Virgin Media 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

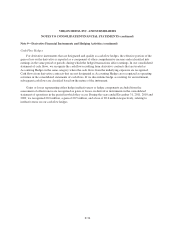

Note 8—Fair Value Measurements (continued)

If the price of our stock is below $19.22 upon maturity of the convertible senior notes, the options may be

allowed to expire unused.

We have determined that the overall valuation of the conversion hedges falls within level 3 of the fair value

hierarchy as the assumption for the expected volatility of our stock price over the term of the options is based on

an unobservable input and is deemed to be significant to the determination of fair value. Non-performance risk is

based on quoted credit default swaps for counterparties to the contracts. The inclusion of counterparty

non-performance risk resulted in a decrease to the fair values of the conversion hedges of approximately

£25.0 million and £19.0 million as of December 31, 2011 and 2010 respectively, and an increase in the loss on

derivative instruments of £6.0 million and £19.0 million in the years ended December 31, 2011 and 2010

respectively.

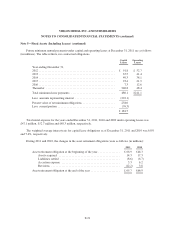

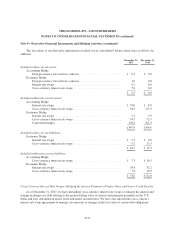

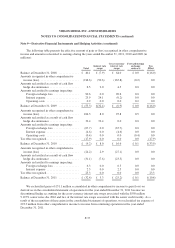

The following table presents a reconciliation of the beginning and ending balances of the conversion hedges

(in millions);

2011 2010

Balance at January 1 ......................................... £191.9 £ 0.0

Purchases .................................................. 0.0 205.4

Unrealized loss included in loss on derivative instruments ........... (52.6) (13.5)

Unrealized currency translation adjustment included in other

comprehensive income ..................................... (1.1) 0.0

Balance at December 31 ...................................... £138.2 £191.9

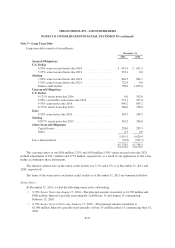

Long term debt: The fair values of our senior notes, convertible senior notes and senior secured notes are

based on the quoted market prices in active markets and incorporate non-performance risk. The carrying values

of the $500 million 5.25% and £650 million 5.50% senior secured notes due 2021 include adjustments of

£45.7 million and £77.9 million, respectively, as a result of our application of fair value hedge accounting to

these instruments.

The carrying amounts and fair values of our long term debt are as follows (in millions):

December 31, 2011 December 31, 2010

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

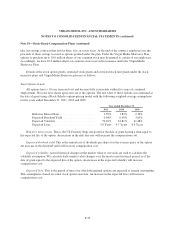

9.125% U.S. dollar senior notes due 2016 ....................... £ 0.0 £ 0.0 £ 352.6 £ 380.3

6.50% U.S. dollar convertible senior notes due 2016 ............... 551.1 869.1 535.4 1,050.8

9.50% U.S. dollar senior notes due 2016 ........................ 849.2 966.4 843.2 990.5

9.50% euro senior notes due 2016 .............................. 145.3 170.1 148.5 182.1

8.375% U.S. dollar senior notes due 2019 ....................... 380.6 416.9 378.8 421.5

8.875% sterling senior notes due 2019 .......................... 345.2 378.9 344.8 397.7

6.50% U.S. dollar senior secured notes due 2018 .................. 635.4 663.5 632.3 677.5

7.00% sterling senior secured notes due 2018 ..................... 864.5 923.1 863.1 925.3

5.25% U.S. dollar senior secured notes due 2021 .................. 353.1 321.8 0.0 0.0

5.50% sterling senior secured notes due 2021 ..................... 722.4 640.3 0.0 0.0

Senior credit facility ........................................ 750.0 750.0 1,675.0 1,672.5

Capital leases and other ...................................... 258.3 258.3 246.7 246.7

F-30