Virgin Media 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

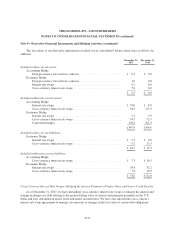

Note 9—Derivative Financial Instruments and Hedging Activities (continued)

On July 26, 2011 we settled the cross-currency interest rate swaps hedging the $550 million senior notes due

2016 and received cash of £65.5 million, which approximated the fair value of these swaps as of June 30, 2011.

The proceeds received upon settlement are classified as a financing activity in the consolidated statement of cash

flows.

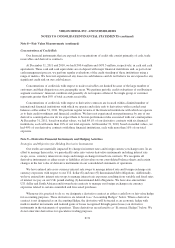

Interest Rate Swaps—Hedging of Interest Rate Sensitive Obligations

As of December 31, 2011, we had outstanding interest rate swap agreements to manage the exposure to

variability in future cash flows on the interest payments associated with our senior credit facility, which accrue at

variable rates based on LIBOR. We have also entered into interest rate swap agreements to manage our exposure

to changes in the fair value of certain debt obligations due to interest rate fluctuations. The interest rate swaps

allow us to receive or pay interest based on three or six month LIBOR in exchange for payments or receipts of

interest at fixed rates.

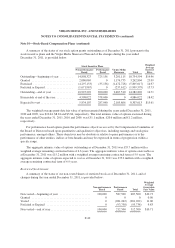

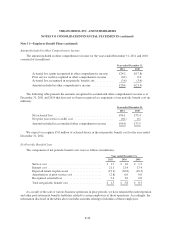

The terms of our outstanding interest rate swap contracts at December 31, 2011 were as follows:

Hedged item/Maturity date Hedge type

Notional

amount

Weighted average

interest rate due from

counterparty

Weighted average

interest rate due to

counterparty

(in millions)

Senior credit facility

July 2012 to December 2015 .......... Economic £200.0 6 month LIBOR 2.91%

July 2012 to December 2015 .......... Economic 200.0 6 month LIBOR 2.87%

July 2012 to December 2015 .......... Economic 200.0 6 month LIBOR 2.79%

£650m senior secured notes due 2021

January 2021 ...................... Accounting £650.0 5.50% 6 month LIBOR

+1.84%

Other

March 2013 ....................... Economic £300.0 3 month LIBOR 3.28%

October 2013 ...................... Economic 300.0 1.86% 3 month LIBOR

September 2012 .................... Economic 600.0 3 month LIBOR 3.09%

September 2012 .................... Economic 600.0 1.07% 3 month LIBOR

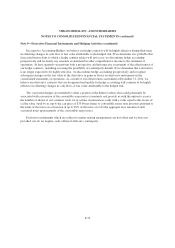

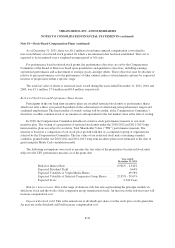

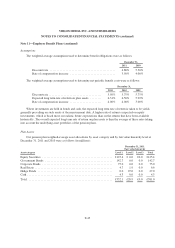

Foreign Currency Forward Rate Contracts—Hedging Committed and Forecasted Transactions

As of December 31, 2011, we had outstanding foreign currency forward rate contracts to purchase U.S.

dollars and South African rand to hedge committed and forecasted purchases. The terms of our outstanding

foreign currency forward rate contracts at December 31, 2011 were as follows:

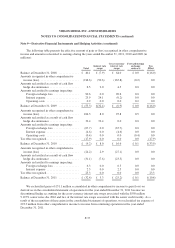

Hedged item/Maturity date Hedge type

Notional

amount due

from

counterparty

Notional

amount due to

counterparty

Weighted

average

exchange rate

(in millions) (in millions)

Committed and forecasted purchases

January 2012 to June 2012 .................... Accounting ZAR 39.0 £ 3.0 12.8588

January 2012 to June 2012 .................... Economic $ 72.0 £44.7 1.6099

F-35