Virgin Media 2011 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218

|

|

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

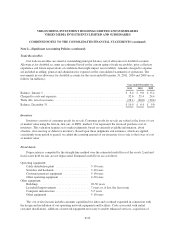

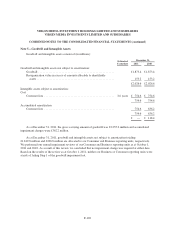

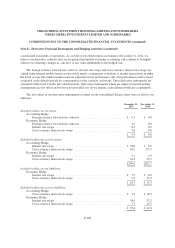

Note 4—Fixed Assets (Including Leases) (continued)

Included in assets acquired under capital leases for the year ended December 31, 2011 is £55.5 million in

respect to customer premise equipment converted from operating leases to capital leases. Included in assets

acquired under capital leases for the year ended December 31, 2010 is £35.8 million in respect to 42 properties

included in a sale and leaseback transaction.

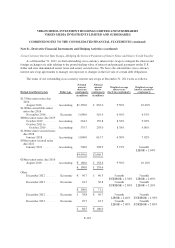

Future minimum annual payments under capital and operating leases at December 31, 2011 are as follows

(in millions). The table reflects our contractual obligations.

Capital Operating

Year ending December 31,

2012 .................................................... £ 91.8 £ 52.7

2013 .................................................... 67.5 41.4

2014 .................................................... 49.3 34.1

2015 .................................................... 23.4 21.9

2016 .................................................... 7.3 12.6

Thereafter ............................................... 240.8 48.4

Total minimum lease payments .............................. 480.1 £211.1

Less: amounts representing interest ........................... (222.1)

Present value of net minimum obligations ...................... 258.0

Less: current portion ....................................... (76.3)

£ 181.7

Total rental expense for the years ended December 31, 2011, 2010 and 2009 under operating leases was

£47.0 million, £52.6 million and £48.2 million, respectively.

The weighted average interest rate for capital lease obligations as of December 31, 2011 and 2010 was 6.8%

and 7.4%, respectively.

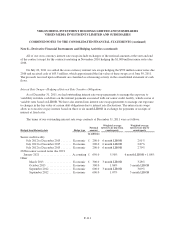

During 2011 and 2010, the changes in the asset retirement obligations were as follows (in millions):

2011 2010

Asset retirement obligation at the beginning of the year ............... £66.4 £45.5

Assets acquired .......................................... 14.0 16.8

Liabilities settled ......................................... (8.4) (6.5)

Accretion expense ........................................ 5.2 6.1

Revisions in cashflow estimates ............................. (11.9) 4.5

Asset retirement obligation at the end of the year .................... £65.3 £66.4

F-101