Virgin Media 2011 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218

|

|

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

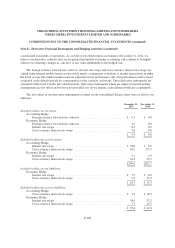

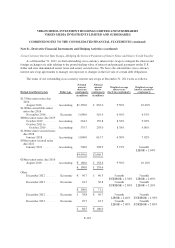

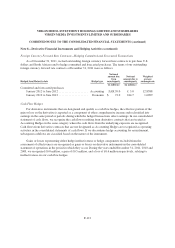

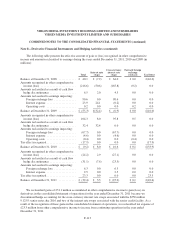

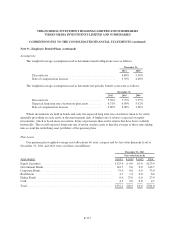

Note 8—Derivative Financial Instruments and Hedging Activities (continued)

Foreign Currency Forward Rate Contracts—Hedging Committed and Forecasted Transactions

As of December 31, 2011, we had outstanding foreign currency forward rate contracts to purchase U.S.

dollars and South African rand to hedge committed and forecasted purchases. The terms of our outstanding

foreign currency forward rate contracts at December 31, 2011 were as follows:

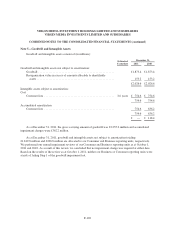

Hedged item/Maturity date Hedge type

Notional

amount due

from

counterparty

Notional

amount due to

counterparty

Weighted

average

exchange rate

(in millions) (in millions)

Committed and forecasted purchases

January 2012 to June 2012 .................... Accounting ZAR 39.0 £ 3.0 12.8588

January 2012 to June 2012 .................... Economic $ 72.0 £44.7 1.6099

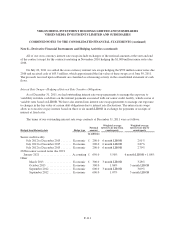

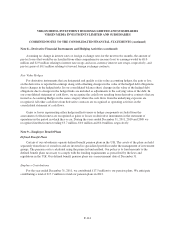

Cash Flow Hedges

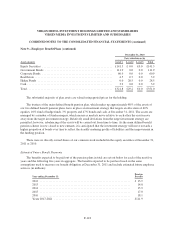

For derivative instruments that are designated and qualify as cash flow hedges, the effective portion of the

gain or loss on the derivative is reported as a component of other comprehensive income and reclassified into

earnings in the same period or periods during which the hedged transactions affect earnings. In our consolidated

statement of cash flows, we recognize the cash flows resulting from derivative contracts that are treated as

Accounting Hedges in the same category where the cash flows from the underlying exposure are recognized.

Cash flows from derivative contracts that are not designated as Accounting Hedges are recognized as operating

activities in the consolidated statements of cash flows. If we discontinue hedge accounting for an instrument,

subsequent cashflows are classified based on the nature of the instrument.

Gains or losses representing either hedge ineffectiveness or hedge components excluded from the

assessment of effectiveness are recognized as gains or losses on derivative instruments in the consolidated

statement of operations in the period in which they occur. During the years ended December 31, 2011, 2010 and

2009, we recognized £0.0 million, a gain of £0.5 million, and a loss of £0.6 million respectively, relating to

ineffectiveness on our cash flow hedges.

F-112