Virgin Media 2011 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

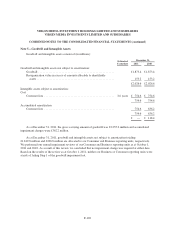

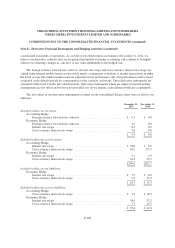

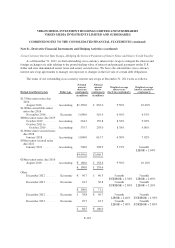

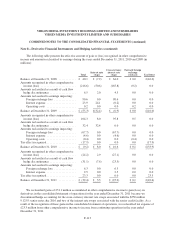

Note 6—Long Term Debt (continued)

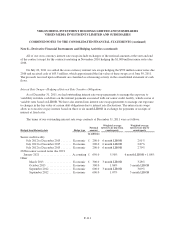

On July 26, 2011, we redeemed in full the outstanding balance of our $550 million 9.125% senior notes due

2016 using £355.8 million of cash from our balance sheet as part of Virgin Media Inc.’s 2010 capital structure

optimization program. We recognized a loss on extinguishment of £15.5 million as a result of this redemption.

Senior Credit Facility

The principal amount outstanding under our senior credit facility at December 31, 2011 was £750.0 million.

Our senior credit facility comprises a term facility denominated in pounds sterling, £750.0 million, and a

revolving facility of £450.0 million. At December 31, 2011, £750.0 million of the term facility had been drawn

and £5.8 million of the revolving credit facility had been utilized for bank guarantees and standby letters of

credit.

The term credit facility bears interest at LIBOR, plus a margin currently ranging from 1.625% to 2.125%

based on leverage ratios. The margins on the revolving credit facility range from 1.325% to 1.825% based on

leverage ratios. Interest is payable at least semi-annually. The term credit facility and the revolving credit facility

are repayable in full on their maturity dates, which are June 30, 2015.

On February 15, 2011, we amended our senior credit facility to increase operational flexibility including,

among other things, changing the required level of total net leverage ratio, increasing certain financial

indebtedness baskets, and eliminating certain restrictions on the use of proceeds of secured indebtedness. This

amendment served to modify the amortization schedule by extending £192.5 million of our June 30, 2014

scheduled amortization payment to June 30, 2015.

In March 2011, we used the net proceeds from our senior secured notes due 2021 to prepay £532.5 million

of the Tranche A outstanding under our senior credit facility, thus eliminating scheduled amortization in 2011

through 2014, and £367.5 million of the Tranche B outstanding under our senior credit facility that was

scheduled for payment in 2015, with the remainder of the proceeds being used for general corporate purposes.

On May 20, 2011, we entered into two new additional facilities under the senior credit facility, comprising

an additional revolving facility with total commitments of £450 million, which replaced the previous

£250 million revolving facility, and an additional term facility with commitments of £750 million. We used the

new term facility of £750 million and £25 million of cash to repay the loan balance from the previous term loan

which was comprised of a £467.5 million Tranche A and £307.5 million Tranche B. The maturity date of the

facilities remains at June 30, 2015. Further changes to the senior credit facility to increase operational flexibility

were also effected on May 27, 2011.

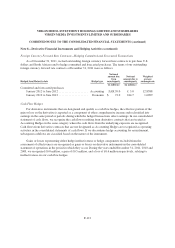

The facility is secured through a guarantee from Virgin Media Finance. In addition, the bulk of the facility is

secured through guarantees and first priority pledges of the shares and assets of substantially all of the operating

subsidiaries of VMIH, and of receivables arising under any intercompany loans to those subsidiaries. We are

subject to financial maintenance tests under the facility, including a test of liquidity, coverage and leverage ratios

applied to us and certain of our subsidiaries. As of December 31, 2011, we were in compliance with these

covenants.

F-105