Volvo 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

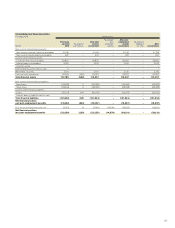

2012 2 011

Current taxes 4 –

Deferred taxes (1,096) (597)

I/S Total income taxes (1,092) (597)

Current taxes consist of an expense of 2 (0) related to this year and an

income of 6 (0) related to prior years.

Deferred taxes relate to estimated tax on the change in tax-loss carryfor-

wards and temporary differences. Deferred tax assets are recognized to

the extent that it is probable that the amount can be utilized against future

taxable income.

Deferred taxes related to change in tax-loss carryforwards amount to

an expense of 1,081 (602) and to changes in other temporary differences

to an expense of 15 (income 5).

The table to the right discloses the principal reasons for the difference

between the corporate income tax of 26.3% and the tax for the period.

2012 2 011

Income before taxes 6,193 6,078

Income tax according to applicable tax rate (1,629) (1,598)

Capital gains/losses 754 0

Non-taxable dividends 253 723

Non-taxable revaluations of shareholdings (37) (16)

Other non-deductible expenses (71) (6)

Other non-taxable income 18 300

Adjustment of current taxes for prior periods 6 –

Withholding tax (2) –

Recognition and derecognition of deferred tax

assets due to change in tax rate (384) –

I/S Income taxes for the period (1,092) (597)

Specification of deferred tax assets Dec 31,

2012 Dec 31,

2011

Tax-loss carryforwards 1,804 2,885

Provision for post-employment benefits 141 163

Provision for restructuring measures 911

Other deductible temporary differences 10 1

B/S Deferred tax assets 1,964 3,060

INCOME TAXES

NOTE 11

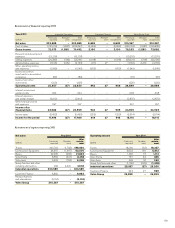

Acquisition cost Dec 31, 2011

Carrying value Investments Sales/scrapping Reclassifications Dec 31, 2012

Carrying value

Rights 52 – – – 52

Other intangible assets 138 –(22) –116

Total intangible assets 190 –(22) –168

Buildings 27 ––– 27

Land and land improvements 14 – – – 14

Machinery and equipment 47 –(7) 242

Construction in progress 32 74 (78) (2) 26

Total tangible assets 120 74 (85) 0109

Accumulated depreciation Dec 31, 2011

Carrying value1Depreciation2Sales/scrapping Dec 31, 2012

Carrying value Dec 31, 2012

Net carrying value3

Rights 52 – – 52 0

Other intangible assets 50 14 –64 52

B/S Total intangible assets 102 14 –116 52

Buildings 3 1 – 4 23

Land and land improvements 0 0 – 0 14

Machinery and equipment 37 1(7) 31 11

Construction in progress –––– 26

B/S Total tangible assets 40 2(7) 35 74

1 Including accumulated write-downs.

2 Including write-downs.

3 Acquisition value, less accumulated depreciation, amortization and write-downs.

Capital expenditures in tangible assets amounted to 74 (65). Capital expendi-

tures approved but not yet implemented at year-end 2012 amounted to 1 (1).

INTANGIBLE AND TANGIBLE ASSETS

NOTE 12

FINANCIAL INFORMATION 2012

166

NOTES TO FINANCIAL STATEMENTS