Virgin Media 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

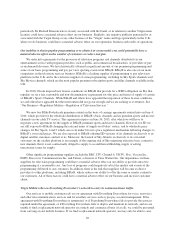

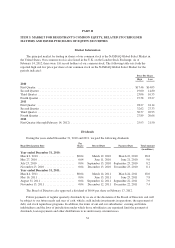

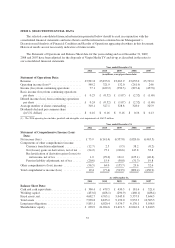

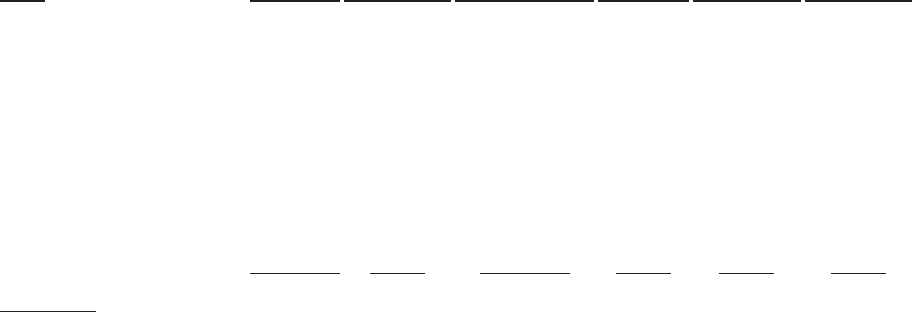

Share Repurchases

The table below summarizes our repurchases under our Board-authorized capital structure optimization

programs during 2011:

Period

Total

Number of

Shares

Purchased

Average

Price Paid

Per Share

(in U.S. dollars)

Total Number

of Shares Purchased

as Part of Publicly

Announced Plans or

Programs

Approximate

Value of

Shares that

May Yet be

Purchased

under the

2010

Program

(in Pounds

Sterling

millions)(1)

Approximate

Value of Shares

that May Yet

be Purchased

under the 2011

Program

(in Pounds

Sterling

millions)(2)

Approximate

Value of Shares

that May Yet

be Purchased

under the 2010

and 2011

Programs

(in Pounds

Sterling

millions)(1)(2)

January 1 – 31, 2011 ....... — $ — — £213.5 £ — £213.5

February1 – 28, 2011 ....... 350,000 27.26 350,000 207.6 — 207.6

March 1 – 31, 2011 ........ 6,825,074 27.09 6,825,074 93.5 — 93.5

April 1 – 30, 2011 ......... — — — 93.5 — 93.5

May 1 – 31, 2011 .......... 2,294,400 31.43 2,294,400 49.3 — 49.3

June 1 – 30, 2011 .......... 2,515,000 31.38 2,515,000 0.6 — 0.6

July 1 – 31, 2011 .......... — — — 0.6 625.0 625.6

August 1 – 31, 2011 ........ 4,583,400 24.85 4,583,400 — 555.7 555.7

September 1 – 30, 2011(3) . . . 10,642,712 24.74 10,642,712 — 390.8 390.8

October 1 – 31, 2011 ....... — — — — 640.8 640.8

November 1 – 30, 2011(4) . . . 13,641,254 21.99 13,641,254 — 452.7 452.7

December 1 – 31, 2011 ..... — — — — 452.7 452.7

Total ....................40,851,840 $25.03 40,851,840 £ — £452.7 £452.7

(1) On July 28, 2010, we announced a capital structure optimization program expected to include the application of, in aggregate, up to

£700 million, in part towards repurchases of up to £375 million of our common stock until August 2011 and in part towards transactions

relating to our debt and convertible debt, including related derivative transactions. On March 4, 2011, we increased the capital

optimization program to permit the full redemption of the 9.125% senior notes due 2016 on or before August 15, 2011. In the first half of

2011, the repurchases were made through open market transactions. The 2010 capital structure optimization program was completed in

July 2011.

(2) On July 27, 2011, we announced a new capital structure optimization program expected to include the application of, in aggregate, up to

£850 million, in part towards repurchases of up to £625 million of our common stock until December 31, 2012 and in part towards

transactions relating to our debt, including related derivative transactions. In addition, on October 27, 2011, we announced our intention

to expend up to a further £250 million on share repurchases from the proceeds from the sale of our UKTV companies. In the third quarter

of 2011, the repurchases were made through open market transactions and accelerated stock repurchase, or ASR, programs.

(3) On September 8, 2011, we entered into an ASR program in the amount of $250 million as a part of our 2011 capital optimization

program. We received 7,287,302 shares on September 13, 2011, 1,801,312 shares on September 22, 2011, and 1,029,098 shares on

November 11, 2011, totalling 10,117,712 shares, under this ASR. This ASR terminated on November 11, 2011. The average price paid

per share under this ASR was $24.71.

(4) On November 10, 2011, we entered into another ASR program in the amount of $300 million as a part of our 2011 capital optimization

program. We received 8,652,515 shares on November 15, 2011, 2,538,546 shares on November 18, 2011, and 2,450,193 shares on

December 20, 2011, totalling 13,641,254 shares, under this ASR. This ASR terminated on December 20, 2011. The average price paid

per share under this ASR was $21.99.

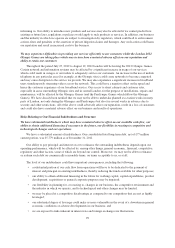

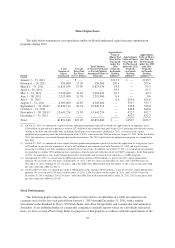

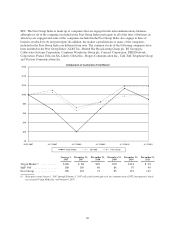

Stock Performance

The following graph compares the cumulative total return to stockholders of a $100 investment in our

common stock for the five-year period from January 1, 2007 through December 31, 2011, with a similar

investment in the Standard & Poor’s 500 Stock Index and a Peer Group Index and assumes the reinvestment of

dividends. As no published index of comparable companies currently reports values on a dividends reinvested

basis, we have created a Peer Group Index for purposes of this graph in accordance with the requirements of the

35