Volvo 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

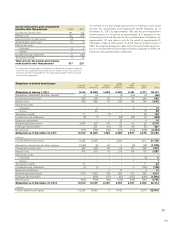

Actual return on plan assets amounted to 2,124 (81).

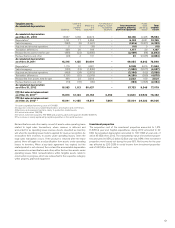

Actuarial gains and losses 2012 2 011

Experience-based adjustments in obligations (412) (3,492)

Experience-based adjustments in plan assets 698 (1,324)

Effects of changes in actuarial assumptions (3,702) (209)

Actuarial gains and (losses), net (3,416) (5,025)

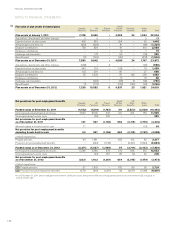

The Volvo Group’s pension foundation in Sweden was formed in 1996 to

secure obligations relating to retirement pensions for salaried employees in

Sweden in accordance with the ITP plan (a Swedish individual pension

plan). Plan assets amounting to 2,456 were contributed to the foundation

at its formation, corresponding to the value of the pension obligations at

that time. Since its formation, net contributions of 2,253, whereof 25 during

2012, have been made to the foundation. The plan assets in the Volvo

Group’s Swedish pension foundation are invested in Swedish and foreign

stocks and mutual funds, and in interest-bearing securities, in accordance

with a distribution that is determined by the foundation’s Board of Directors.

As of December 31, 2012, the fair value of the foundation’s plan assets

amounted to 7,217 (7,554), of which 31% (31) was invested in shares or

mutual funds. At the same date, retirement pension obligations attributable

to the ITP plan amounted to 12,140 (11,624).

Swedish companies can secure new pension obligations through balance-

sheet provisions or pension-fund contributions. Furthermore, a credit

insurance policy must be taken out for the value of the obligations. In

addition to benefits relating to retirement pensions, the ITP plan also

includes, for example, a collective family pension, which the Volvo Group

finances through an insurance policy with the Alecta insurance company.

According to an interpretation from the Swedish Financial Reporting

Board, this is a multi-employer defined-benefit plan. For fiscal year 2012,

the Volvo Group did not have access to information from Alecta that would

have enabled this plan to be reported as a defined-benefit plan. Accord-

ingly, the plan has been recognized as a defined-contribution plan. Alec-

ta’s funding ratio is 129% (113).

The Volvo Group’s subsidiaries in the United States mainly secure their

pension obligations through transfer of funds to pension plans. At the end

of 2012, the total value of pension obligations secured by pension plans

of this type amounted to 14,645 (13,925). At the same point in time, the

total value of the plan assets in these plans amounted to 10,592 (9,842),

of which 54% (54) was invested in shares or mutual funds. The regula-

tions for securing pension obligations stipulate certain minimum levels

concerning the ratio between the value of the plan assets and the value

of the obligations. During 2012, Volvo Group contributed 1,022 (829) to

the American pension plans.

During 2012, the Volvo Group has made extra contributions to the pension

plans in Great Britain in the amount of 87 (91).

In 2013, the Volvo Group estimates to transfer an amount of about SEK

1 billion to pension plans.

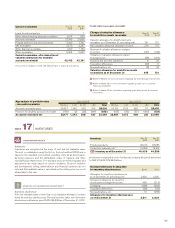

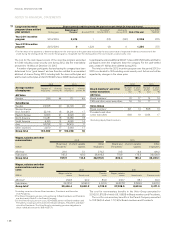

Plan assets by category 2011

Shares and participations, Volvo, 246 (1%)

Shares and participations, other, 9,565 (40%)

Bonds and interest-bearing

securities, 12,460 (52%)

Property, 644 (3%)

Other, 958 (4%)

Shares and participations, Volvo, 333 (1%)

Shares and participations, other,

10,041 (41%)

Bonds and interest-bearing

securities, 11,750 (48%)

Property, 766 (3%)

Other, 1,728 (7%)

Plan assets by category 2012

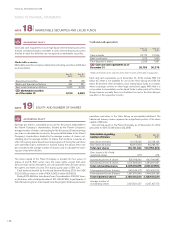

Provisions

Provisions are recognized when a legal or constructive obligation exists as a

result of a past event and it is probable that an outflow of resources will be

required to settle the obligation and the amount can be reliably estimated.

Provisions for residual value risks

Residual value risks are attributable to operating lease contracts or sales

transactions combined with buy-back agreements or residual value guaran-

tees. Residual value risks are the risks that the Volvo Group in the future

would have to dispose used products at a loss if the price development of

these products is worse than what was expected when the contracts were

entered. Provisions for residual value risks are made on a continuing basis

based upon estimations of the used products’ future net realizable values.

The estimations of future net realizable values are made with consideration

to current prices, expected future price development, expected inventory

turnover period and expected direct and indirect selling expenses. If the

residual value risks pertain to products that are reported as tangible assets

in the Volvo Group’s balance sheet, these risks are reflected by depreciation

or write-down of the carrying value of these assets. If the residual value risks

pertain to products, which are not reported as assets in the Volvo Group’s

balance sheet, these risks are reflected under the line item current provisions.

Refer to Note 7 for more information regarding Income.

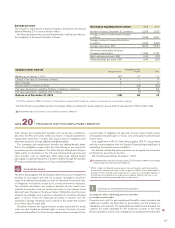

Provision for product warranty

Estimated provision for product warranties are reported when the products

are sold. The provision includes both contractual warranty and so called

goodwill warranty and is determined based on historical statistics consider-

ing known quality improvements, costs for remedy of defaults e.t.c. Provision

for campaigns in connection with specific quality problems are reported

when the campaign is decided.

Provision for Restructuring costs

A provision for decided restructuring measures is reported when a detailed

plan for the implementation of the measures is complete and when this

plan is communicated to those who are affected. Restructuring costs are

reported as a separate line item in the income statement if they relate to

a considerable change of the Group structure. Other restructuring costs

are included in Other operating income and expenses.

ACCOUNTING POLICY

NOTE 21

OTHER PROVISIONS

131