Virgin Media 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

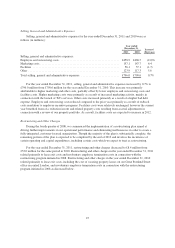

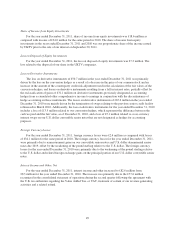

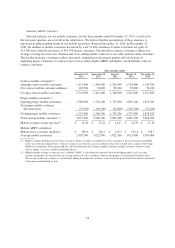

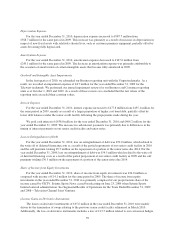

Income Tax (Expense) Benefit

For the year ended December 31, 2011, income tax expense was £16.0 million as compared with a benefit of

£124.1 million for the same period in 2010. The 2011 and 2010 tax (expense) benefit was comprised of

(in millions):

2011 2010

Current:

Federal ................................................ £ (1.0) £ (4.9)

State and local .......................................... 0.0 0.3

Foreign ................................................ 5.1 25.0

Total current ................................................ 4.1 20.4

Deferred:

Federal ................................................ 3.2 79.8

Foreign ................................................ (23.3) 23.9

Total deferred ............................................... (20.1) 103.7

Total ...................................................... £(16.0) £124.1

The income tax expense for the year ended December 31, 2011 related primarily to our discontinuance of

hedge accounting for the swaps associated with the $550 million 9.125% senior notes that were prepaid during

the year, which resulted in a reclassification of tax effects associated with gains on those swaps from

accumulated other comprehensive income. This expense was partially offset by consortium tax relief receivable

from our joint venture operations, which were sold during 2011.

The foreign current tax benefit and the foreign deferred tax benefit for the year ended December 31, 2010,

were primarily driven by the application of the intraperiod allocation rules of the Income Taxes Topic of the

FASB ASC. The foreign current tax benefit attributable to continuing operations includes £18.3 million related to

the gain on discontinued operations and is offset by tax expense of £18.3 million that is included within

discontinued operations. The £23.9 million foreign deferred tax benefit attributable to continuing operations is

offset by tax expense of £23.9 million that is included within other comprehensive as a result of gains in other

comprehensive income during 2010.

Additionally, during 2010 we concluded that it was more likely than not that we would be able to utilize

certain net operating loss carryforwards prior to their expiration, which will occur between 2020 and 2030, to

reduce future U.S. federal income tax liabilities. Accordingly, we reduced the previously established valuation

allowance on these net operating loss carryforwards to nil and recorded a federal deferred tax benefit of £79.8

million. This change was due to a re-assessment of our intentions regarding certain assets during the

carryforward period and our judgment that it is more likely than not that these NOLs will be utilized prior to

expiry.

Income (Loss) from Continuing Operations

For the year ended December 31, 2011, the net income from continuing operations was £77.1 million,

compared with a loss of £169.2 million for the same period in 2010 due to the factors discussed above.

Gain on Disposal

For the year ended December 31, 2010, gain on disposal relating the sale of our Virgin Media TV business

was £19.2 million, net of tax of £15.0 million.

50