Virgin Media 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

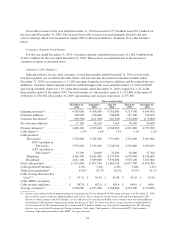

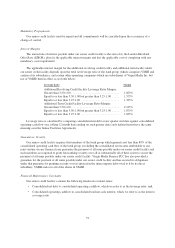

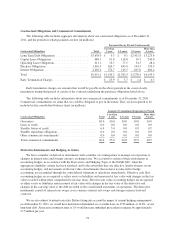

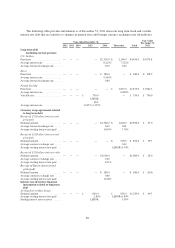

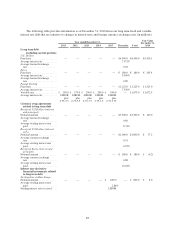

These covenant ratios are calculated with respect to our bank group companies, pursuant to the definitions

contained in our senior credit facility, and are subject to certain adjustments provided therein. The minimum

required ratios are outlined below:

Quarter Date

Leverage

Ratio

Interest

Coverage

Ratio

December 31, 2011 ........................................................ 3.75:1.00 2.95:1.00

March 31, 2012 ........................................................... 3.75:1.00 3.00:1.00

June 30, 2012 ............................................................ 3.75:1.00 3.05:1.00

September 30, 2012 ........................................................ 3.75:1.00 3.10:1.00

December 31, 2012 ........................................................ 3.75:1.00 3.10:1.00

March 31, 2013 ........................................................... 3.75:1.00 3.15:1.00

June 30, 2013 ............................................................ 3.75:1.00 3.20:1.00

September 30, 2013 ........................................................ 3.75:1.00 3.25:1.00

December 31, 2013 ........................................................ 3.75:1.00 3.35:1.00

March 31, 2014 ........................................................... 3.75:1.00 3.45:1.00

June 30, 2014 ............................................................ 3.75:1.00 3.55:1.00

September 30, 2014 ........................................................ 3.75:1.00 3.70:1.00

December 31, 2014 ........................................................ 3.75:1.00 3.80:1.00

March 31, 2015 ........................................................... 3.75:1.00 3.95:1.00

June 30, 2015 ............................................................ 3.75:1.00 4.00:1.00

Failure to meet these covenant levels would result in a default under our senior credit facility. As of

December 31, 2011, we were in compliance with these covenants.

Restrictions

Our senior credit facility significantly, and in some cases absolutely, restricts the ability of the members of

the bank group to, among other things:

• incur or guarantee additional indebtedness;

• pay dividends or make other distributions, or redeem or repurchase equity interests or subordinated

obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• create liens;

• enter into agreements that restrict the bank group’s ability to pay dividends or make inter-company

loans;

• merge or consolidate or transfer all or substantially all of their assets; and

• enter into transactions with affiliates.

We are also subject to financial maintenance covenants under our senior credit facility. The senior credit

facility also contains certain carve-outs from these limitations.

73