3,267 896 4,163

Net financial position for the joint ventures (excluding post-employment benefits) amounted to 244 as of December 31, 2012.

As of December 31, Volvo Group’s share of contingent liabilities in its joint ventures totaled 61 (38).

109