Volvo 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Closely linked to the GDP development

The Volvo Group is one part of the transport indus-

try that connects production with consumption.

We are what you might call the life blood. Demand

for transport capacity and thus for many of

the Group’s products is closely linked to the

GDP trend.

The extent of investment in infrastructure,

which drives demand for building and construc-

tion equipment, is also closely linked to the GDP

trend. Increased global wealth means that there

is a long-term need to build roads, airports, rail-

ways, factories, offices, shopping centers, as

well as housing and recreational facilities. In the

short term, demand is affected by a number of

factors including fuel prices, the implementation

of new emission regulations, interest rates, etc.

The registration of new trucks on a particular

market often follows the same pattern as eco-

nomic growth in the region.

– The transport industry is largely in tune with

the overall economic development, but demand

for our products is also governed very largely by

expectations about the future, says Johan Adler,

Head of Economic Research in the Volvo Group.

This is one of the explanations why many

North American haulage companies chose to

postpone their investment decisions in the

autumn of 2012. Even if there was business to

be done and goods to transport, with both the

presidential election and federal budget negoti-

ations around the corner, customers decided it

was better to be safe than sorry and therefore

postponed their purchases.

Markets move at different paces

The transportation industry is directly linked to

economic developments, but the global econo-

mies do not move at the same pace. Countries that

are heavily dependent on exports, such as

Sweden and Germany, are more affected when

consumers in other countries tighten their belts.

Countries like the USA and Brazil are also

impacted by a slowdown, but to a lesser degree, as

they have such large domestic markets and a rela-

tively small part of what they produce is exported.

− The fact that the Volvo Group is global is

an enormous advantage. If we had not been

established on the growth markets, we wouldn’t

have been in the position we currently enjoy,

says Johan Adler.

Another kind of event that impacts the whole

Economic growth in the U.S.,

Europe and Brazil

Annual GDP-growth, %

Source: Consensus Economics

EU

Brazil

11

1.6

2.7

1.8

12

(0.3)

1.0

2.2 USA

10

1.9

7.5

3.0

09

(4.1)

(0.3)

(3.5)

08

0.6

5.2

(0.3)

0

Economic growth in Asia

Annual GDP-growth, %

Asia/

Pacific*

India

Japan

* China, Hong Kong, South Korea, Taiwan,

Indonesia, Malaysia, Singapore, Thailand,

Phillippines, Vietnam, Australia, New Zealand,

India, Japan, Sri Lanka

Source: Consensus Economics

11

4.6

6.5

1.9

9.3

12

4.7

5.3

7.8 China

10

7.1

8.5

(0.5)

10.4

09

1.9

8.0

4.5

9.2

08

3.8

6.8

(5.5)

9.6

0

(1.1)

First up and then down again. The transportation industry is cyclical with swings up and down in

the short term. Then add emission standards, political decisions and expectations about the future,

all of which impact customers’ decisions to purchase now or wait until later. However, in the longer

term, the industry’s growth is closely linked to an increasing need for transports as economies grow.

Long-term growth

of the commercial vehicle industry is the intro-

duction of new emission legislation. New stand-

ards have traditionally resulted in more expen-

sive, more technically complex trucks. This has

generated an advance purchasing effect, a

prebuy, as haulage companies have taken the

opportunity to update their fleets just before the

new regulations come into force. At the same

time, new regulations have positive effects on

the environment.

Growth rates in different parts of the world

According to Consensus Economics, global GDP

grew by 2.5% during 2012 compared with 3.1% in

2011. GDP in the EU declined by 0.3% following

and increase by 1.6% in 2011. US GDP increased

by 2.2% (1.8%). Japan’s GDP expanded by 1.9%

following a decline of 0.5% in 2011. Growth in

countries such as Brazil, India and China hit cycli-

cal lows during 2012. For 2013, global GDP is

expected to grow by 2.6%. The emerging markets

in primarily Asia and Latin America are foreseen

to be the prime drivers of global growth.

(

6)

(

5)

(

4)

(

3)

(

2)

(

1)

0

1

2

3

4

5

6

% %

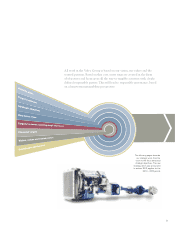

Euro Area GDP and heavy-duty trucks registration growth

(

60

)

(

50

)

(

40

)

(

30

)

(

20

)

(

10

)

0

10

20

30

40

50

60

1210 1106 07 08 090504

GDP growth (left axis)

New heavy-duty trucks registration growth (right axis)

The Volvo business moves in close tandem

with macroeconomic development

A GLOBAL GROUP 2012 OPERATING CONTEXT FUTURE TRANSPORT NEEDS

6