Virgin Media 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

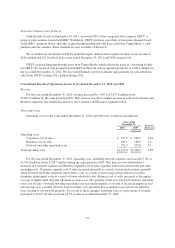

Non-cable revenue for the year ended December 31, 2010 increased to £77.2 million from £58.7 million for

the year ended December 31, 2009. The increased non-cable revenue was predominantly driven by the new

service offerings which were launched in August 2009 as discussed further in “Summary Non-cable Statistics”

below.

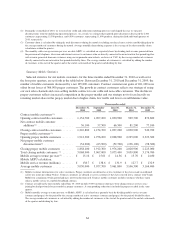

Consumer Segment Contribution

For the year ended December 31, 2010, Consumer segment contribution increased to £1,982.4 million from

£1,841.9 million for the year ended December 31, 2009. This increase was primarily due to the increase in

consumer revenues as described above.

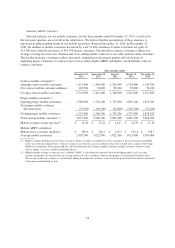

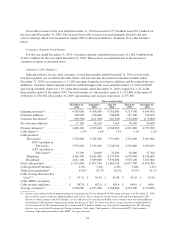

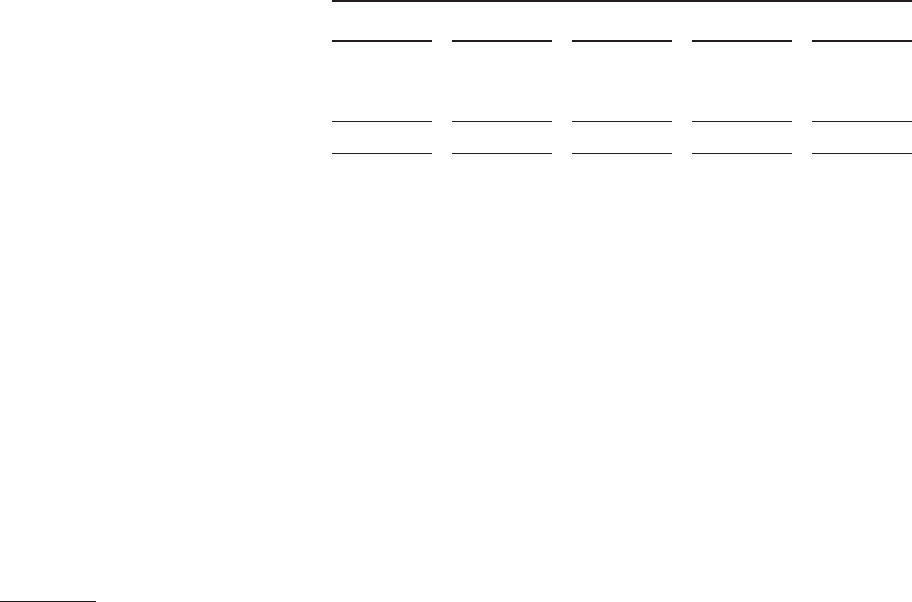

Summary Cable Statistics

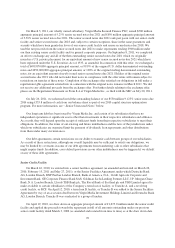

Selected statistics for our cable customers, for the three months ended December 31, 2010 as well as the

four prior quarters, are set forth in the table below. Our net customer movement for the three months ended

December 31, 2010 was an increase of 17,100 customers being the net of gross additions and disconnections (net

additions). Customer churn remained relatively stable throughout the years ended December 31, 2010 and 2009

and average monthly churn was 1.3% in the three months ended December 31, 2010 compared to 1.2% in the

three months ended 31 December 2009. The total number of cable products grew to 11,951,600 at December 31,

2010 from 11,678,300 at December 31, 2009, representing a net increase in products of 273,300.

Three months ended

December 31, September June 30, March 31, December 31,

2010 2010 2010 2010 2009

Opening customers(1) .............. 4,783,000 4,768,900 4,761,800 4,723,500 4,694,900

Customer additions ............... 206,600 236,000 188,600 193,100 198,600

Customer disconnects(2) ............ (189,500) (221,900) (181,500) (154,800) (170,000)

Net customer additions ............ 17,100 14,100 7,100 38,300 28,600

Closing customers(1) .............. 4,800,100 4,783,000 4,768,900 4,761,800 4,723,500

Cable churn(1)(3) .................. 1.3% 1.6% 1.3% 1.1% 1.2%

Cable products:

Television(1) ................. 3,778,800 3,766,700 3,751,900 3,729,600 3,693,900

DTV (included in

Television) ............ 3,759,600 3,745,900 3,728,700 3,702,800 3,656,200

ATV (included in

Television)(1) .......... 19,200 20,800 23,200 26,800 37,700

Telephone .................. 4,161,700 4,161,000 4,175,300 4,178,000 4,146,600

Broadband .................. 4,011,100 3,969,800 3,936,000 3,910,100 3,837,800

Total cable products .............. 11,951,600 11,897,500 11,863,200 11,817,700 11,678,300

Cable products/Customer(1) ......... 2.49x 2.49x 2.49x 2.48x 2.47x

Triple-play penetration(1) ........... 63.0% 62.7% 62.4% 61.9% 61.1%

Cable Average Revenue Per

User(1)(4) ..................... £ 47.51 £ 46.38 £ 45.88 £ 45.01 £ 45.28

Cable ARPU calculation:

Cable revenue (millions) ........... £ 682.8 £ 662.6 £ 656.4 £ 640.0 £ 640.1

Average customers(1) .............. 4,790,000 4,763,400 4,768,800 4,739,500 4,712,600

(1) As part of our analog switch off program during the first quarter of 2010 we identified 49,300 analog customers as of December 31, 2009

that we did not expect to convert to digital products and services. These customers were previously reflected in our Summary Cable

Statistics as both customers and ATV products. As they did not receive any directly billable services from us they were not included in

our Summary Cable Statistics commencing with the first quarter of 2010. To ensure our statistics are presented on a comparable basis,

we have removed 49,300 customers from our customer and ATV product numbers for all previously reported periods. The following

statistics were recalculated: Opening and Closing customers, Cable churn, Cable products—Television and ATV, Cable products/

Customer, Triple-play penetration, Cable ARPU, Average customers.

63