Volvo 2012 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

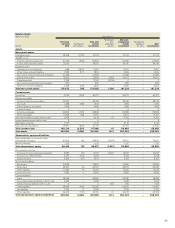

Cash-flow analysis

The cash-flow statement is prepared in accordance with IAS 7, Cash flow

statement, indirect method. The cash-flow statements of foreign Group

companies are translated at the average rate. Changes in Group struc-

ture, acquisitions and divestments, are recognized net, excluding cash

and cash equivalents, in the item Acquisition and divestment of subsidiar-

ies and other business units and are included in cash flow from Investing

activities.

Cash and cash equivalents include cash, bank balances and parts of

marketable securities, with date of maturity within three months at the

time for investment. Marketable securities comprise interest-bearing

securities, the majority of which with terms exceeding three months. How-

ever, these securities have high liquidity and can easily be converted to

cash. In accordance with IAS 7, certain investment in marketable securi-

ties are excluded from the definition of cash and cash equivalents in the

cash-flow statement if the date of maturity of such instruments is later

than three months after the investment was made.

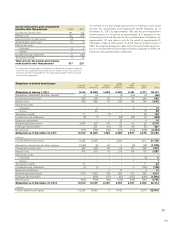

Other items not affecting cash

amounted to: 2012 2011

Risk provisions and losses related to doubtful

accounts receivable/customer-financing

receivables 764 801

Capital gains/losses on the sale of

subsidiaries and other business units (596) 19

Unrealized exchange rate gains/losses on

accounts receivable and payable 224 (249)

Provision for global profit sharing program 200 550

Fair value commercial derivatives (316) 276

R&D tax credit – (283)

Write-down of assets held for sale – 54

Reversal of write-down of assets held for sale – (60)

Provision for restructuring reserves 914 –

Othernon-cash items 240 154

Total Other items not affecting cash flow 1,430 1,262

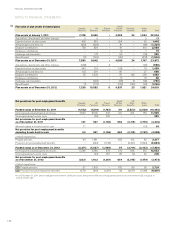

Acquired and divested shares

and participations, net 2012 2011

New issue of shares (6) (9)

Capital contribution (6) (15)

Acquisitions (1,212) (165)

Divestments 39 69

Other (1) 1

Total cash flow from acquired and

divested shares and participations, net (1,186) (119)

During 2012 AB Volvo acquired additional shares in Deutz AG, which had

a negativ impact on cash-flow of SEK 1.1 billion.

Acquired and divested subsidiaries

and other business units: 2012 2 011

Acquired subsidiaries and other

business units (1,527) (1,528)

Divested subsidiaries and other

business units 4,917 (62)

Total cash flow from acquired and divested

subsidiaries and other business units

3,390 (1,590)

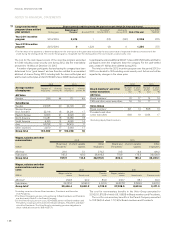

Important increase/decrease in bond loans and other loans

In 2012, the Volvo Group increased its borrowings as a consequence of a

negative operational cash flow and higher demands of funding from the

Customer Finance Operations.

ACCOUNTING POLICY

NOTE 29

CASH-FLOW

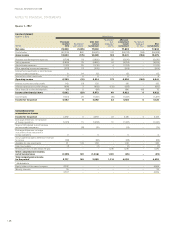

Fees to the auditors 2012 2 011

PricewaterhouseCoopers AB

– Audit fees 102 97

– Audit-related fees 6 4

– Tax advisory services 17 18

– Other fees 31 8

Total 156 127

Audit fees to others 2 1

Volvo Group Total 158 128

Audit involves examination of the Annual report, financial accounting and

the administration by the Board and the President. Audit-related assign-

ments mean quality assurance services required by enactment, articles of

association, regulations or agreement. The amount includes the fee for

the half-year review. Tax services include both tax consultancy and tax

compliance services. All other tasks are defined as other.

NOTE 28

FEES TO THE AUDITORS

139