Virgin Media 2011 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

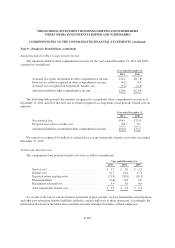

Note 9—Employee Benefit Plans (continued)

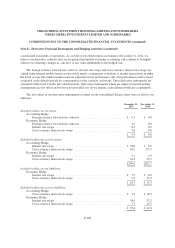

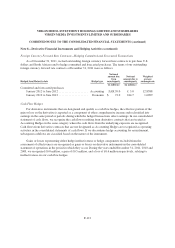

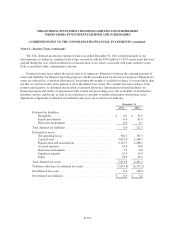

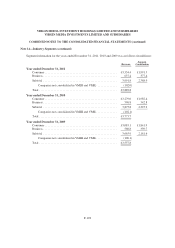

December 31, 2010

Fair value hierarchy

Asset category Level 1 Level 2 Level 3 Total

Equity Securities ................................................ £141.3 £ 0.0 £0.0 £141.3

Government Bonds .............................................. 111.9 0.0 0.0 111.9

Corporate Bonds ................................................ 60.9 0.0 0.0 60.9

Real Estate ..................................................... 4.5 0.7 0.0 5.2

Hedge Funds ................................................... 0.0 28.5 0.0 28.5

Cash .......................................................... 3.2 0.0 0.0 3.2

Total .......................................................... £321.8 £29.2 £0.0 £351.0

The substantial majority of plan assets are valued using quoted prices for the holding.

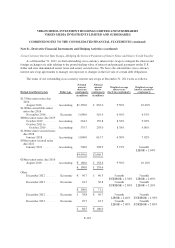

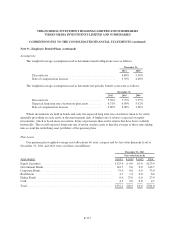

The trustees of the main defined benefit pension plan, which makes up approximately 80% of the assets of

our two defined benefit pension plans, have in place an investment strategy that targets an allocation of 40%

equities, 10% fund of hedge funds, 3% property and 47% bonds and cash, at December 31, 2011. The assets are

managed by a number of fund managers, which means as markets move relative to each other the assets move

away from the target investment strategy. Relatively small deviations from the target investment strategy are

permitted; however, rebalancing of the assets will be carried out from time to time. As the main defined benefit

pension scheme is now closed to new entrants, it is anticipated that the investment strategy will move towards a

higher proportion of bonds over time to reflect the steadily maturing profile of liabilities and the improvement in

the funding position.

There were no directly owned shares of our common stock included in the equity securities at December 31,

2011 or 2010.

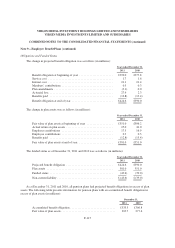

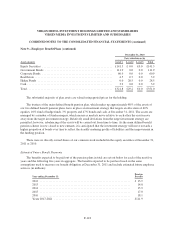

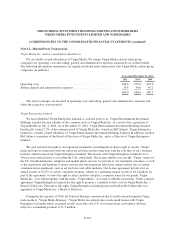

Estimated Future Benefit Payments

The benefits expected to be paid out of the pension plans in total are set out below for each of the next five

years and the following five years in aggregate. The benefits expected to be paid are based on the same

assumptions used to measure our benefit obligation at December 31, 2011 and include estimated future employee

services (in millions):

Year ending December 31:

Pension

Benefits

2012 .............................................................. £ 13.9

2013 .............................................................. 14.8

2014 .............................................................. 15.9

2015 .............................................................. 17.0

2016 .............................................................. 18.1

Years 2017-2021 .................................................... £111.9

F-118