Virgin Media 2011 Annual Report Download - page 69

Download and view the complete annual report

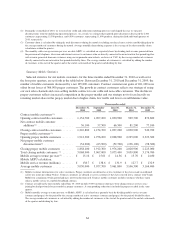

Please find page 69 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Years Ended December 31, 2010 and 2009

For the year ended December 31, 2010, cash provided by operating activities increased to £1,037.6 million

from £893.5 million for the year ended December 31, 2009. This increase was primarily attributable to the

improvements in operating results. For the year ended December 31, 2010, cash paid for interest, exclusive of

amounts capitalized, increased to £438.8 million from £404.2 million during the same period in 2009. The

increase was primarily due to differences in the timing of interest payments on senior credit facility and senior

notes.

For the year ended December 31, 2010, cash used in investing activities decreased to £411.4 million from

£571.3 million for the year ended December 31, 2009. The decrease was primarily due to net proceeds received

from the disposal of Virgin Media Television, totaling £167.4 million, partially offset by increased purchases of

fixed assets, which increased to £628.4 million for the year ended December 31, 2010 from £568.0 million for

the year ended December 31, 2009.

Cash used in financing activities for the year ended December 31, 2010 was £551.8 million compared with

cash used in financing activities of £69.7 million for the year ended December 31, 2009. For the year ended

December 31, 2010, the principal uses of cash were the partial repayments under our previous senior credit

facility and repayment our senior notes due 2014 totaling £3,186.6, capital lease payments totaling £53.2 million,

purchases of our own shares totaling £161.5 million and the purchase of conversion hedges relating to the shares

issuable under our convertible senior notes totaling £205.4 million. The principal components of cash provided

by financing activities were new borrowings from the issuance of our senior notes due 2016 and our senior notes

due 2019, net of financing fees, of £3,072.0 million. For the year ended December 31, 2009, the principal uses of

cash were the partial repayments under our senior credit facility and our senior notes due 2014 totaling £1,695.0,

and capital lease payments totaling £42.4 million. The principal components of cash provided by financing

activities were new borrowings from the issuance of our senior notes due 2016 and our senior notes due 2019, net

of financing fees, of £1,610.2 million.

Cash flows from discontinued operations for the year ended December 31, 2010 are attributable to Virgin

Media TV. Cash flows from discontinued operations for the year ended December 31, 2009 are attributable to

Virgin Media TV and sit-up.

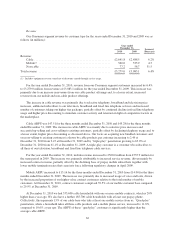

Liquidity and Capital Resources

As of December 31, 2011, we had £5,855.1 million of debt outstanding, compared to £6,020.4 million as of

December 31, 2010, and £300.4 million of cash and cash equivalents, compared to £479.5 million as of

December 31, 2010. The decrease in debt from December 31, 2010 is principally due to the redemption of the

$550 million 9.125% senior notes due 2016 using cash.

Our business is capital intensive and has significant leverage. We have significant cash requirements for

operating costs, capital expenditures and interest expense. The level of our capital expenditures and operating

expenditures are affected by the significant amounts of capital required to connect customers to our network,

expand and upgrade our network and offer new services. On January 11, 2012, we announced a major program to

double the speeds of over four million broadband customers. This will involve an incremental investment of

approximately £110 million during 2012. Excluding the £110 million incremental investment it is estimated that

our purchase of fixed assets in 2012 will be in the range of 15% to 17% of our revenue.

We expect that our cash on hand, together with cash from operations and amounts undrawn on our revolving

credit facility, will be sufficient for our cash requirements through December 31, 2012. However, our cash

requirements after December 31, 2012 may exceed these sources of cash. We refinanced our senior credit facility

and now have no significant principal payments under our senior credit facility until 2015.

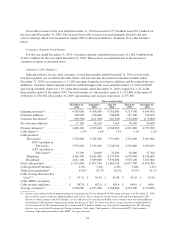

On July 28, 2010, we announced our intention to undertake a range of capital structure optimization actions

including the application of, in aggregate, up to £700 million, in part towards repurchases of up to £375 million

68