Virgin Media 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

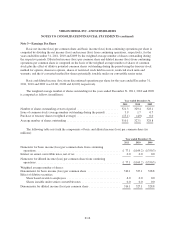

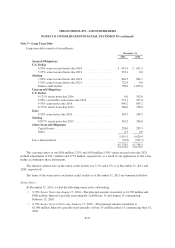

Note 3—Earnings Per Share (continued)

Restricted Stock Grants

The shares of restricted stock granted under our stock incentive plans have a term of up to three and a half

years and vest based on time or performance, subject to continued employment. For performance-based restricted

stock grants, the performance objectives are based upon quantitative and qualitative objectives, including

earnings, operational performance and achievement of strategic goals, amongst others, and vest after a one to

three year period. These objectives may be absolute or relative to prior performance or to the performance of

other entities, indices or benchmarks and may be expressed in terms of progression within a specific range.

Restricted Stock Unit and Performance Share Grants

The restricted stock units and performance shares granted under our stock incentive plans have a term of up

to ten years and vest based on performance, subject to continued employment. These targets may be absolute or

relative to prior performance or to the performance of other entities, indices or benchmarks and may be expressed

in terms of progression within a specific range. The final number of awards vesting will be settled in either

common stock or an amount of cash equivalent to the fair market value at the date of vesting.

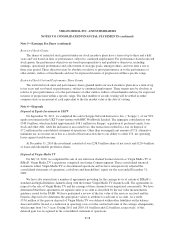

Note 4—Disposals

Disposal of Equity Investment in UKTV

On September 30, 2011, we completed the sale to Scripps Network Interactive, Inc. (“Scripps”), of our 50%

equity investment in the UKTV joint venture with BBC Worldwide Limited. The aggregate consideration was

£349.9 million, which included approximately £98.1 million for Scripps’ acquisition of preferred equity, loan

stock and other debt. After the inclusion of associated fees, this transaction resulted in a loss on disposal of

£7.2 million in the consolidated statement of operations. Other than an insignificant amount of U.S. alternative

minimum tax, no income tax is due as a result of this transaction due to our ability to offset U.S. net operating

losses against taxable income.

At December 31, 2010 the investment consisted of our £238.8 million share of net assets and £120.4 million

of loans and redeemable preference shares.

Disposal of Virgin Media TV

On July 12, 2010, we completed the sale of our television channel business known as Virgin Media TV to

BSkyB. Virgin Media TV’s operations comprised our former Content segment. These consolidated financial

statements reflect Virgin Media TV as discontinued operations and we have retrospectively adjusted the

consolidated statements of operations, cash flows and shareholders’ equity for the year ended December 31,

2009.

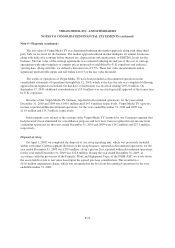

We have also entered into a number of agreements providing for the carriage by us of certain of BSkyB’s

standard and high-definition channels along with the former Virgin Media TV channels sold. The agreements in

respect to the sale of Virgin Media TV and the carriage of these channels were negotiated concurrently. We have

determined that these agreements are separate units of account as described by the fair value measurements

guidance issued by the FASB. We have performed a review of the fair value of the services received and the

business disposed of to determine the appropriate values to attribute to each unit of account. As a result,

£33.6 million of the gain on disposal of Virgin Media TV was deferred within other liabilities on the balance

sheet and will be treated as a reduction in operating costs over the contractual terms of the carriage arrangements,

which range from 3 to 7 years. During 2011 and 2010, £6.0 million and £2.0 million, respectively, of this

deferred gain was recognized in the consolidated statement of operations.

F-18