Virgin Media 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of 5.50% senior secured notes due 2021. The senior secured notes due 2021 rank pari passu with our senior credit

facility and senior secured notes due 2018 and, subject to certain exceptions, share in the same guarantees and

security which have been granted in favor of our senior credit facility and senior secured notes due 2018. We

used the net proceeds from the senior secured notes due 2021 to make repayments totalling £900 million under

our senior credit facility and for general corporate purposes. On September 8, 2011, we completed an offer to

exchange any and all of the then outstanding senior secured notes due 2021 which we originally issued in a U.S.

private placement, for an equivalent amount of new senior secured notes due 2021, which have been registered

under the U.S. Securities Act of 1933, as amended. In connection with this offer, we exchanged a total of

$499,870,000 aggregate principal amount, or 99.9% of the original U.S. dollar denominated outstanding notes

and £650,000,000 aggregate principal amount, or 100% of the original sterling denominated outstanding notes,

for an equivalent amount of newly issued senior secured notes due 2021. Holders of the original senior secured

notes due 2021 who did not tender their notes in compliance with the offer terms will remain subject to

restrictions on transfer of these notes. Completion of the exchange offer satisfied our obligations in full under a

registration rights agreement entered into in connection with the original notes issuance in March 2011. We did

not receive any additional proceeds from the exchange offer. For further details relating to the exchange offer,

please see the Registration Statement on Form S-4 of Virgin Media Inc., as filed with the SEC on July 20, 2011.

On July 26, 2011, we redeemed in full the outstanding balance of our $550 million 9.125% senior notes due

2016 using $575.1 million, or £355.8 million, of cash from our balance sheet as part of our 2010 capital structure

optimization program. For more information, see “Capital Structure Optimization” below.

Capital Structure Optimization

On July 28, 2010, we announced our intention to undertake a range of capital structure optimization actions,

including the application of, in aggregate, up to £700 million, in part towards repurchases of up to £375 million

of our common stock until August 2011, and in part towards transactions relating to our debt and convertible

debt, including related derivative transactions. During the first quarter of 2011, we increased the 2010 capital

structure optimization program to permit full redemption of the $550 million 9.125% senior notes due 2016,

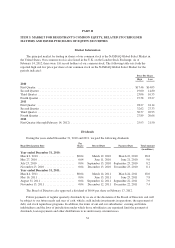

which occurred on July 26, 2011. See note 7 to the consolidated financial statements of Virgin Media Inc. for a

discussion of the conversion hedges related to our convertible senior notes, which were entered into as part of the

2010 capital structure optimization program.

On July 27, 2011, we announced a new capital structure optimization program which includes the

application of, in aggregate, up to £850 million for purposes of repurchasing our common stock and debt and for

effecting associated derivative transactions until December 31, 2012. Our new capital structure optimization

program consists of the application of up to £625 million in repurchases of our common stock and up to

£225 million for transactions relating to our debt and convertible debt, including related derivative transactions.

On October 27, 2011, we announced our intention to expend up to a further £250 million on share repurchases

from the proceeds of the sale of UKTV by the end of 2012, in addition to the £625 million under the new capital

structure optimization program. Our capital structure optimization programs may be effected through open

market, privately negotiated, and/or derivative transactions, and may be implemented through arrangements with

one or more brokers. Any shares of common stock acquired in connection with these programs will be held in

treasury or cancelled.

During the year ended December 31, 2011, we repurchased approximately 40.9 million shares of common

stock at an average purchase price per share of $25.03 ($1,022.5 million in aggregate), of which approximately

17.1 million shares were repurchased through open market repurchases at an average purchase price per share of

$27.64 ($472.5 million in aggregate) and approximately 23.8 million shares were repurchased through capped

accelerated stock repurchase programs at an average purchase price per share of $23.15 ($550 million in

aggregate). Approximately 12.0 million shares of common stock were repurchased through open market

repurchases under the 2010 capital structure optimization program at an average purchase price per share of

$28.83 ($345.5 million in aggregate), and approximately 28.9 million shares of common stock were repurchased

39