Volvo 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

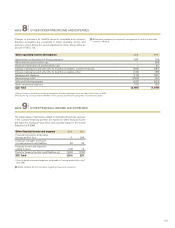

CREDIT RISKS

Credit risks are defined as the risk that Volvo Group’s does not receive

payment for recognized accounts receivable and customer-financing

receivables (commercial credit risk), that Volvo Group’s investments are

unable to be realized (financial credit risk) and that potential profit is not

realized due to the counterparty not fulfilling its part of the contract when

using derivative instruments (financial counterparty risk).

POLICY

The objective of the Volvo Group Credit Policy is to define and measure

the credit exposure and control the risk of losses deriving from credits to

customers, credits to suppliers, counter party risks and Customer Dealer

Financing activities.

Commercial credit risk

Volvo Group’s credit granting is steered by Group-wide policies and cus-

tomer-classification rules. The credit portfolio should contain a distribu-

tion among different customer categories and industries. The credit risks

are managed through active credit monitoring, follow-up routines and,

where applicable, product repossession. Moreover, regular monitoring

ensures that the necessary allowances are made for incurred losses on

doubtful receivables. In Notes 15 and 16, ageing analyses are presented

of customer finance receivables overdue and accounts receivables over-

due in relation to the reserves made.

The customer-financing receivables in the Volvo Group’s customer-

financing operations amounted at December 31, 2012, to approximately

net SEK 81 billion (79). The credit risk of this portfolio is distributed over a

large number of retail customers and dealers. Collaterals are provided in

the form of the financed products. In the credit granting the Volvo Group

strives for a balance between risk exposure and expected return.

Read more about Volvo’s credit risk in the customer-financing operation in

Note 15.

The Volvo Group’s accounts receivables amounted as of December 31,

2012 to approximately net SEK 27 billion (28).

Financial credit risk

The Volvo Group’s financial assets are largely managed by Volvo Treasury

and invested in the money and capital markets. All investments must meet

the requirements of low credit risk and high liquidity. According to Volvo

Group’s credit policy, counterparties for investments and derivative trans-

actions should have a rating of A or better from one of the well-

established credit rating institutions.

Liquid funds and marketable securites amounted as of December 31,

2012 to approximately SEK 29 billion (37).

Read more about Volvo Group’s Marketable securities and liquid funds in

Note 18.

Financial counterparty risk

The use of derivatives involves a counterparty risk, in that a potential gain

will not be realized if the counterparty fails to fulfill its part of the contract.

To reduce the exposure, master netting agreements are signed, wherever

possible, with the counterparty in question. Counterparty risk exposure for

futures contracts is limited through daily or monthly cash transfers cor-

responding to the value change of open contracts. The estimated gross

exposure to counterparty risk relating to futures, interest-rate swaps and

interest-rate forward contracts, options and commodities derivatives

amounted as of December 31, 2012, to 1,144 (281), 2,507 (2,757), 10

(284) and 23 (68).

CREDIT RISKS

107