Volvo 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

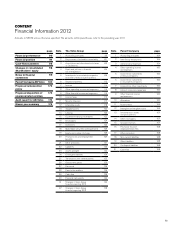

Net sales

Net sales for the Volvo Group decreased by 2%

to 303,647 in 2012, compared with 310,367 in

the preceding year.

Operating income

Volvo Group’s operating income amounted to

17,622 (26,899).

Operating income for the Industrial Operations

decreased to 16,130 compared with 25,930 in

the preceding year. The Customer Finance oper-

ations’ operating income rose to 1,492 (969).

Net financial items

Net interest expense amounted to 1,966, com-

pared with 2,267 in the preceding year.

During the year, market valuation of deriva-

tives, mainly used for eliminating interest expo-

sure in the customer financing portfolio, had a

positive effect on Other financial income and

expenses of 7. During 2011 the impact was

positive 544.

Income taxes

The tax expense for the year amounted to

4,097 (6,814) corresponding to a tax rate of

27% (27).

Income for the period and earnings

per share

The income for the period amounted to 11,258

(18,115), corresponding to diluted earnings per

share of SEK 5.44 (8.75). The return on share-

holders’ equity was 12.9% (23.1).

The Volvo Group

Net sales by business area, SEK M 2012 2011 %

Trucks 192,283 198,920 (3)

Construction Equipment 63,558 63,500 0

Buses 20,295 21,823 (7)

Volvo Penta 7,631 8,458 (10)

Volvo Aero 5,219 6,356 (18)

Eliminations and other 7,045 4,532 –

Industrial Operations1296,031 303,589 (2)

Customer Finance 9,783 8,882 10

Reclassifications and eliminations (2,167) (2,104) –

Volvo Group 303,647 310,367 (2)

1 Adjusted for acquired and divested units and changes in currency rates, net sales

decreased by 2%.

Change in operating income,

SEK bn

Change

(excluding

currency)

Currency

impact Total

Operating income 2011 26.9

Change in gross income Industrial operations1(7.0) 1.3 (5.7)

Change in gross income Customer financing 0.6 00.6

Highercapitalization of development cost 1.2 (0.1) 1.1

Higherresearch and development

expenditures (2.7) 0.1 (2.6)

Higherselling and administrative expenses (2.3) 0(2.3)

Restructuring and efficiency programs

in Japan and Europe (1.6) 0(1.6)

Profitfrom the sale of Volvo Aero 0.6 00.6

Volvo profit sharing program 0.3 00.3

Insurance compensation for damages from

earthquake and Tsunami in Japan in 2011 0.1 00.1

Provision for negative outcome

in court ruling related to EPA (0,1) 0(0,1)

Other 0.3 00.3

Operating income 2012 17. 6

1 During 2012 gross income was affected by underabsorption of costs amounting

to SEK neg 2.7 billlions and adjustment in warranty provisions amouting to SEK

neg 0.5 billions. Distruptions in the Volvo Group’s Japanese operations, as a

consequence of earthquake and tsunami affected gross income by SEK

neg 0.7 billions during 2011.

Operating income (loss) by business area, SEK M 2012 2011

Trucks 10,216 18,227

Construction Equipment 5,773 6,812

Buses 51 1,114

Volvo Penta 541 825

Volvo Aero 767 360

Eliminations and other (1,217) (1,408)

Industrial Operations 16,130 25,930

Customer Finance 1,492 969

Volvo Group 17,622 26,899

Operating margin, % 2012 2011

Trucks 5.3 9.2

Construction Equipment 9.1 10.7

Buses 0.3 5.1

Volvo Penta 7.1 9.8

Volvo Aero 14.7 5.7

Industrial Operations 5.4 8.5

Volvo Group 5.8 8.7

Net sales, SEK bn

12111009

310265218304

08

304

Operating income, SEK M

2011

Q4

6,955

Q3

5,774

Q2

7,648

Q1

6,522

2012

Q4

1,121

Q3

2,927

Q2

7,335

Q1

6,239

91