Volvo 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WORLD

TOGETHER WE MOVE THE

THE VOLVO GROUP

ANNUAL REPORT 2012

Table of contents

-

Page 1

THE VOLVO GROUP ANNUAL REPORT 2012 TOGETHER WE MOVE THE WORLD -

Page 2

... events Trucks Buses Construction equipment Volvo Penta Volvo Financial Services Financial management Shareholder value The share Risks and uncertainties Corporate Governance 74 Corporate Governance Report 80 Board of Directors and Secretary 84 Group Management Financial information 89 Financial... -

Page 3

... of trucks, buses, construction equipment and marine and industrial engines. The Group also provides complete solutions for financing and service. The Volvo Group, which employs about 115,000 people, has production facilities in 18 countries and sells its products in more than 190 markets. In 2012... -

Page 4

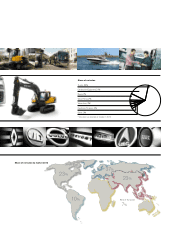

Share of net sales Trucks, 63% Construction Equipment, 21% Buses, 7% Volvo Penta, 2% Volvo Aero, 2%* Customer Finance, 3% Other, 2% * Volvo Aero was divested on October 1, 2012. Share of net sales by market 2012 23% 37% 23% 10% Rest of the world 7% -

Page 5

... income Industrial Operations, SEK M Operating income Customer Finance, SEK M Operating margin Volvo Group, % Income after financial items, SEK M Income for the period, SEK M Diluted earnings per share, SEK Dividend per share, SEK Return on shareholders' equity, % number of permanent employees Share... -

Page 6

..., and Volvo CE strengthened its position as number one in China - the world's largest market for construction equipment. Volvo Buses made inroads into new customer segments thanks to hybrid buses at the forefront of the bus industry and Volvo Penta has a modern and competitive product range. But... -

Page 7

"To secure competitive future products for all our businesses, we are in a very intense phase of renewing and broadening the product portfolios." 3 -

Page 8

... entails increasing fuel efficiency. The Volvo Group estimates the fuel-saving potential for a standard truck will be 15% in 2020 compared with fuel consumption in 2005. We are also investing considerable resources in the development of alternative drivelines, for example hybrid solutions and... -

Page 9

... to take an active part in the Group's development and future. Therefore, The Group invests in the development, health and wellbeing of its employees. The Volvo Group also strives for a company culture in which employees are encouraged to develop and seek out new challenges in their careers. 5 -

Page 10

... trend. Increased global wealth means that there is a long-term need to build roads, airports, railways, factories, offices, shopping centers, as well as housing and recreational facilities. In the short term, demand is affected by a number of factors including fuel prices, the implementation of new... -

Page 11

...new Tech World website. For the first time, many of the research projects on which the company's engineers have been involved were openly displayed. The Volvo Group is one of the world's largest manufacturers of commercial vehicles and a leader in terms of developing sustainable transport solutions... -

Page 12

... welcomed new employees and companies. As a consequence of this, the Group currently has operations in approximately 190 markets and employs about 115,000 individuals, who strive to create efficient and sustainable transport solutions for our customers. Adaptation of governance In the past year, we... -

Page 13

... parties. This will lead to responsible governance, based on a long-term sustainability perspective. The following pages describe our strategic work, from the vision to the focus areas and strategic objectives. The new strategy, which was announced in autumn 2012, applies for the 2013 - 2015 period... -

Page 14

... business partners. • We have captured profitable growth opportunities. • We are proven innovators of energy-efficient transport and infrastructure solutions. • We are a global team of high performing people. Quality Quality is an expression of our goal to offer reliable products and services... -

Page 15

...Industrial Operations shall be a maximum of 40% of shareholders' equity under normal conditions. At the end of 2012, the ï¬nancial net debt amounted to 29.3% of shareholders' equity. As of January 1, 2013, new accounting rules for employee beneï¬ts was effective. As a consequence, AB Volvo's Board... -

Page 16

... and optimized positioning of our brands and products. Strategic objectives Trucks' impact on Group Business Areas: Volvo CE, Buses, Volvo Penta, Governmental Sales, Financial Services IT cost at 2% of total Group costs Expected impact on Group operating margin + + app. 4.0 percentage points app... -

Page 17

... R&D efficiency. This will help us to more effectively manage multiple demands in various markets. An optimized project portfolio is another key factor. 1.6 IT cost on 2% of Volvo Group total cost by 2015 This strategic objective is to optimize the business value from IT over time. The use of global... -

Page 18

...ï¬tability The Group's strong brand are important assets. By selling products under different brands, the Group can address many different customer and market segments in mature as well as growth markets. Read 22. More information on the Volvo more on page 28. Groups' service offering is available... -

Page 19

... we use our brand portfolio, also addressing new customer segments. Other measures include ensuring the right product quality and the appropriate coverage in sales and service networks. In addition to South America and Eastern Europe, Asia and Africa are important growth markets for the Volvo Group... -

Page 20

...fuel economy. To reach our annual goal of 2%, we need to pursue fuel-efficiency improvements and optimization of Group Trucks vehicles and the existing diesel engine platform. We must also continue to develop hybrid solutions and alternative drivelines. 4.2 Commercialize alternative fuel technology... -

Page 21

... of Group Trucks. Managers must provide clear feedback to employees and reward and recognize performance. 5.3 Secure leadership and strategic competencies, primary focus is the implementation of Volvo Group University By establishing a Volvo Group university, we will gather training and development... -

Page 22

... on more markets than today - SDLG outside China and Volvo in India, China and Brazil, for example. Read more about Volvo CE's wheel loader L105, developed specifically for the Chinese market, on 48. page Read more about Volvo Buses' new telematics system, which is currently being used in more... -

Page 23

... the business in this area by 2015. Volvo Penta is also to prepare for new markets, mainly in Asia but also in Africa and South America. Volvo Financial Services Profitability, integrated offerings for dealers and customers, increased opportunities for profitable growth and leadership development... -

Page 24

... alternative fuels. This is profitable for the customer, good for the environment and a competitive advantage for the Volvo Group. Responsible purchasing involves encouraging behavior, managing risks and building long-term relations with our suppliers to improve social, environmental and business... -

Page 25

... important to the offering, which can help to reduce ownership and operating costs for customers. • The Volvo Group takes into account resource efficiency and recycling potential already in the development of its products. • We have stations where trucks, buses and equipment are disassembled and... -

Page 26

... with Eicher Motors in India. Over the past decade, the Group has also invested heavily in developing technology platforms, customer relations, a global industrial footprint and global distribution networks. until recently each truck brand has been operating relatively independently and often in the... -

Page 27

... Chinese construction machinery industry, especially for wheel loaders. The SDLG brand is sold primarily in China and other emerging markets. Nova Bus nova Bus is a leading north American provider of sustainable transit solutions, including environmentally-friendly buses, high-capacity vehicles and... -

Page 28

...Volvo Buses Buses Volvo Buses' product range includes complete buses and bus chassis for city, intercity and coach traffic. The company has a total offering that, in addition to buses, includes a global service network, efficient spare parts handling, service and repair contracts, financial services... -

Page 29

... Crawler excavators from Lingong Lingong wheel loaders Pavers All over the world, Volvo CE is a leading provider when customers want to buy superior construction equipment. Skidsteer loaders Asphalt milling machines Marine engines Engines for boats and industrial applications Volvo Penta... -

Page 30

...For instance, the use of a hybrid driveline may improve fuel savings by up to 39% in certain bus operations. 39% makes this bus a commercially viable option. In 2011 Volvo Trucks commenced sales of hybrid trucks, under the name Volvo FE Hybrid, to customers in selected European markets. With a plug... -

Page 31

... oil and fuel production Life Cycle Assessment Each new product from the Volvo Group should have less environmental impact than the product it replaces. The Group uses Life Cycle Analysis (LCA) to map a product's environmental impact in order to make wellinformed decisions in the development process... -

Page 32

... show that the Volvo Group's companies get high ratings in terms of service and spare parts availability in most markets. As important as getting the customers' vehicles and machines back in operation quickly, is the way customers are treated. This does not apply to just a specific workshop, instead... -

Page 33

... driving with Volvo Buses Volvo Buses also offers courses in efficient driving to help drivers save fuel and provide passengers with a pleasant ride. Together with Volvo Buses' new web-based tool - Volvo Bus Telematics - that gives bus operators better control over their vehicles' fuel consumption... -

Page 34

... and profitable. The Volvo Group's training programs are offered at all levels for employees, and the activities range from traditional and e-based training to individual coaching and mentoring. Individual competence development is based on a personal business plan, which provides support for... -

Page 35

... business and deliver results. This is how we partner with customers and suppliers, how we work and change, and how we build the future together. Key ï¬gures number of permanent employees at year-end number of temporary employees and consultants Share of women, % Share of women, Board Members... -

Page 36

... 2012 North America 17% 16,569 employees Share of employees South America 6% 5,977 employees Major production facilities North America South America Group Trucks Operations Eicher* Mack Renault Trucks uD Trucks Volvo Engines and transmissions Construction Equipment Buses Volvo Penta... -

Page 37

... 54% Asia 20,222 employees 20% Other markets 2,515 employees 3% Europe Asia Rest of the world Pithampur* (IN) Brisbane (AU) Blainville, Bourg-en-Bresse , Limoges, Vénissieux (FR), Kaluga (Ru) Ageo (JP), Hangzhou* (Cn) Göteborg, umeå (SE), ... -

Page 38

...tool is Volvo Production System (VPS), which includes methods for streamlining the operation and minimizing productivity losses. VPS includes tools for documenting work-related risks, indicators for measuring health and safety and methods for ergonomic workplaces. Today, 17 of the Group's production... -

Page 39

...in the Volvo Group's Code of Conduct and international norms of behaviour. Sourcing and risk assessments In 2012, more than 36,000 suppliers delivered products and services to the Volvo Group. Approximately 6,000 are suppliers of direct material used in automotive products. 8% of these suppliers are... -

Page 40

... heavy-duty trucks, buses and construction equipment and is today also a leading manufacturer of heavy-duty diesel engines and marine and industrial engines. During this time, a number of acquisitions have been made, which have brought economies of scale and increased geographical reach. Volvo Group... -

Page 41

... of net sales by geography 2012 Europe, 37% North America, 23% South America, 10% Asia, 23% Rest of the world, 7% Distribution of Group's net sales 2012 Trucks, 63% Construction Equipment, 21% Buses, 7% Volvo Penta, 2% Volvo Aero, 2%* Customer Finance, 3% Other, 2% * Volvo Aero was divested... -

Page 42

... number of service points is expected to increase by 30-40% for Renault Trucks and by 10% for Volvo. The new organization is a stage in the implementation of the new strategy for the Volvo Group's truck operation, which is a key component of efforts to improve the Volvo Group's operating margin by... -

Page 43

... Group in Europe • Net sales: SEK 111,606 M (120,828) • Share of net sales: 37% • Number of employees: 53,434 • Share of Group employees: 54% • Largest markets: France, the UK, Sweden and Russia. Volvo Group invests SEK 783 M in cab plant in Russia Market development, heavy-duty trucks... -

Page 44

A GLOBAL GROUP 2012 GROUP PERFORMANCE DEVELOPMEnT By COnTInEnT - EuROPE FOCUS NEW VOLVO FH A truck that will carry us far into the future Ten important news on the new Volvo FH The new Volvo FH containts ten news that will change the world. At least for truck drivers. Improvements have been ... -

Page 45

... Nilsson, head of Volvo Trucks, summarizes the new versions of the Volvo FH and Volvo FH16 that was launched in September 2012. - For almost two decades, the Volvo FH Series has provided haulage companies with safety, ef ficient transport and high quality. With our new replacements, we are going to... -

Page 46

... products and strong network During 2012, the Volvo Group maintained its market shares in north America. The combined market share in the heavy-duty segment was 18.3% (18.2), on the back of a competitive customer offering of trucks equipped with engines and gearboxes that provide considerable fuel... -

Page 47

... 2012, the heavy-duty truck market increased by Volvo Group in North America • Net sales: SEK 71,101 M (60,560) • Share of net sales: 23% • Number of employees: 16,569 • Share of Group employees: 17% • Largest markets: USA, Canada and Mexico. 15 % Market development, heavy-duty trucks... -

Page 48

... 2013, Volvo CE also decided to consolidate its production capacity in the Americas by relocating the manufacturing of Volvo branded backhoe loaders from Tultitlan, Mexico to Pederneiras. During the year, deliveries started of bus chassis to be used in the third phase of Bogotá's public transport... -

Page 49

... in Brazil in 2012. Volvo Group in South America • Net sales: SEK 29,164 M (35,142) • Share of net sales: 10% • Number of employees: 5,977 • Share of Group employees: 6% • Largest markets: Brazil, Chile and Peru. Market development, heavy-duty trucks, South America, Thousands 08 117... -

Page 50

A GLOBAL GROUP 2012 GROUP PERFORMANCE DEVELOPMEnT By COnTInEnT - SOuTH AMERICA FOCUS PERU The second largest market for Volvo trucks in South America Brand loyalty runs in the family Santiago RodrÃguez Banda S.A.C. is a family owned carrier company with workshops in the cities of Arequipa and ... -

Page 51

...operation of the Volvo Group in South America, given that it will support Volvo, Mack and uD Trucks. Strong position The Peruvian market for heavy-duty trucks amounted to 9,985 vehicles during 2012, compared with 8,441 trucks during 2011. In terms of the Volvo truck brand, Peru is the second largest... -

Page 52

... is to develop products for growth markets under the Volvo brand. In november 2012, the medium-heavy wheel loader Volvo L105 was launched. It was developed specifically to meet the needs of customers in China. Since 1998, Volvo CE's main facility for the development and manufacture of excavators is... -

Page 53

... the Volvo Group's solid, nationwide network of 25 service points. Volvo CE's new wheel loader L105 has been developed specifically for the Chinese market. In India, success continued for VECV with trucks under the brand Eicher. Currently investments are made in the development of new products and... -

Page 54

A GLOBAL GROUP 2012 GROUP PERFORMANCE DEVELOPMEnT By COnTInEnT - ASIA Chinese truck market development Thousands 1,200 1,000 800 600 FOCUS DONGFENG 400 200 0 02 04 06 08 10 12 Heavy-duty trucks Medium-duty trucks Volvo Group to become world's largest heavy-duty truck manufacturer 50 -

Page 55

... only provides the Volvo Group with ownership in the largest heavy-duty and medium-duty truck manufacturer in China, but also offers excellent opportunities to achieve economies of scale in terms of sourcing, development and production for the Group's truck operations. There are a number of areas in... -

Page 56

A GLOBAL GROUP 2012 GROUP PERFORMANCE FOCUS AFRICA Volvo CE supports training of technicians in Africa Volvo Construction Equipment (Volvo CE) is confronting a shortage of technicians in Sub-Saharan Africa with a Sida (Swedish International Development Cooperation Agency) project to help support ... -

Page 57

...still enormous. The largest potential for growth can be found in southern Africa: from Angola down to Namibia, Botswana and South Africa and then up again to Mozambique, Tanzania and Kenya, says Anders Petersson, Manager Transport Industry Analysis at Group Trucks Sales & Marketing EMEA, in response... -

Page 58

... the Volvo Group's delivery figures for 2012. By tradition, Renault Trucks enjoys a strong position in north Africa, in Algeria in particular, but it is also represented in many other African markets. Volvo trucks are also sold in the north, in Morocco, for example, but the brand is largest in South... -

Page 59

...different brands and products are going to target different customer segments. This could also include introducing trucks from our joint venture with Eicher Motors in India in the African market. Engines for diesel-powered gensets constitute Volvo Penta's largest business sector in Africa. Industry... -

Page 60

... 26 it was announced that Renault Trucks Defense, which is included in the Volvo Group's Governmental Sales business area, acquires the French company Panhard, which specializes in manufacturing light transport vehicles adapted for defense operations. In 2011, Panhard reported sales of EUR 81 M and... -

Page 61

... that the company had divested all of its shares in AB Volvo through the sales of 138,604,945 Series A shares on the stock market. In connection with Renault's divestment, Industrivärden increased its holding and at year-end was the largest owner with 6.5% of the outstanding number of shares (19... -

Page 62

.... Share of Group net sales 63% (64) The truck operation's product offer stretches from heavy-duty trucks for long-haulage and construction work to light-duty trucks for distribution. Number of employees 61,300 Position on world market The Volvo Group is one of the world's largest manufacturers... -

Page 63

... product renewal Volvo VM The Volvo VM is a truck developed speciï¬cally for the South American market, where it is used for regional transports and city distribution. Market shares in Europe, heavy-duty trucks Market shares in North America, heavy-duty trucks Market shares in Japan, heavy-duty... -

Page 64

... of China and India, the global bus market declined in 2012. Volvo Buses delivered 10,678 buses and bus chassis (12,786). At the same time, Volvo Buses' market share in Europe rose to 13%, thanks to sales of hybrid buses. Markets shares were also strengthened in north America and South America. The... -

Page 65

... Deliveries by market number of buses Europe north America South America Asia Other markets Total 2012 2,491 1,826 2,560 2,945 856 10,678 2011 2,695 3,014 2,620 3,417 1,040 12,786 Net sales SEK bn 20.3 08 17.3 09 18.5 10 20.5 11 21.8 12 20.3 Operating income (loss) and operating margin SEK... -

Page 66

...in tons, tons transported per liter of fuel and number of cycles. Share of Group net sales 21% (21) Volvo CE manufactures equipment for construction applications and related industries. Number of employees 14,800 Position on world market Volvo CE is the world's leading manufacturer of articulated... -

Page 67

Net sales by market SEK M Europe north America South America Asia Other markets Total 2012 2011 16,518 17,765 12,027 7,829 3,788 4,163 27,033 29,999 4,192 3,745 63,558 63,500 Net sales SEK bn 63.6 08 56.3 09 35.7 10 11 12 63.6 53.8 63.5 Operating income (loss) and operating margin SEK ... -

Page 68

... operating margin was 7.1% (9.8). Earnings were negatively impacted mainly by lower sales and an unfavorable product mix. New products Using aggressive investments in product development, Volvo Penta has created a modern and highly competitive product program for industrial engines in recent years... -

Page 69

Net sales by market SEK M Europe north America South America Asia Other markets Total 2012 3,620 1,486 306 1,867 352 7,631 2011 4,274 1,379 335 2,130 341 8,458 Engine volumes no. of units 2012 17,240 Marine engines1 Industrial engines 17,584 Total 34,824 1 Excluding outboard engines. 2011 20,... -

Page 70

... 31, 2012, credit reserves were 1.23% (1.33) of the credit portfolio. Share of Group net sales 3% (3) Conducts operations in customer and dealer financing. Number of employees 1,400 Position on world market Volvo Financial Services operates exclusively to provide finance and leasings solutions to... -

Page 71

... of credit portfolio Penetration rate1, % 1 Share of unit sales ï¬nanced by Volvo Financial Services in relation to total number units sold by the Volvo Group in 14 13 markets where ï¬nanUD cial services Trucks are offered. Volvo Trucks 43% Volvo CE 29% Renault Trucks 11% Mack Trucks 9% Buses... -

Page 72

BOARD OF DIRECTORS' REPORT 2012 GROUP PERFORMANCE FINANCIAL MANAGEMENT Balancing the requirements of different stakeholders The objectives of the ï¬nancial management in the Volvo Group is to assure shareholders long-term attractive and stable total return and debt providers the ï¬nancial ... -

Page 73

.... In 1935, AB Volvo was listed on the Stockholm Stock Exchange. All through its history, the Volvo Group has strived to create long-term value for ist shareholders. The graph shows the total return for the Volvo B share, measured as the share price development with all dividends re-invested, since... -

Page 74

BOARD OF DIRECTORS' REPORT 2012 GROUP PERFORMANCE THE SHARE The most traded share in Stockholm In spite of the slowdown in the economy, many of the world's leading stock markets had a positive development in 2012. The Volvo share also had a positive development. The Volvo share is listed on the ... -

Page 75

Price trend, Volvo Series B shares, 2008-2012, SEK 140 The largest shareholders in AB Volvo, 31 december1 2012 Röstandel, % 2011 120 Industrivärden Violet Partners LP SHB2 Norges Bank Investment Management AMF Insurance & Funds 19.5 6.5 5.5 5.1 5.0 15.6 5.6 4.7 2.4 3.9 100 80 Renault ... -

Page 76

.... The Volvo Group is a signiï¬cant player in the commercial vehicle industry and one of the world's largest producers of heavy-duty diesel engines. The product development capacity within the Volvo Group is well consolidated to be able to focus resources for research and development to meet tougher... -

Page 77

...of managed capital transferred to independent pension plans being partly invested in instruments of these types. Operational risk The proï¬tability depends on successful new products The Volvo Group's long-term profitability depends on the Company's ability to successfully launch and market its new... -

Page 78

... for the Volvo Group was initiated. At the Annual General Meeting held on April 4, 2012, Carl-Henric Svanberg was appointed new Chairman of the AB Volvo Board. In December 2012, Renault s.a.s. divested its holding of Volvo shares and, in connection therewith, converted a large number of series... -

Page 79

...Elects Board 3 Auditor 7 4 Board of Directors The auditors review the interim report for the period January 1 to June 30 and audit the annual report and consolidated financial statements Appoints President/CEO 8 9 President/CEO 9 Group Executive Team BUSINESS AREAS/ DIVISIONS Operations 75 -

Page 80

... its shareholders, refer to the Board of Director's report on pages 70-71 of the Annual Report. General The General Meeting is Volvo's highest decisionmaking body. The General Meeting held within six months after the end of the ï¬scal year and that adopts the income statement and balance sheet is... -

Page 81

...'s long-term development and strategy, for regularly controlling and evaluating the Group's operations and for the other duties set forth in the Swedish Companies Act. Composition During the period January 1, 2012 - December 31, 2012, AB Volvo's Board consisted of nine members elected by the Annual... -

Page 82

... the Volvo Group during 2012, which was the result of a long-term development project that has been discussed and decided upon by the AB Volvo Board. During 2012 the Volvo Group further divested the subsidiary Volvo Aero to the British engineering company GKN and the Group increased its shareholding... -

Page 83

...the Board regarding the terms and conditions of employment and remuneration for the President of AB Volvo, principles for remuneration, including pensions and severance payments, for other members of the Group Executive Team, and principles for variable salary systems, share-based incentive programs... -

Page 84

... Managing Director, Renault Nissan Purchasing Organization. He was then named Group Controller. Today, he works as an independant consultant. 4. Hanne de Mora Born 1960. BA in Economics from HEC in Lausanne, MBA from IESE in Barcelona. Board Chairman: a-connect (group) ag. Board member: Sandvik AB... -

Page 85

...and General Counsel of the Volvo Group. Secretary to the Volvo Board since 1997. Holdings in Volvo, own and related parties: 64,468 shares, including 62,909 Series B shares. 13. Lars Ask Employee representative, deputy member. Born 1959. With Volvo since 1982. Deputy member of the Volvo Board since... -

Page 86

... Group's vision is to become the world leader in sustainable transport solutions. The vision describes the overall long-term goal for the operations. Volvo has also adopted a wanted position 2020 with the aim to achieve its long-term vision. In addition, the Board has resolved on a number of new... -

Page 87

... Strategy GROUP TRUCKS Group Trucks Sales & Marketing Americas Group Trucks Sales & Marketing EMEA Group Trucks Sales & Marketing and JVs APAC Group Trucks Operations Group Trucks Technology Construction Equipment Business Areas Volvo Financial Services Volvo Penta Buses Governmental Sales... -

Page 88

... M. Sc. Industrial Engineering and Management, M. Sc. Financial Economics, M. Sc. Business and Economics. Has held various senior positions in the Volvo Group, most recently as Executive Vice President Group Trucks Sales & Marketing APAC 2012. President of Volvo Group Asia Truck Operations 2007-2011... -

Page 89

... Volvo Financial Services the Americas 2005-2010. Member of the Group Executive Team 2010-2011 and since 2013. With Volvo since 2005. Holdings in Volvo, own and related parties: 14,675 Series B shares. Karin Falk Executive Vice President Corporate Strategy Born 1965. B. Sc. Business Administration... -

Page 90

... prior to the Annual General Meeting 2013, www.volvogroup. com. For more information about remuneration to the Group Executive Team and an account of outstanding share and share-price related incentive programs to the management, refer to note 27 in the Group's notes in the Annual Report. Changes to... -

Page 91

... and the Board's Audit Committee. Control environment Fundamental to Volvo's control environment is the business culture that is established within the Group and in which managers and employees operate. Volvo works actively on communications and training regarding the company's basic values as... -

Page 92

... of the evaluation activities are reported to Group management and the Audit Committee. Gothenburg, February 21, 2013 Volvo (publ) The Board of Directors To the annual meeting of the shareholders in AB Volvo, corporate identity number 556012-5790 It is the Board of Directors who is responsible for... -

Page 93

...Financial Information 2012 Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the preceding year, 2011. page Financial performance Financial position Cash-ï¬,ow statement Changes in consolidated Shareholders' equity Notes to ï¬nancial statements Parent Company AB... -

Page 94

... income amounted to SEK 17.6 billion. INCOME STATEMENTS VOLVO GROUP Industrial operations SEK M 2012 2011 Customer Finance 2012 2011 Eliminations 2012 2011 Volvo Group 2012 2011 Net sales Cost of sales Gross income Research and development expenses Selling expenses Administrative expenses Other... -

Page 95

... return on shareholders' equity was 12.9% (23.1). Net sales by business area , SEK M Trucks Construction Equipment Buses Volvo Penta Volvo Aero Eliminations and other Industrial Operations1 Customer Finance Reclassiï¬cations and eliminations Volvo Group 2012 2011 % Operating margin , % Trucks... -

Page 96

FINANCIAL INFORMATION 2012 Industrial Operations In 2012, net sales for the Volvo Group's Industrial Operations decreased by 2% to 296,031 (303,589). Compared with 2011, sales increased in North America, Eastern Europe and in some smaller markets, however sales decreased in Western Europe, South ... -

Page 97

...for the period Return on Equity 2012 2011 Key ratios, Customer Finance1 Credit portfolio net, SEK M Operating income, SEK M Return on shareholders' equity, % Total penetration rate, % Penetration by business area , % Volvo CE Volvo Trucks Renault Trucks Mack Trucks Buses uD Trucks 1 2012 2011... -

Page 98

... growth in the Customer Finance Operations 94 and an increase in assets under operating lease mainly related to the construction equipment rental operation. The Volvo Group's intangible assets amounted to SEK 40.4 billion as of December 31, 2012. Investments in research and development amounted to... -

Page 99

... GROUP - SHAREHOLDERS' EQUITY AND LIABILITIES Industrial Operations SEK M Dec 31 2012 Dec 31 2011 Customer Finance Dec 31 2012 Dec 31 2011 Eliminations Dec 31 2012 Dec 31 2011 Volvo Group Dec 31 2012 Dec 31 2011 Equity and liabilities Equity attributable to the equity holder of the Parent Company... -

Page 100

...fixed assets and leasing vehicles Operating cash ï¬,ow Investments and divestments of shares, net Acquired and divested operations, net Interest-bearing receivables incl marketable securities Cash-ï¬,ow after net investments Financing activities Change in loans, net Dividend to AB Volvo shareholders... -

Page 101

... China handling development of BRIC machines for both Volvo and SDLG brand. Product related investments during the year refer to the latest emission regulations in Europe and north America (Tier 4 final), and market specific requirements for new models in the BRIC countries. The investments in Buses... -

Page 102

FInAnCIAL InFORMATIOn 2012 CHANGES IN CONSOLIDATED SHAREHOLDERS' EQUITY Shareholders' equity attributable to equity holders of the Parent Company SEK M Balance at December 31, 2010 Income for the period Share capital 2,554 - Other reserves1 115 - Translation reserve 2,271 - Retained earnings 68,... -

Page 103

...Accounting principle Non-current assets held for sale and discontinued operations Joint ventures Note 3, Acquisitions and divestments of shares in subsidiaries 5, Shares and participations 31, Changes in Volvo Group Financial Reporting 2013 5, Investment in associated companies and other shares... -

Page 104

... of Financial Assets are presented in note 30. The Swedish Financial Reporting Board has published an amendment in RFR 2 regarding group contribution which is effective for the annual period beginning January 1, 2013. This amendment has been early adopted by the parent company in 2012. AB Volvo... -

Page 105

... of tangible assets Credit loss reserves Note Volvo Group's most signiï¬cant accounting policies are primarily described together with the applicable note. Refer to Note 1, Accounting Policies for a speciï¬cation. The preparation of AB Volvo's Consolidated Financial Statements requires the use of... -

Page 106

... French automotive manufacturer Panhard. Panhard was a private owned company specialized in manufacturing of light transport vehicles adapted for defense operations. Panhard is included in the Volvo Group's governmental sales business area. The purchase price amounted to 538 and the goodwill to 326... -

Page 107

... quarter 2012, AB Volvo ï¬nalized the sale of Volvo Aero to the global engineering company, GKN, for the equivalent of SEK 6.9 billion on a debt-free basis. The total capital gain amount to 568. The adjusted purchase price is expected to be paid during 2013. In addition to that the Volvo Group has... -

Page 108

FInAnCIAL InFORMATIOn 2012 NOTES TO FINANCIAL STATEMENTS NOTE 4 GOALS AnD POLICIES In FInAnCIAL RISK MAnAGEMEnT The Volvo Group's global operations expose the company to ï¬nancial risks in the form of interest rate risks, currency risks, credit risks and liquidity risks. Work on ï¬nancial ... -

Page 109

... exchange rates. Currency risks in the Volvo Group's operations are related to changes in the value of contracted and expected future payment flows (commercial currency exposure), changes in the value of loans and investments (financial currency exposure) and changes in the value of assets and... -

Page 110

...assets in foreign subsidiaries and associated companies amounted at year-end 2012 to SEK 69.8 billion (67.8). The remaining loans used as hedging instruments have expired in 2011. For more information on hedging of net investments in foreign operations recognized in equity refer to note 30 Financial... -

Page 111

... a balance between risk exposure and expected return. Read more about Volvo's credit risk in the customer-ï¬nancing operation in Note 15. POLICY The Volvo Group's accounts receivables amounted as of December 31, 2012 to approximately net SEK 27 billion (28). Financial credit risk The Volvo Group... -

Page 112

... loans, as well as granted but unutilized credit facilities in Note 22. Read more about contractual term analyses of the Volvo Group's future payments from non-annullable financial and operational lease contracts in Note 14. Future cash-ï¬,ow including derivatives related to non-current and current... -

Page 113

... statements net sales Operating income Income after financial items Income taxes Volvo Group's share of joint ventures' income for the period Volvo Group's share of joint ventures' balance sheets non-current assets Current assets The Volvo Group's share of joint ventures' assets Shareholders' equity... -

Page 114

FInAnCIAL InFORMATIOn 2012 NOTES TO FINANCIAL STATEMENTS Joint Ventures (cont.) Volvo Group's share of total number of employees 2012 Number of employees of which women, % 2011 Number of employees of which women, % Shanghai Sunwin Bus Corp. Dong Feng nissan Diesel Motor Co., Ltd. VE Commercial ... -

Page 115

... from other investments 2012 2011 - 16 4 20 (75) (14) - (89) 12 (1) 11 22 (47) 2 13 6 21 (43) (226) (1) (270) 11 5 8 24 (225) 1 Write-downs of shares refer mainly to financial assets available for sale for which a reliable market value can be calculated. Changes in Volvo Group's holding of... -

Page 116

... & Marketing Americas, Group Trucks Sales & Marketing APAC (Asia Pacific), Group Trucks Operations and Group Trucks Technology. In addition, a separate unit for Truck Joint Ventures is included in business area Trucks. Business areas Buses, Construction Equipment, Volvo Penta and Customer Finance... -

Page 117

... and simliar charges I/S Other financial income and expense I/S Income after ï¬nancial items Trucks Construction Equipment Buses Volvo Penta Volvo Aero Group functions and other incl. eliminations Industrial Operations Customer Finance Eliminations Volvo Group 196,999 1,921 198,920... -

Page 118

... InFORMATIOn 2012 NOTES TO FINANCIAL STATEMENTS NOTE 7 InCOME ACCOUNTING POLICY ! SOURCES OF ESTIMATION UNCERTAINTY The Volvo Group's recognized net sales pertain mainly to revenues from sales of goods and services. Net sales are, if the occasion arises, reduced by the value of discounts... -

Page 119

... Restructuring costs2 Volvo profit sharing program Other income and expenses I/S Total 1 Gains/losses on divestment of Group companies include capital gain from the sale of Volvo Aero of 568. 2 Restructuring costs are mainly related to restructuring and efficiency programs in Europe and Japan... -

Page 120

...18,386 (18,552) were recognized in the Volvo Group's balance sheet. The Volvo Group has signiï¬cant tax-loss carryforwards that are related to countries with long or indeï¬nite periods of utilization, mainly Sweden, Japan and France. The Volvo Group considers it to be most certain that sufï¬cient... -

Page 121

...Accelerated depreciation on property, plant and equipment Accelerated depreciation on leasing assets LIFO valuation of inventories Capitalized product and software development Adjustment to fair value at company acquisitions untaxed reserves Market value of derivative instruments Provisions for post... -

Page 122

... margin, product mix, expenses and capital needs. Measurements are based on nominal values and utilize a general rate of inflation in line with the European target. The Volvo Group uses a discounting factor calculated to 12% (12) before tax for 2012. In 2012, the value of Volvo's operations exceeded... -

Page 123

.... 3 Includes capitalized borrowing costs of 295 (112). 4 Costs less accumulated, amortization and impairments. 5 Of which impairments 83 (74). Goodwill per Business Area Trucks Construction Equipment Buses Volvo Rents Other business areas Total goodwill value Dec 31, 2012 Dec 31, 2011 12,759... -

Page 124

... equipment3 Construction in progress, including advance payments Total investment property, property, plant and equipment Assets under operating leases Total tangible assets Acquisition costs as of Dec 31, 2010 Capital expenditures1 Sales/scrapping Acquired and divested operations Translation... -

Page 125

...operating leases. Most reclassiï¬cations within tangible assets relate to construction in progress, which are reclassiï¬ed to the respective category within property, plant and equipment. Investment properties The acquisition cost of the investment properties amounted to 1,474 (1,625) at year-end... -

Page 126

... InFORMATIOn 2012 NOTES TO FINANCIAL STATEMENTS NOTE 14 LEASInG Volvo Group as a lessee As of December 31, 2012, future rental payments (minimum leasing fees) related to non-cancellable leases amounted to 3,817 (3,799). Future rental payments are distributed as follows: Finance leases Operating... -

Page 127

... receivables Installment credits Financial leasing Dealer financing Other receivables B/S Current customer ï¬nancing receivables as of December 31 Dec 31, 2012 Dec 31, 2011 Non-current and current receivables recognized in the Volvo Group's customer financing operations. ! SOURCES OF ESTIMATION... -

Page 128

... Financial Services' trend during the year on page 66. Geographic market, percentage of customer-ï¬nancing portfolio (%). Europe, 43.0% North America, 29.5% Asia, 12.8% South America, 14.6% Other markets, 0.1% NOTE 16 RECEIVABLES Non-current receivables Dec 31, 2012 Dec 31, 2011 ! SOURCES... -

Page 129

... are made based on current conditions. Costs for research and development, selling, administration and financial expenses are not included. net realizable value is calculated as the selling price less costs attributable to the sale. Finished products Production materials, etc. B/S Inventory as... -

Page 130

... the Annual General Meeting 2012 was SEK 3.00 (2.50) per share or total of SEK 6,082.3 million (5,068.6). During 2012 AB Volvo transferred, free of consideration, 250,922 treasury B-shares, with a total quota value of 301,106.40 SEK, to participants of Volvo Group's long-term, share-based incentive... -

Page 131

... year-end, less fair value of plan assets, unrecognized actuarial gains or losses and unrecognized unvested past service costs. As a supplement to IAS 19, Volvo Group applies uFR 4*, in accordance with the recommendation from the Swedish Financial Reporting Board, in calculating the Swedish pension... -

Page 132

FInAnCIAL InFORMATIOn 2012 NOTES TO FINANCIAL STATEMENTS Assumptions when calculating pensions and other post-employment beneï¬ts (cont.) The assumptions include discount rates, health care cost trends rates, inflation, salary growth, long-term return on plan assets, retirement rates, mortality ... -

Page 133

...other than pensions Current year service costs Interest costs Expected return on plan assets Actuarial gains and losses1 Past service costs - unvested - Vested Curtailments and settlements Termination benefits Total costs for the period, post-employment beneï¬ts other than pensions 2012 2011 141... -

Page 134

FInAnCIAL InFORMATIOn 2012 NOTES TO FINANCIAL STATEMENTS Fair value of plan assets in funded plans Great Britain Pensions Sweden Pensions US Pensions France Pensions US Other beneï¬ts Other plans Total Plan assets at January 1, 2011 Acquisitions, divestments and other changes Expected ... -

Page 135

.... The plan assets in the Volvo Group's Swedish pension foundation are invested in Swedish and foreign stocks and mutual funds, and in interest-bearing securities, in accordance with a distribution that is determined by the foundation's Board of Directors. As of December 31, 2012, the fair value of... -

Page 136

... affect the Volvo Group's operating income. High inventories in the truck industry and the construction equipment industry and low demand may have a negative impact on the prices of new and used trucks and construction equipment. In monitoring estimated net realizable value of each product under... -

Page 137

... the Volvo Group's non-current liabilities in which the largest loans are listed by currency. The main part are issued by Volvo Treasury AB. Information regarding loan terms refer to December 31, 2012. The Volvo Group hedges foreign-exchange and interest-rate risks using derivative instruments... -

Page 138

... pledged. NOTE 23 ASSETS PLEDGED Dec 31, 2012 Dec 31, 2011 Property, plant and equipment - mortgages Assets under operating leases Receivables Cash, loans and marketable securities Other assets pledged Total 97 150 3,781 32 39 4,099 128 265 1,333 78 28 1,832 At year-end, liabilities for which... -

Page 139

... on the financial position of the Volvo Group. NOTE 25 TRAnSACTIOnS WITH RELATED PARTIES until December 2012 Renault s.a.s was a related party to the Volvo Group due to its holding in AB Volvo. In December 2012 Renault s.a.s sold their Volvo shares. Sales to and purchases from Renault s.a.s. and... -

Page 140

... the Annual General Meeting 2011, as proposed by the Board of AB Volvo, it was decided to implement a long-term share-based incentive program for Group Executives and senior executives in the Volvo Group consisting of three annual programs covering each of the financial years 2011, 2012 and 2013. In... -

Page 141

...beginning of the year and 14 members at the end of the year. Other benefits, mainly pertaining to car and housing, amounted to SEK 6,127,427 in 2012. Group Executives, excluding the CEO, also participate in the long-term incentive program which was approved by the Annual General Meeting held in 2011... -

Page 142

... share settled plan and and the cash-settled plan, a total of 250,922 shares (929) have been allotted Average number of employees AB Volvo Sweden Subsidiaries Sweden Western Europe (excl. Sweden) Eastern Europe north America South America Asia Other countries Group total 2012 number of employees... -

Page 143

...-financing receivables Capital gains/losses on the sale of subsidiaries and other business units unrealized exchange rate gains/losses on accounts receivable and payable Provision for global profit sharing program Fair value commercial derivatives R&D tax credit Write-down of assets held for sale... -

Page 144

... part of net financial items in accordance with the effective interest method. Dividends received attributable to these assets are recognized in profit and loss as Income from other investments. Volvo Group recognizes shares and participations in listed companies at market value on the balance-sheet... -

Page 145

... - commercial exposure The Volvo Group's outstanding raw materials derivatives The Volvo Group's outstanding interest and currency risk derivatives - financial exposure3 Financial liabilities valued at amortized cost Long term bond loans and other loans Short term bank loans and other loans Trade... -

Page 146

... contracts-commercial exposure3 Loans receivable and other receivables Accounts receivables / trade payables Customer ï¬nancing receivables VFS Financial assets available for sale Shares and participations for which a market value can be calculated Shares and participations for which a market value... -

Page 147

... - supplementary information Hedging of forecast electricity consumption In 2012, the Volvo Group recognized neg 1 (4) related to the ineffectiveness of the hedging of forecasted electricity. Hedging of currency and interest rate risks on loans Fair value of the hedge instruments outstanding amounts... -

Page 148

... effect from the restatements on net sales, operating income and operating margin divÃded by segment and quarter. Further is a presentation on the opening balance sheet, income statement and balance sheet per quarter, full year income statement and net financial position at December 31, 2012. 144 -

Page 149

...After restatement Quarter 4/2012 Previously reported Restatement After restatement Previously reported Year 2012 Restatement After restatement SEK M Trucks Construction Equipment Buses Volvo Penta Volvo Aero Group functions and other Industrial operations Customer Finance Volvo Group 3,521 2,131... -

Page 150

... 2/2012 Previously reported After restatement Quarter 3/2012 Previously reported After restatement Quarter 4/2012 Previously reported After restatement Year 2012 Previously reported After restatement % Trucks Construction Equipment Buses Volvo Penta Volvo Aero Industrial Operations Volvo Group... -

Page 151

... Non-current assets Intangible assets Tangible assets property, plant and equipment Assets under operating leases Financial assets Investments in Joint Venturs and associated companies Other shares and participations Non-current customer-financing receivables Deferred tax assets prepaid pensions Non... -

Page 152

FINANCIAl INFORMATION 2012 NOTES TO FINANCIAL STATEMENTS Quarter 1, 2012 Income statement Quarter 1, 2012 Previously reported 2012 After Joint venture restatement Volvo Group Restatement postemployment benefits After postemployment beneï¬t restatement restatement hedging of fir m flows SEK M ... -

Page 153

... Assets Non-current assets Intangible assets Tangible assets Property, plant and equipment Assets under operating leases Financial assets Investments in Joint Ventures Other shares and participations Non-current customer-financing receivables Deferred tax assets Prepaid pensions Non-current... -

Page 154

FINANCIAl INFORMATION 2012 NOTES TO FINANCIAL STATEMENTS Quarter 2, 2012 Income statement Quarter 2, 2012 Previously reported 2012 After joint venture restatement Volvo Group Restatement postemployment benefits After postemployment beneï¬t restatement restatement hedging of fir m flows SEK M ... -

Page 155

...Non-current assets Intangible assets Tangible assets Property, plant and equipment Assets under operating leases Financial assets Investments in Joint Ventures and associated companies Other shares and participations Non-current customer-financing receivables Deferred tax assets Prepaid pensions Non... -

Page 156

FINANCIAl INFORMATION 2012 NOTES TO FINANCIAL STATEMENTS Quarter 3, 2012 Income statement Quarter 3, 2012 Previously reported 2012 After joint venture restatement Volvo Group Restatement postemployment benefits After postemployment beneï¬t restatement restatement hedging of fir m flows SEK M ... -

Page 157

...Non-current assets Intangible assets Tangible assets Property, plant and equipment Assets under operating leases Financial assets Investments in Joint Ventures and associated companies Other shares and participations Non-current customer-financing receivables Deferred tax assets Prepaid pensions Non... -

Page 158

FINANCIAl INFORMATION 2012 NOTES TO FINANCIAL STATEMENTS Quarter 4, 2012 Income statement Quarter 4, 2012 Previously reported 2012 After joint venture restatement Volvo Group Restatement postemployment benefits After postemployment beneï¬t restatement restatement hedging of fir m flows SEK M ... -

Page 159

...Non-current assets Intangible assets Tangible assets Property, plant and equipment Assets under operating leases Financial assets Investments in Joint Ventures and associated companies Other shares and participations Non-current customer-financing receivables Deferred tax assets Prepaid pensions Non... -

Page 160

FINANCIAl INFORMATION 2012 NOTES TO FINANCIAL STATEMENTS Full year, 2012 Income statement Full year, 2012 Previously reported 2012 After joint venture restatement Volvo Group Restatement postemployment benefits After postemployment beneï¬t restatement restatement hedging of fir m flows SEK M ... -

Page 161

... reported 2012 After joint venture restatement Volvo Group Restatement postemployment benefits After postemployment beneï¬t restatement restatement hedging of fir m flows SEK M Restatement joint ventures After restatements Non-current interest-bearing assets Non-current customer-financing... -

Page 162

... global potential for the Trucks business. Therefore, the overall Truck business is considered one single operating segment under the new organization. The Volvo Group will thus continue to be reported in the six segments Trucks, Construction Equipment, Buses, Volvo Penta, Customer Finance and Group... -

Page 163

... restatement Operating income SEK M Previously reported Year 2011 Restatement After restatement Trucks Construction Equipment Buses Volvo Penta Volvo Aero Group function and other including eliminations Industrial operations Customer Finance Reclassiï¬cations and eliminations Volvo Group 200... -

Page 164

... year, 2011. Board of Directors' report AB Volvo is the Parent Company of the Volvo Group and its operations comprise of the Group's head ofï¬ce with staff together with some corporate functions. Income from investments in Group companies includes 2,865 from gain on sales of shares in Volvo Aero AB... -

Page 165

... non-current assets Current assets Current receivables Receivables Group companies Tax receivables Other receivables Cash and bank accounts Total current assets Total assets Shareholders' equity and liabilities Shareholders' equity Restricted equity Share capital (2,128,420,220 shares, quota value... -

Page 166

...fixed assets Shares and participations in Group companies, net Shares and participations in non-Group companies, net Cash-ï¬,ow after net investments Financing activities Change in loans, net Dividend to AB Volvo's shareholders Change in liquid funds Liquid funds, Beginning of year Liquid funds, End... -

Page 167

... equity Balance at December 31, 2010 Income for the period Other comprehensive income Available-for-sale investments: Gain/(loss) at valuation to fair value Other comprehensive income Total income for the period Transactions with shareholders Dividend to AB Volvo's shareholders Share-based payments... -

Page 168

... The Parent Company has outstanding pension obligations of 0 (0) to these individuals. The number of employees at year-end was 258 (181). Information on the average number of employees, wages, salaries and other remunerations including incentive program as well as Board members and senior executives... -

Page 169

... Income include 2,865 from gain on sale of shares in Volvo Aero AB. Dividends from Group companies amounted to 920 (2,719). Of the dividends, 572 (-) pertain to dividend from Volvo Aero AB, 258 (2,500) from Volvo Construction Equipment NV, 55 (-) from Volvo China Investment Co Ltd, 32 (63) from... -

Page 170

FInAnCIAL InFORMATIOn 2012 nOTES TO FInAnCIAL STATEMEnTS NOTE 11 INCOME TAXES 2012 2011 2012 2011 Current taxes Deferred taxes I/S Total income taxes 4 (1,096) (1,092) - (597) (597) Current taxes consist of an expense of 2 (0) related to this year and an income of 6 (0) related to prior ... -

Page 171

... in Group companies During 2012 AB Volvo divested the total shares in Volvo Aero AB with a carrying value of 2,885. At year end the holding of shares in Volvo Italia SpA was written down by 110 (60). During 2011 AB Volvo acquired the total shares in VFS Latvia SIA of 9. Shares were also acquired in... -

Page 172

... companies Investments and sales of shares in non-Group companies are presented in note 13. Change in loans, net 2012 2011 - 5,097 5,097 (94) 1 (93) Decrease in loans is related to the company´s liability in the group account at Volvo Treasury AB. The liability has decreased by 2.964 (increased... -

Page 173

... Volvo Group Automotive Ticaret, Ltd, Sirketi, Turkey3 Volvo Holding France SA, France Volvo Trucks France s.a.s., France Volvo Compact Equipment s.a.s., France Volvo CE Europe s.a.s., France VFS Finance France s.a.s., France VFS Location France s.a.s., France Dec 31, 2012 Registration number... -

Page 174

... AB Volvo Penta, Sweden Volvo Aero AB, Sweden Volvo Aero Norge AS, Norway VNA Holding Inc., USA Volvo Group North America Inc., USA Arrow Truck Sales, Inc., USA Mack Trucks Inc., USA Volvo Construction Equipment North America Inc., USA Volvo Penta of The Americas Inc., USA Volvo Commercial Finance... -

Page 175

... holding by Volvo Italia and AB Volvo is 100%. 9 Total holding by AB Volvo and Volvo Trucks Region Central Europe is 100%. 10 The total holding of AB Volvo and AB Volvo Penta is 100%. The company was reclassified to group company in 2012. 11 AB Volvo's share of shareholders' equity in subsidiaries... -

Page 176

...proposals on remuneration of the members of the Volvo Group Executive Team. The Remuneration Committee is further responsible for the review and recommendation to the Board of share and share-price related incentive programs to be decided upon by the Annual General Meeting. 6. Authority to decide on... -

Page 177

... as per year end 2012. The Board of Directors has the view that the Company's and the Group's shareholders' equity will, after the proposed dividend, be sufficient in relation to the nature, scope and risks of the business. 1 The total dividend amount is based on the number of outstanding shares as... -

Page 178

... parts of the annual accounts and consolidated accounts. We therefore recommend that the annual meeting of shareholders adopt the income statement and balance sheet for the parent company and the group. Report on other legal and regulatory requirements In addition to our audit of the annual accounts... -

Page 179

... income statements Industrial Operations SEK M 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Net sales Cost of sales Gross income Research and development expenses Selling expenses Administrative expenses Other operating income and expenses Income from Volvo Financial Services Income... -

Page 180

FINANCIAL INFORMATION 2012 ELEVEN-YEAR SUMMARY Consolidated balance sheets SEK M 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Intangible assets Property, plant and equipment Assets under operating leases Shares and participations Inventories Customer-ï¬nancing receivables Interest-... -

Page 181

..., plant and equipment Assets under operating leases Shares and participations Inventories Customer-ï¬nancing receivables Interest-bearing receivables Other receivables Non-current assets held for sale Cash and cash equivalents Assets Shareholders' equity Provision for post-employment beneï¬ts... -

Page 182

..., net (1.2) Acquired and divested subsidiaries and other business units, net 3.4 Interest-bearing receivables including marketable securities 3.7 Cash-ï¬,ow after net investments (11.8) Change in loans, net Repurchase of own shares Dividend to AB Volvo's shareholders Cash payment to minority Other... -

Page 183

... 2007 2006 2005 2004 2003 2002 Volvo Group, total 84,314 91,065 72,688 41,829 96,571 88,606 80,517 71,133 62,653 49,300 52,730 Key ratios 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Gross margin, %1 21.9 23.7 23.3 Research and development expenses as percentage of net... -

Page 184

...value at year-end minus net ï¬nancial position and minority interests divided by operating income excluding restructuring costs and revaluation of shares. 6 Cash dividend divided by basic earnings per share. 7 Shareholders' equity for shareholders in AB Volvo divided by number of shares outstanding... -

Page 185

... 403 49 132 9,925 (807) 186,198 Europe north America South America Asia Other markets Total Other and eliminations Net sales Industrial Operations Customer Finance Europe north America South America Asia Other markets Total Eliminations Volvo Group total 2,326 2,605 1,131 1,156 571 435... -

Page 186

FINANCIAL INFORMATION 2012 ELEVEN-YEAR SUMMARY Operating income SEK M 20124 2011 2010 2009 2008 2007 20061 2005 20042 20033 2002 Trucks Buses Construction Equipment Volvo Penta Volvo Aero Customer Finance Other Operating income (loss) Volvo Group 10,216 51 5,773 541 767 1,492 (1,217) 17,622 18,... -

Page 187

Employees Number1 Sweden Europe, excluding Sweden North America South America Asia Other markets Volvo Group total 2012 23,052 30,382 16,569 5,977 20,222 2,515 98,717 2011 24,663 30,458 15,427 5,234 19,924 2,456 98,162 ... -

Page 188

...post-employment benefits. Operating margin Operating income divided by net sales. Penetration rate Share of unit sales financed by Volvo Financial Services in relation to total number units sold by the Volvo Group in markets where financial services are offered. Return on shareholders' equity Income... -

Page 189

... 2014 The reports are available on www.volvogroup.com on date of publication and are also sent electronically to shareholders who have advised Volvo that they wish to receive financial information. Historical and current time series reflecting the Volvo Group's market information and share data are... -

Page 190

TRANSPORTERS Downloaded 1.5 million times Have you played it yet? AB Volvo, Investor Relations and Corporate Reporting