Volvo 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

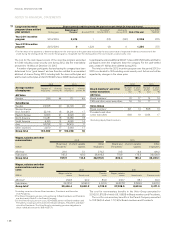

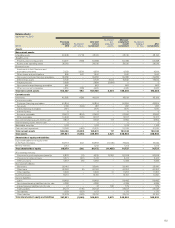

Below is a presentation of derivative instruments and options

of financial and commercial receivables and liabilities.

Outstanding derivative instruments for dealing with

currency and interest-rate risks related to financial

assets and liabilities Dec 31, 2012 Dec 31, 2011

SEK M Notional amount Carrying value Notional amount Carrying value

Interest-rate swaps

– receivable position 64,825 2,507 76,383 2,757

– payable position 74,247 (1,169) 68,046 (2,183)

Forwards and futures

– receivable position –10 7,155 –

– payable position 7,470 (34) 6,908 –

Foreign exchange derivative contracts

– receivable position 21,743 1,003 18,520 227

– payable position 19,224 (127) 33,005 (642)

Options purchased

– receivable position 367 5 991 231

– payable position 74 – 104 –

Options written

– receivable position – – 89 –

– payable position 130 (2) 978 (231)

Total 2,193 159

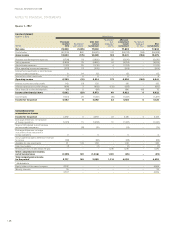

Outstanding forward contracts and

options contracts for hedging of

currency risk and interest risk of

commercial receivables and liabilities Dec 31, 2012 Dec 31, 2011

SEK M Notional amount Carrying value Notional amount Carrying value

Foreign exchange derivative contracts

– receivable position 3,682 141 2,444 54

– payable position 303 (4) 5,145 (200)

Options purchased

– receivable position 352 53,521 53

– payable position – – – –

Options written

– receivable position – – – –

– payable position 352 (1) 3,532 (79)

Subtotal 141 (172)

Raw materials derivative contracts

– receivable position (120) 23 (227) 68

– payable position 467 (84) 693 (134)

Total 80 (238)

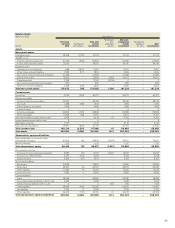

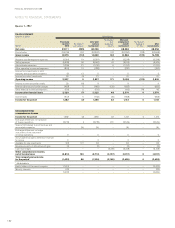

Hedge accounting – supplementary information

Hedging of forecast electricity consumption

In 2012, the Volvo Group recognized neg 1 (4) related to the ineffectiveness

of the hedging of forecasted electricity.

Hedging of currency and interest rate risks on loans

Fair value of the hedge instruments outstanding amounts to 1,697 (1,484).

Changes in fair value of the loan related to hedge accounting amounts to

negative 1,495 (neg 1,285). The changes in the fair value of the hedge

instruments outstanding and the changes in the fair value of the loan are

recognized in net financial positions in profit and loss.

Hedging of net investments in foreign operations

A total of neg 205 (neg 205) was recognized in other comprehensive income

relating to hedging of net investments in foreign operations as of December

31, 2012. The loans used as hedging instruments expired during 2011.

143