Volvo 2012 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

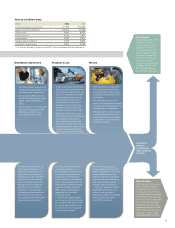

3.2 Establish required commercial presence to sup-

port revenue growth by 50% in APAC (Asia

Pacific) and 25% in Africa

New markets are emerging and we must lie ahead

of the projected growth curve. This requires that we

cover strategic locations, understand the specifics

of selected emerging markets, and adapt our busi-

ness models accordingly.

3.3 Establish required Order to Delivery footprint

and supply chain in APAC and Africa achieving

lead time reduction by 15% and capital tied up

reduction by 15%

This relates to further developing what has already

been built up and set in motion in the Asia Pacific

region, and gearing up in Africa to match our com-

mercial ambitions for that continent. Reaching this

target will require action in such areas as sourcing

strategies and supplier performance, as well as

industrial and logistical structure.

3.4 Increase aftermarket sales per unit in operation

by 12%, including total commercial solution offer

for second and third owner

This objective aims to increase our share of the

aftermarket business, covering the first, second

and third owner of the trucks. We will achieve this

by providing a competitive offering for parts and

services wherever the location of the vehicles.

Our offering should encompass all of our

customers’ needs.

3.5 Build 1 billion SEK new businesses comple-

mentary to existing offering

We recognize the potential for new business, and

for expanding our current offering, in such areas

such as vehicle productivity. Other examples include

revenue streams from the truck end-of-life phase

and from services facilitated by connected vehicles.

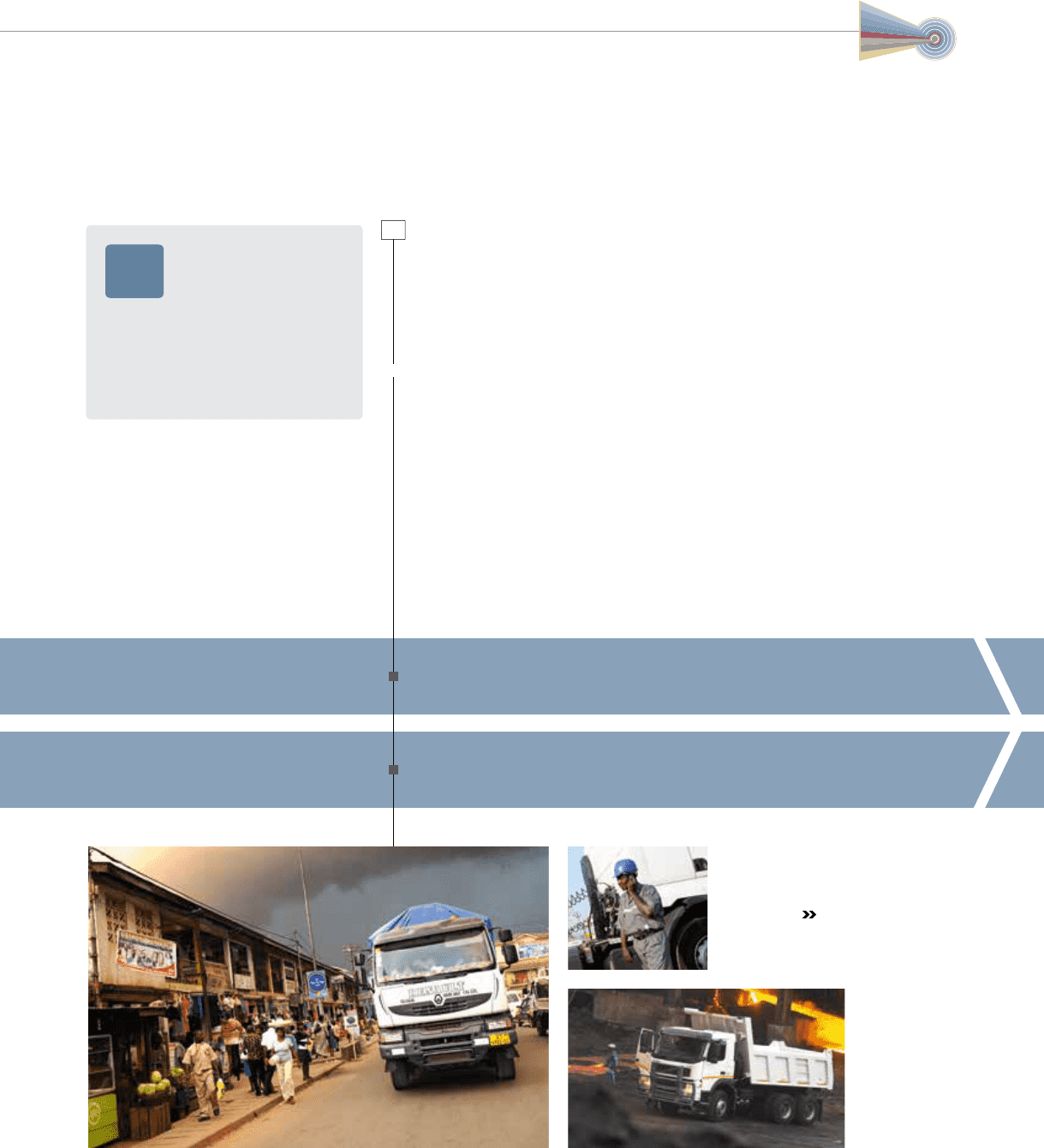

In addition to South America and Eastern

Europe, Asia and Africa are important growth

markets for the Volvo Group. Read more

about the Volvo Group's development in

Africa on page 52.

3.1 By optimizing the brand assets become number 1

or 2 in combined Group Trucks HD market share

Our brand portfolio represents a unique strength. It

is our goal to become number 1 or 2 in combined

Group Trucks market share for heavy duty trucks in

mature markets. In a number of markets we can

optimize the manner in which we use our brand

portfolio, also addressing new customer segments.

Other measures include ensuring the right product

quality and the appropriate coverage in sales and

service networks.

Focus area 3:

Capture profitable growth

opportunities

We want to retain and strengthen

our position as a profitable and global player in

the truck industry. This is crucial given that high

volumes help us achieve economies of scale

and maintain our priority position among sup-

pliers and retailers. Organic sales growth

should be on par with or surpass the weighted

average for our competitors.

3

15