Volvo 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

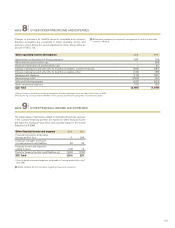

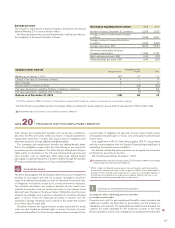

Credit loss reserves

The establishment of credit loss provisions for account receivables is recog-

nized as soon as it is probable that a credit loss has incurred. A credit loss has

incurrent when there has been an event that has triggered the customer’s

inability to pay. As of December 31, 2012, the total credit loss reserves for

account receivables amounted to 2.41% (2.57) of total account receivables.

Refer to Note 4 regarding credit risk.

Non-current receivables Dec 31,

2012 Dec 31,

2011

Other interest-bearingloans to external parties 76 98

Other interest-bearing financial receivables 261 596

Other financial receivables 767 2,131

Other receivables 2,552 2,184

Non-current receivables

as of December 3113,656 5,009

1 Of non-current receivables 1,190 (2,822) pertains to financial instruments.

SOURCES OF ESTIMATION UNCERTAINTY

!

NOTE 16

RECEIVABLES

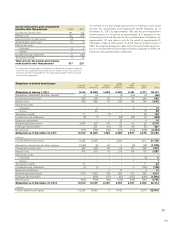

Customer financing receivables

total exposure

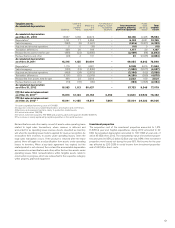

Dec 31, 2012 Dec 31, 2011

Not due 1–30 31–90 >90 Total Not due 1–30 31–90 >90 Total

Customer financing receivables 72,068 7,221 2,161 630 82,080 70,085 6,828 1,971 965 79,849

Concentration of credit risk

Customer concentration

The ten largest customers in Customer Finance account for 6.2 % (5.6) of the

total asset portfolio. The rest of the portfolio is pertinent to a large number of

customers. This way the credit risk is spread across many markets and among

many customers.

Concentration by geographical market

The adjacent table discloses the concentration of the customer-financing

portfolio divided into geographical markets.

Read more about the Volvo Group’s overall description credit risks in Note 4,

Financial-risk management.

Read more about Volvo Financial Services’ trend during the year on

page 66.

Geographic market, percentage

of customer-financing portfolio (%).

Europe, 43.0%

North America, 29.5%

Asia, 12.8%

South America, 14.6%

Other markets, 0.1%

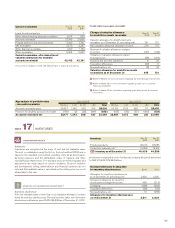

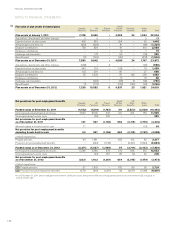

Change of valuation allowance for doubtful

customer-financing receivables 2012 2 011

Valuation allowance for doubtful customer-financing

receivables as of December 31, preceding year 1,150 1,325

New valuation allowance charged to income 835 910

Reversal of valuation allowance charged to income (252) (250)

Utilization of valuation allowance related to

actual losses (575) (821)

Translation differences (67) (14)

Valuation allowance for doubtful customer-

financing receivables as of December 31 1,091 1,150

The total contractual amount to which the overdue payments pertain are

presented in the table below. In order to provide for occurred but not yet

identified customer-financing receivables overdue, there are additional

reserves of 833 (776). The remaining exposure is secured by liens on the

purchased equipment and, in certain circumstances, other credit enhance-

ments such as personal guarantees, credit insurance, liens on other property

owned by the borrower etc.

Collaterals taken in possession that meet the recognition criteria amounted

to 200 (412) as of December 31, 2012.

Customer-financing receivables (cont.)

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2012

124