Virgin Media 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 13—Income Taxes (continued)

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax

assets are reduced by a valuation allowance if, based upon the weight of available evidence, it is more likely than

not that we will not realize some portion or all of the deferred tax assets. We consider relevant evidence, both

positive and negative, to determine the need for a valuation allowance. Information evaluated includes our

financial position and results of operations for the current and preceeding years, the availability of deferred tax

liabilities and tax carrybacks, as well as an evaluation of currently available information about future years.

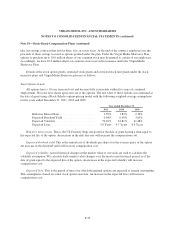

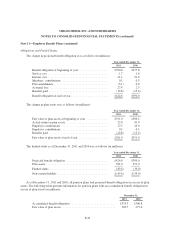

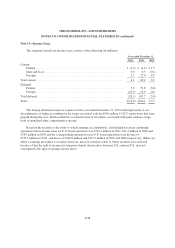

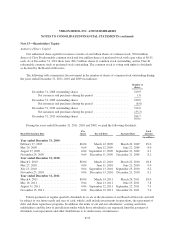

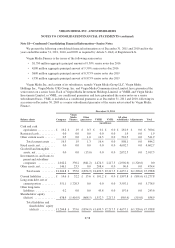

Significant components of deferred tax liabilities and assets are as follows (in millions):

December 31,

2011 2010

Deferred tax liabilities:

Intangibles ................................................ £ 0.0 £ 31.5

Equity investments .......................................... 0.0 83.0

Derivative instruments ....................................... 0.0 6.7

Convertible bond accretion .................................... 32.3 37.0

Unrealized foreign exchange differences ......................... 1.6 1.5

Total deferred tax liabilities ....................................... 33.9 159.7

Deferred tax assets:

Net operating losses ......................................... 659.5 829.9

Capital losses .............................................. 3,026.0 3,268.8

Depreciation and amortization ................................. 2,188.2 2,340.7

Accrued expenses ........................................... 44.0 57.8

Employee benefits .......................................... 23.5 19.8

Derivative instruments ....................................... 5.4 0.0

Capital costs and others ...................................... 80.3 94.0

Total deferred tax assets .......................................... 6,026.9 6,611.0

Valuation allowance for deferred tax assets ........................... (5,993.0) (6,454.5)

Net deferred tax assets ........................................... 33.9 156.5

Net deferred tax liabilities ........................................ £ 0.0 £ 3.2

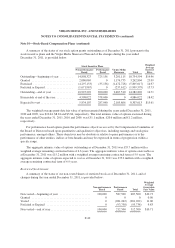

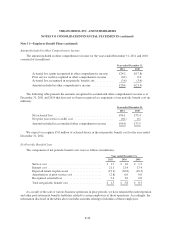

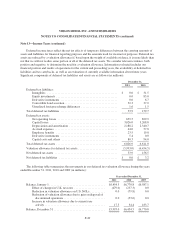

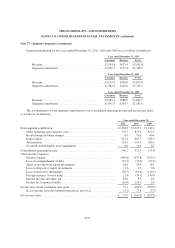

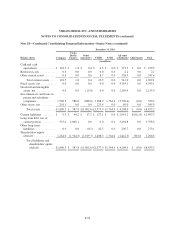

The following table summarizes the movements in our deferred tax valuation allowance during the years

ended December 31, 2011, 2010 and 2009 (in millions):

Year ended December 31,

2011 2010 2009

Balance, January 1 ...................................... £6,454.5 £6,770.8 £6,587.1

Effect of changes in U.K. tax rates ..................... (479.0) (237.3) 0.0

Reduction in valuation allowance on U.S. NOLs .......... 0.0 (79.8) 0.0

Reduction of valuation allowance due to gain on disposal of

discontinued operations ............................ 0.0 (33.6) 0.0

Increase in valuation allowance due to current year

activity ......................................... 17.5 34.4 183.7

Balance, December 31 ................................... £5,993.0 £6,454.5 £6,770.8

F-49