Virgin Media 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on our mobile business on less favorable terms. Additionally, migration of all or some of our customer base to

any such replacement network operator would be dependent in part on Everything Everywhere and could entail

potential technical or commercial risk.

Everything Everywhere is also a customer of Virgin Media Business. Any disagreements between

Everything Everywhere and Virgin Mobile or between Everything Everywhere and Virgin Media Business could

have a material adverse effect on the relationship of the other Virgin Media businesses and Everything

Everywhere.

We do not insure the underground portion of our cable network and various pavement-based electronics

associated with our cable network.

Our cable network is one of our key assets. However, we do not insure the underground portion of our cable

network or various pavement-based electronics associated with our cable network. Almost all our cable network

is constructed underground. As a result, any catastrophe that affects our underground cable network or our

pavement-based electronics could prevent us from providing services to our customers and result in substantial

uninsured losses which would have a material adverse effect on our business and results of operations.

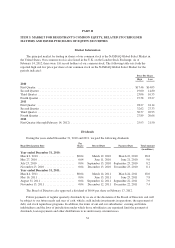

We are subject to currency and interest rate risks.

We are subject to currency exchange rate risks because substantially all of our revenues and operating

expenses are paid in U.K. pounds sterling, but we pay interest and principal obligations with respect to a portion

of our indebtedness in U.S. dollars and euros. To the extent that the pound sterling declines in value against the

U.S. dollar and the euro, the effective cost of servicing our U.S. dollar and euro-denominated debt will be higher.

Changes in the exchange rate result in foreign currency gains or losses.

We are also subject to interest rate risks. As of December 31, 2011, we had interest determined on a variable

basis, either through unhedged variable rate debt or derivative hedging contracts, on £1,108.9 million of our long

term debt. An increase in interest rates of 1% would increase our interest cost by approximately £11.1 million per

year.

We also incur costs in U.S. dollars, euros and South African rand, in the ordinary course of our business,

including for customer premise equipment and network maintenance services. Any deterioration in the value of

the pound relative to the U.S. dollar, euro or the rand could cause an increase in the effective cost of purchases

made in these currencies as only part of these exposures are hedged.

We are subject to tax in more than one tax jurisdiction and our structure poses various tax risks.

We are subject to taxation in multiple jurisdictions, in particular the U.S. and the U.K. Our effective tax rate

and tax liability will be affected by a number of factors in addition to our operating results, including the amount

of taxable income in particular jurisdictions, the tax rates in those jurisdictions, tax treaties between jurisdictions,

the manner in which and extent to which we transfer funds to and repatriate funds from our subsidiaries,

accounting standards and changes in accounting standards, and future changes in the law. We may incur losses in

one jurisdiction that cannot be offset against income earned in a different jurisdiction and so we may pay income

taxes in one jurisdiction for a particular period even though on an overall basis we incur a net loss for that period.

Substantially all of our operations are conducted through U.K. subsidiaries that are owned by one or more

members of a U.S. holding company group. We do not expect to have current U.K. tax liabilities on our

operating earnings for at least the medium term. However, our operations may give rise to U.S. tax on “Subpart

F” income generated by our U.K. subsidiaries, or on repatriations of cash from our U.K. operating subsidiaries to

the U.S. holding company group. We believe that our U.K. subsidiaries have a substantial U.S. tax basis which

may be available to avoid or reduce U.S. tax on repatriation of cash from our U.K. subsidiaries. However, there is

27